Public Employees Retirement System of Ohio boosted its holdings in On Holding AG (NYSE:ONON - Free Report) by 106.6% in the second quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 68,583 shares of the company's stock after purchasing an additional 35,391 shares during the quarter. Public Employees Retirement System of Ohio's holdings in ON were worth $3,570,000 at the end of the most recent quarter.

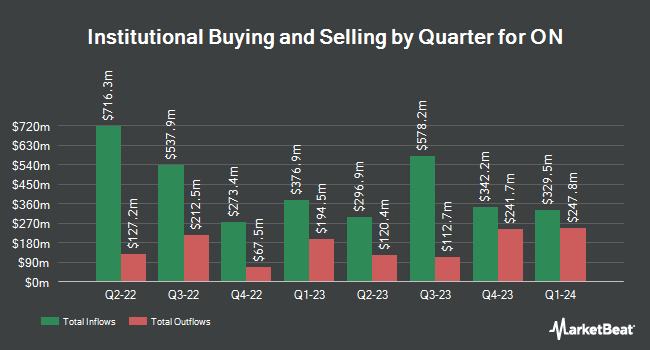

Other hedge funds have also added to or reduced their stakes in the company. PNC Financial Services Group Inc. increased its holdings in ON by 36.8% in the first quarter. PNC Financial Services Group Inc. now owns 11,245 shares of the company's stock worth $494,000 after purchasing an additional 3,025 shares in the last quarter. Citigroup Inc. increased its holdings in ON by 73.1% in the first quarter. Citigroup Inc. now owns 213,127 shares of the company's stock worth $9,361,000 after purchasing an additional 89,982 shares in the last quarter. Red Spruce Capital LLC increased its holdings in ON by 64.8% in the second quarter. Red Spruce Capital LLC now owns 35,566 shares of the company's stock worth $1,851,000 after purchasing an additional 13,980 shares in the last quarter. Kestra Private Wealth Services LLC increased its holdings in ON by 151.2% in the first quarter. Kestra Private Wealth Services LLC now owns 18,878 shares of the company's stock worth $829,000 after purchasing an additional 11,362 shares in the last quarter. Finally, Quantitative Investment Management LLC bought a new stake in ON in the first quarter worth approximately $410,000. 36.39% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of research analysts recently weighed in on ONON shares. Needham & Company LLC reaffirmed a "buy" rating and set a $62.00 price target on shares of ON in a research note on Tuesday, August 12th. Barclays upped their price target on ON from $68.00 to $69.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 13th. UBS Group upped their price target on ON from $75.00 to $79.00 and gave the stock a "buy" rating in a research note on Wednesday, August 13th. Raymond James Financial downgraded ON from a "strong-buy" rating to an "outperform" rating and set a $66.00 price target on the stock. in a research note on Tuesday, July 22nd. Finally, Telsey Advisory Group reaffirmed an "outperform" rating and set a $65.00 price target on shares of ON in a research note on Thursday, August 7th. One equities research analyst has rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating, one has assigned a Hold rating and one has issued a Sell rating to the company's stock. Based on data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $64.20.

Read Our Latest Report on ONON

ON Stock Performance

Shares of ON stock opened at $42.31 on Wednesday. The company has a market cap of $26.64 billion, a PE ratio of 94.02, a price-to-earnings-growth ratio of 5.63 and a beta of 2.23. On Holding AG has a 52 week low of $34.59 and a 52 week high of $64.05. The business has a 50 day moving average price of $45.87 and a 200-day moving average price of $48.95. The company has a quick ratio of 2.00, a current ratio of 2.53 and a debt-to-equity ratio of 0.31.

About ON

(

Free Report)

On Holding AG engages in the development and distribution of sports products such as footwear, apparel, and accessories for high-performance running, outdoor, all-day activities, and tennis. It sells its products worldwide through independent retailers and global distributors, its own online presence, and its own stores.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ON wasn't on the list.

While ON currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.