GSA Capital Partners LLP increased its position in Red Rock Resorts, Inc. (NASDAQ:RRR - Free Report) by 115.8% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 32,446 shares of the company's stock after purchasing an additional 17,414 shares during the quarter. GSA Capital Partners LLP's holdings in Red Rock Resorts were worth $1,407,000 at the end of the most recent quarter.

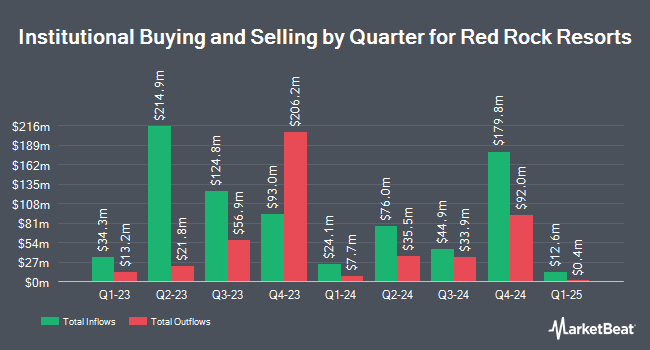

A number of other institutional investors have also recently bought and sold shares of the business. GAMMA Investing LLC boosted its stake in Red Rock Resorts by 7,978.4% in the first quarter. GAMMA Investing LLC now owns 8,240 shares of the company's stock worth $357,000 after purchasing an additional 8,138 shares in the last quarter. Vaughan Nelson Investment Management L.P. raised its stake in shares of Red Rock Resorts by 19.2% in the first quarter. Vaughan Nelson Investment Management L.P. now owns 1,602,368 shares of the company's stock worth $69,494,000 after acquiring an additional 258,310 shares during the last quarter. SG Americas Securities LLC bought a new stake in shares of Red Rock Resorts during the first quarter valued at approximately $750,000. KBC Group NV boosted its position in Red Rock Resorts by 44.6% in the 1st quarter. KBC Group NV now owns 2,887 shares of the company's stock valued at $125,000 after buying an additional 891 shares during the last quarter. Finally, Deutsche Bank AG lifted its stake in shares of Red Rock Resorts by 47.4% during the fourth quarter. Deutsche Bank AG now owns 41,788 shares of the company's stock valued at $1,932,000 after acquiring an additional 13,441 shares during the period. Institutional investors and hedge funds own 47.84% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently issued reports on the stock. Stifel Nicolaus raised their target price on shares of Red Rock Resorts from $44.00 to $60.00 and gave the company a "hold" rating in a research note on Wednesday. Barclays raised their price target on Red Rock Resorts from $62.00 to $65.00 and gave the stock an "overweight" rating in a research report on Wednesday. Macquarie restated an "outperform" rating and set a $58.00 target price on shares of Red Rock Resorts in a research report on Friday, May 2nd. Citigroup reiterated an "outperform" rating on shares of Red Rock Resorts in a report on Friday, July 18th. Finally, Truist Financial upgraded Red Rock Resorts from a "hold" rating to a "buy" rating and lifted their price objective for the company from $45.00 to $67.00 in a report on Wednesday, July 16th. Four equities research analysts have rated the stock with a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat, Red Rock Resorts presently has a consensus rating of "Moderate Buy" and an average price target of $60.36.

Check Out Our Latest Research Report on RRR

Red Rock Resorts Price Performance

Shares of NASDAQ:RRR traded down $0.81 during midday trading on Friday, hitting $60.54. The stock had a trading volume of 1,622,630 shares, compared to its average volume of 829,017. The company's 50-day moving average price is $52.38 and its 200-day moving average price is $47.96. Red Rock Resorts, Inc. has a fifty-two week low of $35.09 and a fifty-two week high of $62.00. The company has a quick ratio of 0.87, a current ratio of 0.92 and a debt-to-equity ratio of 9.04. The company has a market capitalization of $6.42 billion, a P/E ratio of 20.59, a price-to-earnings-growth ratio of 3.64 and a beta of 1.66.

Red Rock Resorts (NASDAQ:RRR - Get Free Report) last issued its earnings results on Tuesday, July 29th. The company reported $0.95 EPS for the quarter, topping the consensus estimate of $0.40 by $0.55. Red Rock Resorts had a return on equity of 59.56% and a net margin of 8.89%. The firm had revenue of $526.27 million during the quarter, compared to the consensus estimate of $485.44 million. During the same quarter in the previous year, the firm earned $0.59 earnings per share. The business's quarterly revenue was up 8.2% on a year-over-year basis. As a group, equities research analysts predict that Red Rock Resorts, Inc. will post 1.76 EPS for the current fiscal year.

Red Rock Resorts Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Monday, September 15th will be given a $0.25 dividend. The ex-dividend date is Monday, September 15th. This represents a $1.00 annualized dividend and a yield of 1.7%. Red Rock Resorts's dividend payout ratio (DPR) is currently 34.01%.

About Red Rock Resorts

(

Free Report)

Red Rock Resorts, Inc, through its interest in Station Casinos LLC, develops and operates casino and entertainment properties in the United States. The company owns and operates gaming and entertainment facilities, including Durango Casino & Resort and smaller casinos in the Las Vegas regional market.

Recommended Stories

Before you consider Red Rock Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Red Rock Resorts wasn't on the list.

While Red Rock Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.