S&CO Inc. bought a new stake in Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 4,103 shares of the pharmaceutical company's stock, valued at approximately $1,989,000.

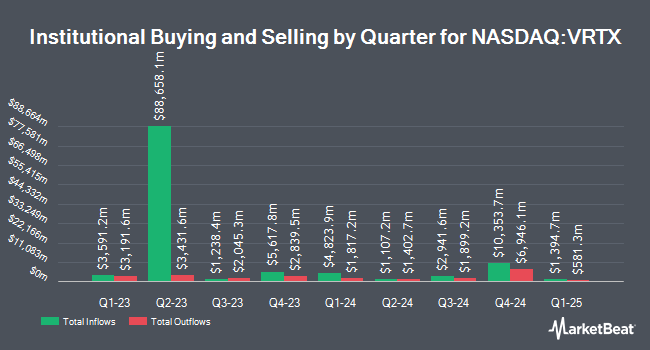

Other hedge funds have also added to or reduced their stakes in the company. Aries Wealth Management acquired a new position in shares of Vertex Pharmaceuticals during the 1st quarter worth approximately $293,000. Polar Asset Management Partners Inc. acquired a new position in shares of Vertex Pharmaceuticals during the 4th quarter worth approximately $22,954,000. GAMMA Investing LLC increased its position in shares of Vertex Pharmaceuticals by 25.1% during the 1st quarter. GAMMA Investing LLC now owns 5,002 shares of the pharmaceutical company's stock worth $2,425,000 after purchasing an additional 1,005 shares during the last quarter. Brighton Jones LLC increased its position in shares of Vertex Pharmaceuticals by 45.0% during the 1st quarter. Brighton Jones LLC now owns 6,421 shares of the pharmaceutical company's stock worth $3,113,000 after purchasing an additional 1,994 shares during the last quarter. Finally, APG Asset Management N.V. increased its position in shares of Vertex Pharmaceuticals by 189.7% during the 4th quarter. APG Asset Management N.V. now owns 359,285 shares of the pharmaceutical company's stock worth $139,724,000 after purchasing an additional 235,265 shares during the last quarter. Institutional investors own 90.96% of the company's stock.

Vertex Pharmaceuticals Trading Up 1.2%

Shares of VRTX stock traded up $5.26 on Friday, hitting $462.13. The company had a trading volume of 1,847,912 shares, compared to its average volume of 1,516,135. The firm has a market cap of $118.67 billion, a P/E ratio of -117.89 and a beta of 0.41. The stock's 50-day moving average is $455.09 and its two-hundred day moving average is $466.12. The company has a debt-to-equity ratio of 0.01, a quick ratio of 2.29 and a current ratio of 2.65. Vertex Pharmaceuticals Incorporated has a twelve month low of $377.85 and a twelve month high of $519.88.

Vertex Pharmaceuticals (NASDAQ:VRTX - Get Free Report) last released its earnings results on Monday, May 5th. The pharmaceutical company reported $4.06 EPS for the quarter, missing the consensus estimate of $4.29 by ($0.23). Vertex Pharmaceuticals had a negative return on equity of 3.36% and a negative net margin of 8.91%. The business had revenue of $2.77 billion for the quarter, compared to analyst estimates of $2.85 billion. During the same period in the prior year, the business earned $4.76 EPS. The company's revenue for the quarter was up 2.6% on a year-over-year basis. On average, equities research analysts anticipate that Vertex Pharmaceuticals Incorporated will post 15.63 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research analysts have weighed in on the company. Scotiabank lowered their price target on Vertex Pharmaceuticals from $450.00 to $442.00 and set a "sector perform" rating on the stock in a research report on Tuesday, May 6th. Wolfe Research downgraded Vertex Pharmaceuticals from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, May 7th. William Blair reiterated an "outperform" rating on shares of Vertex Pharmaceuticals in a research note on Tuesday, May 6th. Needham & Company LLC reiterated a "hold" rating on shares of Vertex Pharmaceuticals in a research note on Tuesday, May 6th. Finally, Morgan Stanley reduced their target price on Vertex Pharmaceuticals from $464.00 to $460.00 and set an "equal weight" rating for the company in a research note on Friday, June 20th. Fourteen equities research analysts have rated the stock with a hold rating, thirteen have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $512.30.

View Our Latest Report on VRTX

About Vertex Pharmaceuticals

(

Free Report)

Vertex Pharmaceuticals Incorporated, a biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF). It markets TRIKAFTA/KAFTRIO for people with CF with at least one F508del mutation for 2 years of age or older; SYMDEKO/SYMKEVI for people with CF for 6 years of age or older; ORKAMBI for CF patients 1 year or older; and KALYDECO for the treatment of patients with 1 year or older who have CF with ivacaftor.

Recommended Stories

Before you consider Vertex Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vertex Pharmaceuticals wasn't on the list.

While Vertex Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.