Sheets Smith Wealth Management purchased a new stake in shares of ADMA Biologics Inc (NASDAQ:ADMA - Free Report) during the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 19,139 shares of the biotechnology company's stock, valued at approximately $349,000.

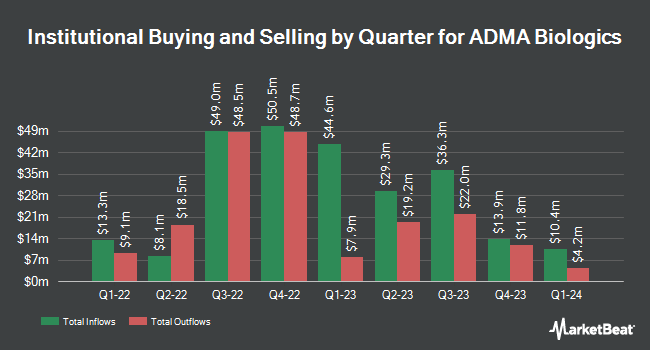

A number of other large investors also recently modified their holdings of the business. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in ADMA Biologics by 0.3% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 511,526 shares of the biotechnology company's stock worth $8,773,000 after acquiring an additional 1,559 shares during the period. Mackenzie Financial Corp grew its holdings in ADMA Biologics by 212.2% during the fourth quarter. Mackenzie Financial Corp now owns 74,539 shares of the biotechnology company's stock worth $1,278,000 after acquiring an additional 50,660 shares during the period. California State Teachers Retirement System grew its holdings in ADMA Biologics by 4.2% during the fourth quarter. California State Teachers Retirement System now owns 217,391 shares of the biotechnology company's stock worth $3,728,000 after acquiring an additional 8,717 shares during the period. Kings Path Partners LLC acquired a new position in ADMA Biologics during the first quarter worth about $425,000. Finally, GAMMA Investing LLC grew its holdings in ADMA Biologics by 6,875.8% during the first quarter. GAMMA Investing LLC now owns 130,726 shares of the biotechnology company's stock worth $2,594,000 after acquiring an additional 128,852 shares during the period. 75.68% of the stock is owned by institutional investors and hedge funds.

ADMA Biologics Price Performance

NASDAQ:ADMA opened at $15.32 on Friday. The business's 50-day moving average price is $17.04 and its 200 day moving average price is $18.89. The firm has a market cap of $3.66 billion, a P/E ratio of 17.81 and a beta of 0.54. ADMA Biologics Inc has a 52-week low of $13.50 and a 52-week high of $25.67. The company has a quick ratio of 2.78, a current ratio of 5.33 and a debt-to-equity ratio of 0.21.

ADMA Biologics (NASDAQ:ADMA - Get Free Report) last released its earnings results on Wednesday, August 6th. The biotechnology company reported $0.15 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.14 by $0.01. The firm had revenue of $121.98 million for the quarter, compared to analyst estimates of $121.77 million. ADMA Biologics had a return on equity of 41.01% and a net margin of 44.06%.ADMA Biologics's revenue was up 13.8% compared to the same quarter last year. During the same period in the previous year, the company earned $0.13 earnings per share. As a group, sell-side analysts predict that ADMA Biologics Inc will post 0.51 earnings per share for the current fiscal year.

ADMA Biologics Company Profile

(

Free Report)

ADMA Biologics, Inc, a biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally. The company offers BIVIGAM, an intravenous immune globulin (IVIG) product indicated for the treatment of primary humoral immunodeficiency (PI); ASCENIV, an IVIG product for the treatment of PI; and Nabi-HB for the treatment of acute exposure to blood containing Hepatitis B surface antigen and other listed exposures to Hepatitis B.

Recommended Stories

Want to see what other hedge funds are holding ADMA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for ADMA Biologics Inc (NASDAQ:ADMA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ADMA Biologics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADMA Biologics wasn't on the list.

While ADMA Biologics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.