Skandinaviska Enskilda Banken AB publ increased its position in shares of Teva Pharmaceutical Industries Ltd. (NYSE:TEVA - Free Report) by 20.3% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,723,201 shares of the company's stock after acquiring an additional 290,827 shares during the period. Skandinaviska Enskilda Banken AB publ owned about 0.15% of Teva Pharmaceutical Industries worth $26,486,000 as of its most recent filing with the Securities and Exchange Commission.

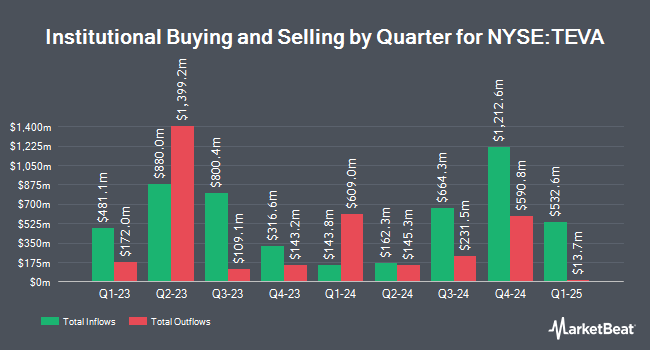

Several other hedge funds have also recently bought and sold shares of the business. Sumitomo Mitsui Trust Group Inc. boosted its holdings in Teva Pharmaceutical Industries by 5.7% during the first quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,504,007 shares of the company's stock valued at $38,487,000 after purchasing an additional 134,705 shares in the last quarter. Financial Sense Advisors Inc. boosted its holdings in Teva Pharmaceutical Industries by 63.5% during the first quarter. Financial Sense Advisors Inc. now owns 405,421 shares of the company's stock valued at $6,231,000 after purchasing an additional 157,421 shares in the last quarter. GAMMA Investing LLC boosted its holdings in Teva Pharmaceutical Industries by 804.7% during the first quarter. GAMMA Investing LLC now owns 67,474 shares of the company's stock valued at $1,037,000 after purchasing an additional 60,016 shares in the last quarter. Migdal Insurance & Financial Holdings Ltd. boosted its holdings in Teva Pharmaceutical Industries by 1.2% during the first quarter. Migdal Insurance & Financial Holdings Ltd. now owns 26,335,422 shares of the company's stock valued at $404,775,000 after purchasing an additional 300,000 shares in the last quarter. Finally, Norges Bank bought a new position in shares of Teva Pharmaceutical Industries in the fourth quarter worth about $38,550,000. 54.05% of the stock is owned by institutional investors and hedge funds.

Teva Pharmaceutical Industries Price Performance

NYSE TEVA traded up $0.61 on Wednesday, hitting $17.15. The stock had a trading volume of 13,491,877 shares, compared to its average volume of 12,075,998. The firm has a 50-day moving average of $16.92 and a 200-day moving average of $16.70. The company has a market capitalization of $19.66 billion, a price-to-earnings ratio of -14.93, a price-to-earnings-growth ratio of 0.97 and a beta of 0.60. Teva Pharmaceutical Industries Ltd. has a 52-week low of $12.47 and a 52-week high of $22.80. The company has a debt-to-equity ratio of 2.59, a quick ratio of 0.74 and a current ratio of 1.03.

Teva Pharmaceutical Industries (NYSE:TEVA - Get Free Report) last issued its quarterly earnings results on Wednesday, July 30th. The company reported $0.66 EPS for the quarter, topping analysts' consensus estimates of $0.64 by $0.02. The firm had revenue of $4.18 billion for the quarter, compared to analyst estimates of $4.34 billion. Teva Pharmaceutical Industries had a negative net margin of 7.74% and a positive return on equity of 45.44%. The business's revenue for the quarter was up .3% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.61 EPS. Equities analysts expect that Teva Pharmaceutical Industries Ltd. will post 2.5 EPS for the current year.

Analyst Ratings Changes

Several brokerages have commented on TEVA. Bank of America upped their target price on shares of Teva Pharmaceutical Industries from $20.00 to $22.00 and gave the company a "buy" rating in a research report on Thursday, May 8th. Truist Financial initiated coverage on shares of Teva Pharmaceutical Industries in a research report on Wednesday, May 28th. They issued a "buy" rating and a $25.00 price objective for the company. The Goldman Sachs Group initiated coverage on Teva Pharmaceutical Industries in a report on Friday, June 6th. They set a "buy" rating and a $24.00 target price for the company. UBS Group lowered their target price on Teva Pharmaceutical Industries from $24.00 to $23.00 and set a "buy" rating for the company in a report on Thursday, June 26th. Finally, Hsbc Global Res upgraded shares of Teva Pharmaceutical Industries to a "strong-buy" rating in a research note on Monday, April 28th. Seven analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company's stock. According to MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $24.71.

Read Our Latest Report on Teva Pharmaceutical Industries

Insider Transactions at Teva Pharmaceutical Industries

In other Teva Pharmaceutical Industries news, EVP Matthew Shields sold 6,206 shares of Teva Pharmaceutical Industries stock in a transaction dated Tuesday, June 3rd. The shares were sold at an average price of $17.02, for a total value of $105,626.12. Following the completion of the transaction, the executive vice president directly owned 9,989 shares of the company's stock, valued at approximately $170,012.78. The trade was a 38.32% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Company insiders own 0.55% of the company's stock.

Teva Pharmaceutical Industries Profile

(

Free Report)

Teva Pharmaceutical Industries Limited develops, manufactures, markets, and distributes generic medicines, specialty medicines, and biopharmaceutical products in North America, Europe, Israel, and internationally. It offers generic medicines in various dosage forms, such as tablets, capsules, injectables, inhalants, liquids, transdermal patches, ointments, and creams; sterile products, hormones, high-potency drugs, and cytotoxic substances in parenteral and solid dosage forms; and generic products with medical devices and combination products.

Recommended Stories

Before you consider Teva Pharmaceutical Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teva Pharmaceutical Industries wasn't on the list.

While Teva Pharmaceutical Industries currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.