Sumitomo Mitsui DS Asset Management Company Ltd raised its holdings in shares of Toast, Inc. (NYSE:TOST - Free Report) by 30.4% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 49,907 shares of the company's stock after purchasing an additional 11,624 shares during the quarter. Sumitomo Mitsui DS Asset Management Company Ltd's holdings in Toast were worth $2,210,000 at the end of the most recent reporting period.

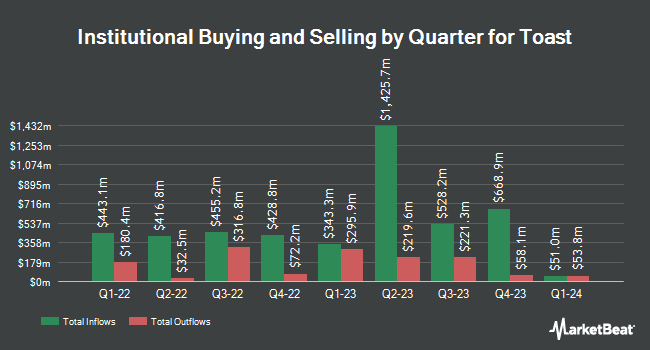

Several other hedge funds have also added to or reduced their stakes in the business. Vanguard Group Inc. lifted its holdings in Toast by 3.5% during the 1st quarter. Vanguard Group Inc. now owns 43,945,584 shares of the company's stock valued at $1,457,675,000 after purchasing an additional 1,471,352 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its holdings in Toast by 17.5% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 23,454,209 shares of the company's stock valued at $777,978,000 after purchasing an additional 3,490,686 shares during the last quarter. T. Rowe Price Investment Management Inc. lifted its holdings in Toast by 7.5% during the 1st quarter. T. Rowe Price Investment Management Inc. now owns 15,520,360 shares of the company's stock valued at $514,811,000 after purchasing an additional 1,082,958 shares during the last quarter. Sumitomo Mitsui Trust Group Inc. lifted its holdings in Toast by 2.9% during the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 5,755,872 shares of the company's stock valued at $190,922,000 after purchasing an additional 160,088 shares during the last quarter. Finally, Principal Financial Group Inc. lifted its holdings in Toast by 14,258.8% during the 1st quarter. Principal Financial Group Inc. now owns 5,474,443 shares of the company's stock valued at $181,587,000 after purchasing an additional 5,436,317 shares during the last quarter. Institutional investors and hedge funds own 82.91% of the company's stock.

Insiders Place Their Bets

In related news, CRO Jonathan Vassil sold 1,427 shares of the firm's stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $48.38, for a total value of $69,038.26. Following the sale, the executive directly owned 63,298 shares of the company's stock, valued at $3,062,357.24. This trade represents a 2.20% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, President Stephen Fredette sold 1,720 shares of the firm's stock in a transaction dated Monday, August 4th. The shares were sold at an average price of $48.38, for a total value of $83,213.60. Following the completion of the sale, the president directly owned 890,818 shares in the company, valued at $43,097,774.84. This trade represents a 0.19% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 88,342 shares of company stock valued at $3,804,710 over the last ninety days. 12.14% of the stock is owned by insiders.

Analyst Ratings Changes

TOST has been the subject of several research reports. Keefe, Bruyette & Woods raised their price target on Toast from $47.00 to $50.00 and gave the company a "market perform" rating in a report on Wednesday, August 6th. DA Davidson increased their price objective on Toast from $40.00 to $46.00 and gave the stock a "neutral" rating in a research report on Tuesday, July 29th. Jefferies Financial Group increased their price objective on Toast from $50.00 to $54.00 and gave the stock a "buy" rating in a research report on Friday, July 18th. Wells Fargo & Company started coverage on Toast in a research report on Wednesday, July 16th. They set a "buy" rating on the stock. Finally, Deutsche Bank Aktiengesellschaft started coverage on Toast in a research report on Thursday, July 17th. They set a "buy" rating and a $54.00 price objective on the stock. Fifteen research analysts have rated the stock with a Buy rating and ten have given a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus target price of $46.30.

Get Our Latest Stock Analysis on TOST

Toast Stock Performance

Shares of NYSE TOST opened at $41.16 on Monday. Toast, Inc. has a 52 week low of $26.63 and a 52 week high of $49.66. The stock has a market capitalization of $20.99 billion, a P/E ratio of 121.06 and a beta of 2.00. The stock's fifty day moving average is $44.25 and its 200 day moving average is $40.66.

Toast (NYSE:TOST - Get Free Report) last issued its quarterly earnings results on Tuesday, August 5th. The company reported $0.13 EPS for the quarter, missing analysts' consensus estimates of $0.23 by ($0.10). Toast had a return on equity of 14.19% and a net margin of 4.07%.The company had revenue of $1.55 billion during the quarter, compared to the consensus estimate of $1.52 billion. During the same quarter in the previous year, the business posted $0.02 EPS. The firm's revenue for the quarter was up 24.8% on a year-over-year basis. Equities research analysts forecast that Toast, Inc. will post 0.39 earnings per share for the current year.

Toast Company Profile

(

Free Report)

Toast, Inc operates a cloud-based digital technology platform for the restaurant industry in the United States, Ireland, and India. The company offers software products for restaurant operations and point of sale, such as Toast POS, Toast now, multi-location management, kitchen display system, Toast mobile order and pay, Toast catering and events, Toast invoicing, Toast tables, and restaurant retail; and hardware products, including Toast flex, Toast flex for guest, Toast go 2, Toast tap, kiosks, and Delphi by Toast.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Toast, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toast wasn't on the list.

While Toast currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report