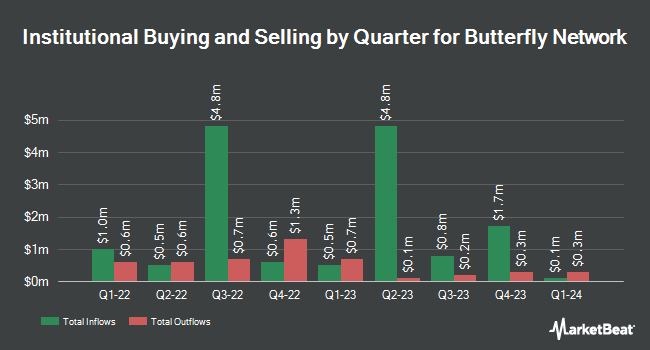

Swiss National Bank acquired a new position in shares of Butterfly Network, Inc. (NYSE:BFLY - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor acquired 271,200 shares of the company's stock, valued at approximately $618,000. Swiss National Bank owned about 0.11% of Butterfly Network as of its most recent SEC filing.

Other hedge funds have also recently added to or reduced their stakes in the company. Ground Swell Capital LLC bought a new stake in Butterfly Network during the 4th quarter worth about $32,000. Total Wealth Planning & Management Inc. bought a new stake in Butterfly Network during the 1st quarter worth about $25,000. TradeLink Capital LLC bought a new stake in Butterfly Network during the 1st quarter worth about $25,000. Deutsche Bank AG bought a new stake in Butterfly Network during the 1st quarter worth about $31,000. Finally, Dark Forest Capital Management LP acquired a new position in Butterfly Network during the 4th quarter valued at about $45,000. Institutional investors own 37.85% of the company's stock.

Butterfly Network Trading Down 0.9%

Shares of NYSE:BFLY traded down $0.02 during mid-day trading on Monday, reaching $1.62. The stock had a trading volume of 2,380,985 shares, compared to its average volume of 3,429,371. The firm has a market cap of $406.56 million, a PE ratio of -5.77 and a beta of 2.52. The firm has a 50 day simple moving average of $1.72 and a two-hundred day simple moving average of $2.31. Butterfly Network, Inc. has a twelve month low of $1.00 and a twelve month high of $4.98.

Butterfly Network (NYSE:BFLY - Get Free Report) last announced its quarterly earnings results on Friday, August 1st. The company reported ($0.06) earnings per share for the quarter, beating analysts' consensus estimates of ($0.07) by $0.01. The business had revenue of $23.38 million for the quarter, compared to the consensus estimate of $23.91 million. Butterfly Network had a negative net margin of 71.79% and a negative return on equity of 30.53%. Butterfly Network has set its FY 2025 guidance at EPS. On average, equities analysts anticipate that Butterfly Network, Inc. will post -0.35 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on BFLY shares. Craig Hallum restated a "positive" rating and set a $2.00 target price on shares of Butterfly Network in a research report on Monday, August 4th. Oppenheimer restated a "market perform" rating on shares of Butterfly Network in a research report on Friday, August 1st. Finally, Lake Street Capital cut their target price on shares of Butterfly Network from $5.00 to $4.00 and set a "buy" rating on the stock in a research report on Monday, May 5th. Three investment analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $3.00.

Read Our Latest Stock Analysis on BFLY

Insider Buying and Selling

In related news, insider Steve Cashman bought 50,000 shares of the company's stock in a transaction on Monday, August 25th. The shares were purchased at an average cost of $1.64 per share, for a total transaction of $82,000.00. Following the acquisition, the insider owned 2,324,474 shares of the company's stock, valued at approximately $3,812,137.36. This represents a 2.20% increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through this link. Company insiders own 25.18% of the company's stock.

Butterfly Network Company Profile

(

Free Report)

Butterfly Network, Inc develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally. It offers Butterfly iQ, a handheld and single-probe whole body ultrasound system; Butterfly iQ+ and iQ3 ultrasound devices that can perform whole-body imaging in a single handheld probe integrated with the clinical workflow, and accessible on a user's smartphone, tablet, and almost any hospital computer system; and Butterfly iQ+ Vet, a handheld ultrasound system designed for veterinarians.

Read More

Before you consider Butterfly Network, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Butterfly Network wasn't on the list.

While Butterfly Network currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.