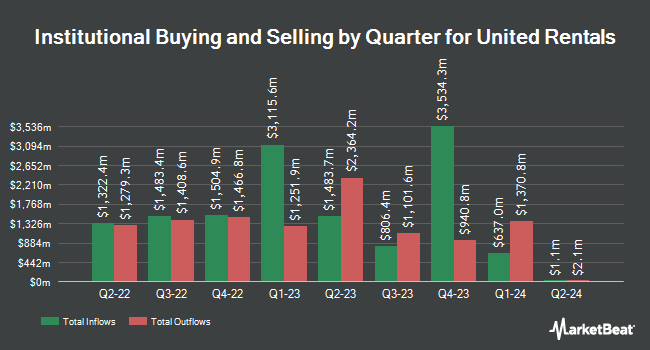

TD Asset Management Inc boosted its stake in United Rentals, Inc. (NYSE:URI - Free Report) by 19.3% in the first quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 279,526 shares of the construction company's stock after purchasing an additional 45,160 shares during the period. TD Asset Management Inc owned about 0.43% of United Rentals worth $175,179,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds have also bought and sold shares of URI. Elevation Point Wealth Partners LLC boosted its position in United Rentals by 32.9% during the first quarter. Elevation Point Wealth Partners LLC now owns 2,220 shares of the construction company's stock valued at $1,391,000 after acquiring an additional 550 shares during the last quarter. Dynamic Advisor Solutions LLC bought a new stake in United Rentals during the first quarter valued at $602,000. Wealth Enhancement Advisory Services LLC boosted its position in United Rentals by 12.4% during the first quarter. Wealth Enhancement Advisory Services LLC now owns 7,160 shares of the construction company's stock valued at $4,488,000 after acquiring an additional 789 shares during the last quarter. Farther Finance Advisors LLC boosted its position in United Rentals by 101.6% during the first quarter. Farther Finance Advisors LLC now owns 859 shares of the construction company's stock valued at $543,000 after acquiring an additional 433 shares during the last quarter. Finally, Brookwood Investment Group LLC bought a new stake in United Rentals during the first quarter valued at $2,966,000. 96.26% of the stock is currently owned by institutional investors and hedge funds.

United Rentals Stock Up 0.2%

NYSE:URI traded up $1.34 on Wednesday, hitting $883.58. The stock had a trading volume of 109,147 shares, compared to its average volume of 664,746. The company has a debt-to-equity ratio of 1.34, a quick ratio of 0.80 and a current ratio of 0.86. The stock has a market cap of $56.85 billion, a P/E ratio of 22.90, a price-to-earnings-growth ratio of 2.07 and a beta of 1.69. United Rentals, Inc. has a 1 year low of $525.91 and a 1 year high of $903.60. The firm's fifty day simple moving average is $754.69 and its two-hundred day simple moving average is $697.14.

United Rentals (NYSE:URI - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The construction company reported $10.47 EPS for the quarter, missing the consensus estimate of $10.54 by ($0.07). The firm had revenue of $3.94 billion during the quarter, compared to analysts' expectations of $3.90 billion. United Rentals had a net margin of 16.11% and a return on equity of 32.01%. The company's quarterly revenue was up 4.5% on a year-over-year basis. During the same quarter last year, the business posted $10.70 EPS. Analysts predict that United Rentals, Inc. will post 44.8 earnings per share for the current year.

United Rentals Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, August 27th. Shareholders of record on Wednesday, August 13th will be paid a $1.79 dividend. The ex-dividend date of this dividend is Wednesday, August 13th. This represents a $7.16 annualized dividend and a yield of 0.81%. United Rentals's dividend payout ratio (DPR) is 18.52%.

Insider Buying and Selling

In other news, VP Andrew B. Limoges sold 708 shares of the firm's stock in a transaction that occurred on Monday, May 12th. The shares were sold at an average price of $705.86, for a total transaction of $499,748.88. Following the completion of the sale, the vice president owned 1,921 shares in the company, valued at $1,355,957.06. This trade represents a 26.93% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 0.51% of the company's stock.

Analyst Ratings Changes

A number of research firms have recently issued reports on URI. Evercore ISI cut their price objective on shares of United Rentals from $974.00 to $921.00 and set an "outperform" rating on the stock in a research report on Monday, May 19th. JPMorgan Chase & Co. increased their price objective on shares of United Rentals from $920.00 to $950.00 and gave the stock an "overweight" rating in a research report on Thursday, July 10th. Truist Financial increased their price objective on shares of United Rentals from $786.00 to $952.00 and gave the stock a "buy" rating in a research report on Friday, July 25th. Barclays increased their price objective on shares of United Rentals from $565.00 to $620.00 and gave the stock an "underweight" rating in a research report on Monday, July 21st. Finally, Bank of America increased their price objective on shares of United Rentals from $895.00 to $900.00 and gave the stock a "buy" rating in a research report on Thursday, July 24th. One investment analyst has rated the stock with a sell rating, five have given a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, the company presently has an average rating of "Moderate Buy" and an average target price of $830.71.

View Our Latest Report on United Rentals

United Rentals Company Profile

(

Free Report)

United Rentals, Inc, through its subsidiaries, operates as an equipment rental company. It operates in two segments, General Rentals and Specialty. The General Rentals segment rents general construction and industrial equipment includes backhoes, skid-steer loaders, forklifts, earthmoving equipment, and material handling equipment; aerial work platforms, such as boom and scissor lifts; and general tools and light equipment comprising pressure washers, water pumps, and power tools for construction and industrial companies, manufacturers, utilities, municipalities, homeowners, and government entities.

Read More

Before you consider United Rentals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and United Rentals wasn't on the list.

While United Rentals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.