Toronto Dominion Bank acquired a new stake in Wayfair Inc. (NYSE:W - Free Report) during the fourth quarter, according to its most recent 13F filing with the SEC. The fund acquired 34,672 shares of the company's stock, valued at approximately $1,536,000.

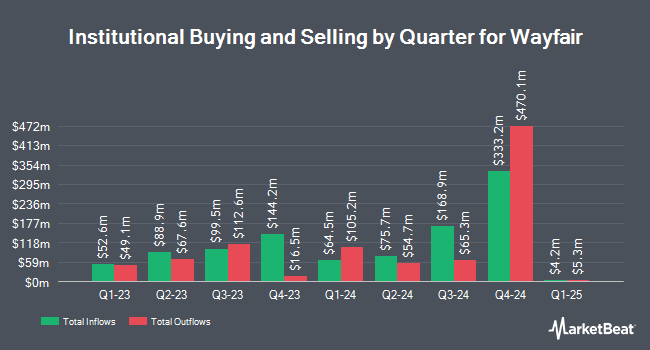

Other institutional investors have also added to or reduced their stakes in the company. Capital World Investors lifted its stake in shares of Wayfair by 6.2% during the 4th quarter. Capital World Investors now owns 13,506,200 shares of the company's stock valued at $598,596,000 after buying an additional 782,757 shares in the last quarter. Baillie Gifford & Co. lifted its stake in shares of Wayfair by 13.6% during the 4th quarter. Baillie Gifford & Co. now owns 6,179,761 shares of the company's stock valued at $273,887,000 after buying an additional 740,641 shares in the last quarter. Norges Bank bought a new position in Wayfair in the 4th quarter worth about $31,472,000. Arrowstreet Capital Limited Partnership bought a new position in Wayfair in the 4th quarter worth about $30,735,000. Finally, Renaissance Technologies LLC boosted its stake in Wayfair by 17.9% in the 4th quarter. Renaissance Technologies LLC now owns 3,834,667 shares of the company's stock worth $169,952,000 after purchasing an additional 581,000 shares during the period. 89.67% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several research analysts have commented on W shares. BMO Capital Markets set a $38.00 target price on Wayfair in a research note on Friday, May 2nd. Mizuho lowered their price target on Wayfair from $60.00 to $50.00 and set an "outperform" rating on the stock in a report on Friday, May 2nd. Needham & Company LLC reaffirmed a "buy" rating and issued a $50.00 price target on shares of Wayfair in a report on Thursday, May 1st. Royal Bank of Canada reaffirmed a "sector perform" rating and issued a $25.00 price target on shares of Wayfair in a report on Friday, April 25th. Finally, Jefferies Financial Group raised Wayfair from a "hold" rating to a "buy" rating and raised their price target for the company from $45.00 to $47.00 in a report on Friday, March 7th. One analyst has rated the stock with a sell rating, twelve have issued a hold rating, twelve have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, the company currently has an average rating of "Moderate Buy" and an average price target of $43.83.

View Our Latest Analysis on W

Insider Activity at Wayfair

In other Wayfair news, insider Steven Conine sold 9,798 shares of Wayfair stock in a transaction on Monday, May 12th. The stock was sold at an average price of $40.02, for a total transaction of $392,115.96. Following the completion of the transaction, the insider now owns 549,275 shares in the company, valued at approximately $21,981,985.50. The trade was a 1.75% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Niraj Shah sold 2,258 shares of Wayfair stock in a transaction on Wednesday, May 14th. The shares were sold at an average price of $40.01, for a total value of $90,342.58. Following the transaction, the chief executive officer now owns 541,627 shares of the company's stock, valued at $21,670,496.27. The trade was a 0.42% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 242,915 shares of company stock worth $9,258,415 over the last ninety days. 21.91% of the stock is owned by corporate insiders.

Wayfair Trading Up 2.3%

Shares of W stock traded up $0.96 during trading hours on Thursday, reaching $43.31. The company's stock had a trading volume of 1,770,409 shares, compared to its average volume of 4,741,011. The stock has a market capitalization of $5.56 billion, a P/E ratio of -10.78 and a beta of 2.93. Wayfair Inc. has a one year low of $20.41 and a one year high of $62.43. The firm's fifty day simple moving average is $32.13 and its 200 day simple moving average is $39.81.

Wayfair (NYSE:W - Get Free Report) last released its quarterly earnings results on Thursday, May 1st. The company reported $0.10 earnings per share for the quarter, beating the consensus estimate of ($0.14) by $0.24. The firm had revenue of $2.73 billion for the quarter, compared to the consensus estimate of $2.71 billion. During the same quarter in the prior year, the firm earned ($0.32) earnings per share. The company's revenue for the quarter was up .0% compared to the same quarter last year. As a group, equities research analysts forecast that Wayfair Inc. will post -2.54 earnings per share for the current fiscal year.

Wayfair Company Profile

(

Free Report)

Wayfair Inc provides e-commerce business in the United States and internationally. The company offers approximately thirty million products for the home sector. It offers online selections of furniture, décor, housewares, and home improvement products through its sites consisting of Wayfair, Joss & Main, AllModern, Birch Lane, Perigold, and Wayfair Professional.

Featured Articles

Before you consider Wayfair, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wayfair wasn't on the list.

While Wayfair currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.