Townsquare Capital LLC cut its holdings in shares of AAON, Inc. (NASDAQ:AAON - Free Report) by 17.9% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 86,713 shares of the construction company's stock after selling 18,843 shares during the quarter. Townsquare Capital LLC owned approximately 0.11% of AAON worth $6,775,000 at the end of the most recent reporting period.

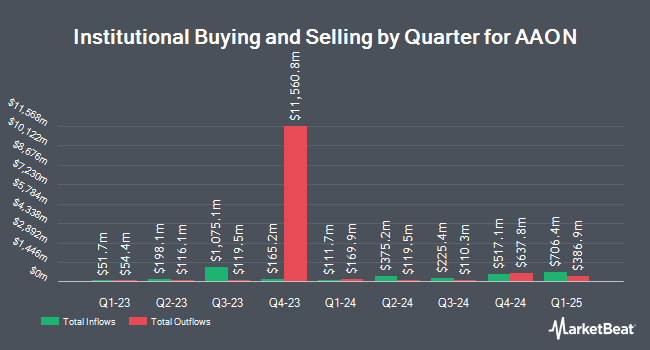

Several other institutional investors and hedge funds have also recently added to or reduced their stakes in AAON. Envestnet Asset Management Inc. lifted its position in AAON by 0.7% during the 4th quarter. Envestnet Asset Management Inc. now owns 340,878 shares of the construction company's stock worth $40,115,000 after buying an additional 2,427 shares in the last quarter. Russell Investments Group Ltd. raised its holdings in shares of AAON by 0.5% in the 4th quarter. Russell Investments Group Ltd. now owns 48,959 shares of the construction company's stock valued at $5,762,000 after purchasing an additional 232 shares during the period. Bank of Montreal Can raised its holdings in shares of AAON by 5.1% in the 4th quarter. Bank of Montreal Can now owns 10,073 shares of the construction company's stock valued at $1,185,000 after purchasing an additional 486 shares during the period. Next Century Growth Investors LLC raised its holdings in shares of AAON by 26.7% in the 4th quarter. Next Century Growth Investors LLC now owns 149,467 shares of the construction company's stock valued at $17,589,000 after purchasing an additional 31,455 shares during the period. Finally, Barclays PLC raised its holdings in shares of AAON by 34.9% in the 4th quarter. Barclays PLC now owns 113,985 shares of the construction company's stock valued at $13,414,000 after purchasing an additional 29,513 shares during the period. 70.81% of the stock is owned by institutional investors.

Insiders Place Their Bets

In other AAON news, Director Gordon Douglas Wichman sold 21,302 shares of the stock in a transaction that occurred on Tuesday, May 20th. The shares were sold at an average price of $104.48, for a total transaction of $2,225,632.96. Following the transaction, the director owned 8,754 shares in the company, valued at $914,617.92. This represents a 70.87% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. 18.70% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

AAON has been the topic of a number of research analyst reports. Sidoti raised shares of AAON from a "neutral" rating to a "buy" rating and set a $95.00 target price on the stock in a report on Monday, June 16th. Wall Street Zen raised shares of AAON from a "sell" rating to a "hold" rating in a report on Saturday. One analyst has rated the stock with a hold rating, four have given a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat, AAON presently has a consensus rating of "Buy" and an average target price of $111.50.

Get Our Latest Analysis on AAON

AAON Stock Down 2.7%

AAON stock opened at $80.52 on Friday. The stock has a market cap of $6.55 billion, a P/E ratio of 42.38 and a beta of 0.94. The company has a quick ratio of 1.80, a current ratio of 2.77 and a debt-to-equity ratio of 0.29. AAON, Inc. has a twelve month low of $68.98 and a twelve month high of $144.07. The company's 50-day moving average price is $78.96 and its two-hundred day moving average price is $88.79.

AAON Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, June 27th. Shareholders of record on Friday, June 6th were issued a $0.10 dividend. This represents a $0.40 annualized dividend and a yield of 0.5%. The ex-dividend date of this dividend was Friday, June 6th. AAON's dividend payout ratio is currently 21.05%.

AAON Company Profile

(

Free Report)

AAON, Inc, together with its subsidiaries, engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada. The company operates through three segments: AAON Oklahoma, AAON Coil Products, and BASX. It offers rooftop units, data center cooling solutions, cleanroom systems, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AAON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAON wasn't on the list.

While AAON currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.