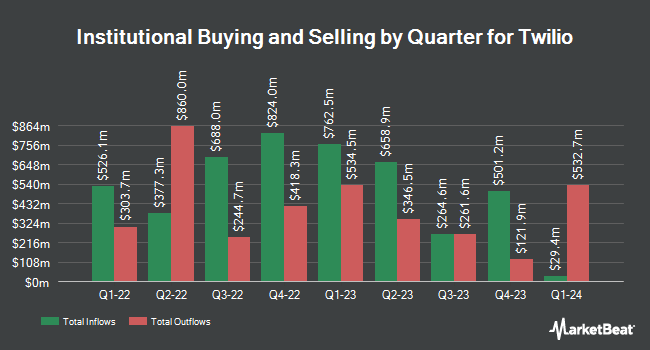

Mediolanum International Funds Ltd cut its stake in Twilio Inc. (NYSE:TWLO - Free Report) by 69.1% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 16,551 shares of the technology company's stock after selling 37,016 shares during the quarter. Mediolanum International Funds Ltd's holdings in Twilio were worth $1,638,000 at the end of the most recent quarter.

Several other hedge funds also recently added to or reduced their stakes in the stock. LRI Investments LLC purchased a new stake in shares of Twilio during the first quarter worth about $25,000. Financial Gravity Asset Management Inc. acquired a new stake in Twilio during the 1st quarter valued at approximately $28,000. Cloud Capital Management LLC acquired a new stake in Twilio during the 1st quarter valued at approximately $34,000. UMB Bank n.a. acquired a new stake in Twilio during the 1st quarter valued at approximately $37,000. Finally, CX Institutional acquired a new stake in Twilio during the 1st quarter valued at approximately $39,000. 84.27% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several analysts have issued reports on TWLO shares. HSBC upgraded Twilio from a "reduce" rating to a "hold" rating and upped their price objective for the company from $77.00 to $99.00 in a research note on Monday, May 5th. Piper Sandler upped their target price on Twilio from $121.00 to $140.00 and gave the stock an "overweight" rating in a research report on Monday, July 14th. UBS Group cut their price objective on Twilio from $175.00 to $150.00 and set a "buy" rating for the company in a research report on Friday, May 2nd. Wells Fargo & Company cut their price objective on Twilio from $160.00 to $120.00 and set an "overweight" rating for the company in a research report on Tuesday, April 22nd. Finally, Mizuho reduced their target price on Twilio from $165.00 to $125.00 and set an "outperform" rating for the company in a report on Tuesday, April 15th. One equities research analyst has rated the stock with a sell rating, seven have assigned a hold rating, seventeen have given a buy rating and one has given a strong buy rating to the stock. According to MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average target price of $127.22.

View Our Latest Stock Analysis on Twilio

Twilio Stock Performance

TWLO stock traded down $1.46 during mid-day trading on Tuesday, reaching $130.05. 2,070,444 shares of the stock traded hands, compared to its average volume of 2,458,750. The company has a quick ratio of 4.78, a current ratio of 4.78 and a debt-to-equity ratio of 0.12. Twilio Inc. has a 52 week low of $56.16 and a 52 week high of $151.95. The business has a 50-day moving average of $120.58 and a two-hundred day moving average of $113.61. The firm has a market capitalization of $19.85 billion, a PE ratio of -619.28, a P/E/G ratio of 4.09 and a beta of 1.30.

Twilio (NYSE:TWLO - Get Free Report) last released its quarterly earnings results on Thursday, May 1st. The technology company reported $1.14 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.92 by $0.22. Twilio had a negative net margin of 0.74% and a positive return on equity of 2.25%. The company had revenue of $1.17 billion during the quarter, compared to analysts' expectations of $1.14 billion. During the same period in the prior year, the company earned $0.80 earnings per share. The business's quarterly revenue was up 12.0% compared to the same quarter last year. As a group, equities analysts predict that Twilio Inc. will post 1.44 EPS for the current fiscal year.

Insider Buying and Selling

In related news, Director Erika Rottenberg sold 4,100 shares of Twilio stock in a transaction dated Monday, June 2nd. The stock was sold at an average price of $120.03, for a total transaction of $492,123.00. Following the sale, the director directly owned 33,488 shares of the company's stock, valued at $4,019,564.64. This trade represents a 10.91% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, CEO Khozema Shipchandler sold 13,595 shares of Twilio stock in a transaction dated Thursday, July 3rd. The stock was sold at an average price of $117.06, for a total value of $1,591,430.70. Following the sale, the chief executive officer directly owned 246,986 shares in the company, valued at approximately $28,912,181.16. This trade represents a 5.22% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 55,888 shares of company stock valued at $6,753,409 over the last three months. 4.50% of the stock is owned by corporate insiders.

About Twilio

(

Free Report)

Twilio Inc, together with its subsidiaries, provides customer engagement platform solutions in the United States and internationally. It operates through two segments, Twilio Communications and Twilio Segment. The company provides various application programming interfaces and software solutions for communications between customers and end users, including messaging, voice, email, flex, marketing campaigns, and user identity and authentication.

Further Reading

Before you consider Twilio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twilio wasn't on the list.

While Twilio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.