Twinbeech Capital LP acquired a new stake in Science Applications International Co. (NYSE:SAIC - Free Report) in the 4th quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor acquired 2,315 shares of the information technology services provider's stock, valued at approximately $259,000.

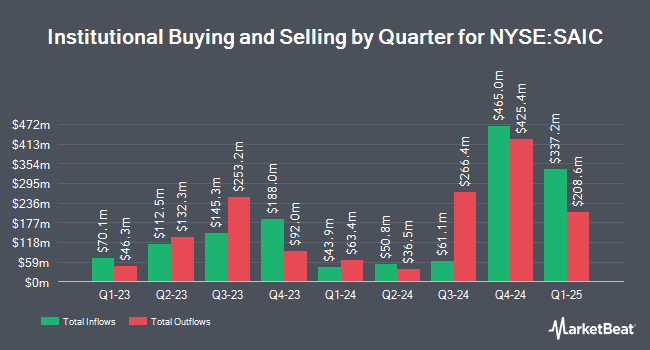

Several other large investors also recently bought and sold shares of the stock. Cornerstone Planning Group LLC acquired a new stake in shares of Science Applications International during the fourth quarter worth about $28,000. True Wealth Design LLC acquired a new stake in shares of Science Applications International during the fourth quarter worth about $48,000. Kapitalo Investimentos Ltda acquired a new stake in shares of Science Applications International during the fourth quarter worth about $58,000. Jones Financial Companies Lllp boosted its stake in shares of Science Applications International by 32.3% during the fourth quarter. Jones Financial Companies Lllp now owns 639 shares of the information technology services provider's stock worth $71,000 after buying an additional 156 shares during the period. Finally, EverSource Wealth Advisors LLC boosted its stake in shares of Science Applications International by 33.1% during the fourth quarter. EverSource Wealth Advisors LLC now owns 671 shares of the information technology services provider's stock worth $75,000 after buying an additional 167 shares during the period. Institutional investors and hedge funds own 76.00% of the company's stock.

Wall Street Analysts Forecast Growth

Several research analysts have weighed in on the company. JPMorgan Chase & Co. cut their price target on Science Applications International from $148.00 to $140.00 and set an "overweight" rating for the company in a report on Tuesday, April 15th. Wells Fargo & Company lowered their price target on Science Applications International from $148.00 to $132.00 and set an "overweight" rating for the company in a report on Tuesday, April 8th. Jefferies Financial Group increased their price target on shares of Science Applications International from $120.00 to $130.00 and gave the stock a "hold" rating in a research report on Thursday, May 15th. Cantor Fitzgerald raised shares of Science Applications International to a "hold" rating in a research report on Tuesday, February 25th. Finally, UBS Group increased their price target on shares of Science Applications International from $123.00 to $126.00 and gave the stock a "neutral" rating in a research report on Tuesday, March 18th. One research analyst has rated the stock with a sell rating, six have given a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat.com, Science Applications International has a consensus rating of "Hold" and an average price target of $131.20.

View Our Latest Analysis on SAIC

Insider Activity at Science Applications International

In other Science Applications International news, Director Milford W. Mcguirt purchased 500 shares of the firm's stock in a transaction on Thursday, March 27th. The shares were purchased at an average price of $110.58 per share, for a total transaction of $55,290.00. Following the completion of the transaction, the director now owns 6,841 shares in the company, valued at $756,477.78. This represents a 7.89% increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Also, Director Garth Graham acquired 215 shares of the firm's stock in a transaction that occurred on Monday, April 14th. The stock was purchased at an average cost of $116.75 per share, with a total value of $25,101.25. Following the purchase, the director now directly owns 7,159 shares in the company, valued at approximately $835,813.25. This trade represents a 3.10% increase in their position. The disclosure for this purchase can be found here. Insiders have purchased 3,260 shares of company stock worth $365,037 over the last quarter. 0.44% of the stock is currently owned by company insiders.

Science Applications International Stock Performance

Shares of NYSE:SAIC traded down $0.56 during trading hours on Thursday, hitting $114.79. The stock had a trading volume of 208,639 shares, compared to its average volume of 513,241. The stock's fifty day simple moving average is $117.01 and its 200 day simple moving average is $114.25. Science Applications International Co. has a 1-year low of $94.68 and a 1-year high of $156.34. The firm has a market capitalization of $5.48 billion, a price-to-earnings ratio of 19.36 and a beta of 0.55. The company has a debt-to-equity ratio of 1.20, a quick ratio of 0.87 and a current ratio of 0.87.

Science Applications International (NYSE:SAIC - Get Free Report) last announced its quarterly earnings results on Monday, March 17th. The information technology services provider reported $2.57 EPS for the quarter, beating the consensus estimate of $2.00 by $0.57. Science Applications International had a net margin of 4.11% and a return on equity of 24.18%. The company had revenue of $1.84 billion for the quarter, compared to analyst estimates of $1.81 billion. During the same quarter last year, the business earned $1.43 earnings per share. Science Applications International's revenue was up 5.8% compared to the same quarter last year. Sell-side analysts anticipate that Science Applications International Co. will post 8.27 earnings per share for the current fiscal year.

Science Applications International Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, April 25th. Investors of record on Friday, April 11th were paid a dividend of $0.37 per share. The ex-dividend date was Friday, April 11th. This represents a $1.48 dividend on an annualized basis and a dividend yield of 1.29%. Science Applications International's dividend payout ratio is presently 20.58%.

About Science Applications International

(

Free Report)

Science Applications International Corporation provides technical, engineering, and enterprise information technology (IT) services primarily in the United States. The company's offerings include IT modernization; digital engineering; artificial intelligence; Weapon systems support design, build, modify, integrate, and sustain weapon systems; and end-to-end services, such as design, development, integration, deployment, management and operations, sustainment, and security of its customers' IT infrastructure, as well as training and simulation and ground vehicles support which integrates, modify, upgrades, and sustains ground vehicles for nation's armed forces.

Featured Articles

Before you consider Science Applications International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Science Applications International wasn't on the list.

While Science Applications International currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.