Foster & Motley Inc. lifted its holdings in UGI Corporation (NYSE:UGI - Free Report) by 6.7% in the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 116,138 shares of the utilities provider's stock after acquiring an additional 7,302 shares during the period. Foster & Motley Inc. owned approximately 0.05% of UGI worth $3,841,000 as of its most recent SEC filing.

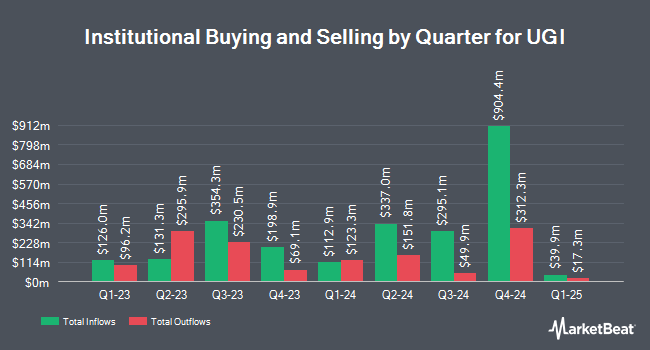

Several other large investors also recently made changes to their positions in the business. Bessemer Group Inc. lifted its position in shares of UGI by 216.7% in the 4th quarter. Bessemer Group Inc. now owns 893 shares of the utilities provider's stock worth $25,000 after buying an additional 611 shares during the last quarter. Altshuler Shaham Ltd acquired a new stake in shares of UGI in the 4th quarter worth about $25,000. CX Institutional acquired a new stake in shares of UGI in the 1st quarter worth about $30,000. GeoWealth Management LLC acquired a new stake in shares of UGI in the 4th quarter worth about $27,000. Finally, Private Trust Co. NA increased its holdings in shares of UGI by 36.1% in the 1st quarter. Private Trust Co. NA now owns 1,395 shares of the utilities provider's stock worth $46,000 after acquiring an additional 370 shares during the period. Institutional investors and hedge funds own 82.34% of the company's stock.

UGI Stock Up 0.1%

NYSE UGI traded up $0.03 during trading on Wednesday, reaching $35.75. The company's stock had a trading volume of 1,119,245 shares, compared to its average volume of 1,412,647. The company has a current ratio of 1.23, a quick ratio of 1.05 and a debt-to-equity ratio of 1.31. The stock has a market capitalization of $7.67 billion, a PE ratio of 14.71, a PEG ratio of 1.70 and a beta of 1.05. The business has a 50-day moving average price of $35.94 and a 200-day moving average price of $33.64. UGI Corporation has a 1-year low of $23.09 and a 1-year high of $37.42.

UGI (NYSE:UGI - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The utilities provider reported $2.21 earnings per share for the quarter, topping analysts' consensus estimates of $1.80 by $0.41. UGI had a net margin of 7.28% and a return on equity of 16.21%. The business had revenue of $2.67 billion during the quarter, compared to analysts' expectations of $3.26 billion. During the same period in the previous year, the company earned $1.97 earnings per share. UGI's revenue for the quarter was up 8.1% on a year-over-year basis. On average, research analysts forecast that UGI Corporation will post 3.02 earnings per share for the current fiscal year.

UGI Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, July 1st. Shareholders of record on Friday, May 16th were issued a $0.375 dividend. This represents a $1.50 annualized dividend and a yield of 4.20%. The ex-dividend date was Monday, June 16th. UGI's dividend payout ratio (DPR) is presently 61.73%.

Analyst Ratings Changes

UGI has been the topic of several research analyst reports. Mizuho raised their target price on shares of UGI from $38.00 to $39.00 and gave the company an "outperform" rating in a research note on Thursday, May 15th. Wall Street Zen cut shares of UGI from a "strong-buy" rating to a "buy" rating in a research note on Friday, July 18th.

Read Our Latest Stock Report on UGI

UGI Profile

(

Free Report)

UGI Corporation, together with its subsidiaries, distributes, stores, transports, and markets energy products and related services in the United States and internationally. The company operates through four segments: AmeriGas Propane, UGI International, Midstream & Marketing, and UGI Utilities. It distributes propane to approximately 1.3 million residential, commercial/industrial, motor fuel, agricultural, and wholesale customers through 1,400 propane distribution locations.

Read More

Before you consider UGI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UGI wasn't on the list.

While UGI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.