Universal Beteiligungs und Servicegesellschaft mbH lessened its position in shares of MGM Resorts International (NYSE:MGM - Free Report) by 30.4% during the first quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 107,353 shares of the company's stock after selling 46,847 shares during the period. Universal Beteiligungs und Servicegesellschaft mbH's holdings in MGM Resorts International were worth $3,182,000 as of its most recent filing with the Securities and Exchange Commission.

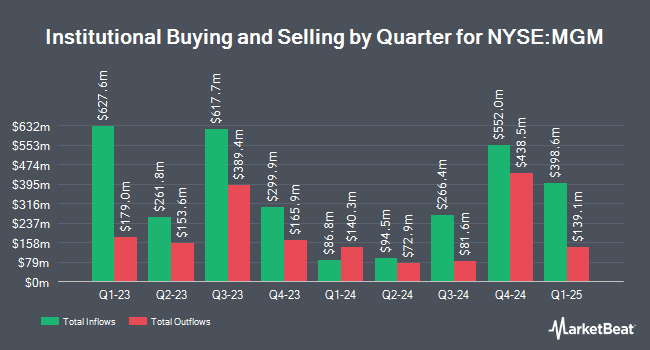

A number of other hedge funds and other institutional investors have also bought and sold shares of MGM. American Century Companies Inc. increased its holdings in MGM Resorts International by 1.9% during the 4th quarter. American Century Companies Inc. now owns 38,941 shares of the company's stock worth $1,349,000 after acquiring an additional 708 shares during the period. Korea Investment CORP increased its holdings in MGM Resorts International by 964.3% during the 4th quarter. Korea Investment CORP now owns 145,287 shares of the company's stock worth $5,034,000 after acquiring an additional 131,636 shares during the period. UniSuper Management Pty Ltd increased its holdings in MGM Resorts International by 13.7% during the 4th quarter. UniSuper Management Pty Ltd now owns 48,696 shares of the company's stock worth $1,687,000 after acquiring an additional 5,864 shares during the period. NEOS Investment Management LLC grew its stake in MGM Resorts International by 29.9% in the 4th quarter. NEOS Investment Management LLC now owns 16,232 shares of the company's stock worth $562,000 after buying an additional 3,732 shares in the last quarter. Finally, Norges Bank purchased a new position in MGM Resorts International in the 4th quarter worth approximately $88,033,000. Institutional investors own 68.11% of the company's stock.

MGM Resorts International Trading Down 1.2%

NYSE:MGM traded down $0.45 during midday trading on Friday, reaching $36.00. 2,676,756 shares of the stock traded hands, compared to its average volume of 5,440,788. The company has a fifty day moving average of $35.04 and a 200 day moving average of $33.38. MGM Resorts International has a 12 month low of $25.30 and a 12 month high of $42.53. The company has a debt-to-equity ratio of 1.79, a quick ratio of 1.26 and a current ratio of 1.31. The stock has a market capitalization of $9.80 billion, a P/E ratio of 19.80, a PEG ratio of 2.45 and a beta of 1.76.

MGM Resorts International (NYSE:MGM - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The company reported $0.79 EPS for the quarter, beating analysts' consensus estimates of $0.58 by $0.21. MGM Resorts International had a net margin of 3.13% and a return on equity of 19.40%. The company had revenue of $4.40 billion during the quarter, compared to analyst estimates of $4.28 billion. During the same period in the prior year, the business posted $0.86 EPS. The firm's revenue was up 1.8% compared to the same quarter last year. On average, research analysts predict that MGM Resorts International will post 2.21 EPS for the current year.

MGM Resorts International declared that its Board of Directors has approved a stock buyback program on Wednesday, April 30th that authorizes the company to repurchase $2.00 billion in shares. This repurchase authorization authorizes the company to purchase up to 22.4% of its stock through open market purchases. Stock repurchase programs are often a sign that the company's management believes its shares are undervalued.

Insider Activity at MGM Resorts International

In related news, COO Corey Ian Sanders sold 40,000 shares of the company's stock in a transaction on Monday, May 12th. The shares were sold at an average price of $34.43, for a total transaction of $1,377,200.00. Following the completion of the sale, the chief operating officer directly owned 281,530 shares in the company, valued at $9,693,077.90. This represents a 12.44% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available through this link. Also, Director Keith A. Meister sold 60,000 shares of the company's stock in a transaction on Friday, June 13th. The shares were sold at an average price of $32.09, for a total transaction of $1,925,400.00. Following the sale, the director owned 5,627,478 shares of the company's stock, valued at $180,585,769.02. This represents a 1.05% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 105,261 shares of company stock worth $3,486,367 in the last three months. 3.06% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of equities analysts have commented on the stock. Susquehanna boosted their price target on shares of MGM Resorts International from $50.00 to $60.00 and gave the stock a "positive" rating in a research note on Tuesday. The Goldman Sachs Group assumed coverage on shares of MGM Resorts International in a research note on Monday, July 7th. They issued a "sell" rating and a $34.00 price target for the company. Citizens Jmp cut shares of MGM Resorts International from an "outperform" rating to a "market perform" rating in a research note on Thursday, June 26th. JMP Securities reissued a "market perform" rating on shares of MGM Resorts International in a research note on Thursday, June 26th. Finally, Citigroup raised shares of MGM Resorts International from a "hold" rating to a "strong-buy" rating and boosted their price target for the stock from $55.00 to $57.00 in a research note on Wednesday, July 9th. Two equities research analysts have rated the stock with a sell rating, eight have given a hold rating, fourteen have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, MGM Resorts International currently has a consensus rating of "Moderate Buy" and a consensus target price of $48.56.

View Our Latest Research Report on MGM Resorts International

MGM Resorts International Profile

(

Free Report)

MGM Resorts International, through its subsidiaries, owns and operates casino, hotel, and entertainment resorts in the United States and internationally. The company operates through three segments: Las Vegas Strip Resorts, Regional Operations, and MGM China. Its casino resorts offer gaming, hotel, convention, dining, entertainment, retail, and other resort amenities.

See Also

Before you consider MGM Resorts International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MGM Resorts International wasn't on the list.

While MGM Resorts International currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report