US Bancorp DE cut its stake in Bilibili Inc. Sponsored ADR (NASDAQ:BILI - Free Report) by 39.5% during the second quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 35,828 shares of the company's stock after selling 23,406 shares during the period. US Bancorp DE's holdings in Bilibili were worth $769,000 at the end of the most recent quarter.

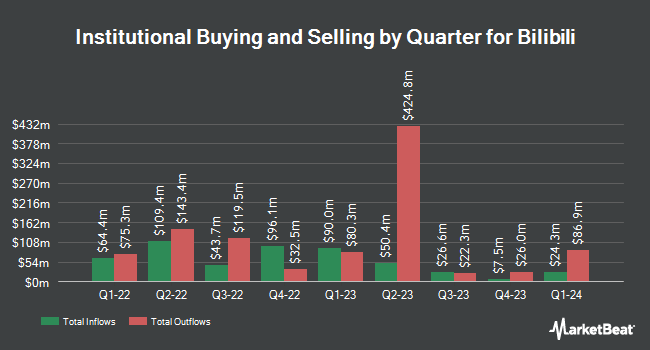

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in BILI. SVB Wealth LLC bought a new position in Bilibili during the 1st quarter worth about $31,000. Brooklyn Investment Group raised its position in Bilibili by 10,989.7% during the 1st quarter. Brooklyn Investment Group now owns 3,216 shares of the company's stock worth $61,000 after buying an additional 3,187 shares during the last quarter. Banque Transatlantique SA purchased a new position in Bilibili during the 1st quarter worth approximately $80,000. Advisors Asset Management Inc. raised its position in Bilibili by 16.6% during the 1st quarter. Advisors Asset Management Inc. now owns 5,280 shares of the company's stock worth $101,000 after buying an additional 751 shares during the last quarter. Finally, PNC Financial Services Group Inc. raised its position in Bilibili by 40.5% during the 1st quarter. PNC Financial Services Group Inc. now owns 9,279 shares of the company's stock worth $177,000 after buying an additional 2,676 shares during the last quarter. 16.08% of the stock is currently owned by institutional investors.

Bilibili Trading Down 0.9%

NASDAQ BILI opened at $27.05 on Friday. The company has a debt-to-equity ratio of 0.57, a current ratio of 1.60 and a quick ratio of 1.60. The stock has a market capitalization of $11.31 billion, a P/E ratio of 386.43 and a beta of 0.93. The firm's 50-day moving average is $25.53 and its two-hundred day moving average is $21.73. Bilibili Inc. Sponsored ADR has a 12 month low of $14.47 and a 12 month high of $30.92.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on BILI. JPMorgan Chase & Co. lowered shares of Bilibili from an "overweight" rating to a "neutral" rating and lifted their target price for the company from $21.00 to $24.00 in a report on Monday, July 28th. Barclays boosted their price target on shares of Bilibili from $25.00 to $28.00 and gave the stock an "overweight" rating in a report on Friday, August 22nd. Wall Street Zen raised shares of Bilibili from a "hold" rating to a "buy" rating in a report on Saturday, August 23rd. Jefferies Financial Group set a $28.00 price target on shares of Bilibili in a report on Thursday, August 21st. Finally, Bank of America boosted their price target on shares of Bilibili from $25.00 to $27.00 and gave the stock a "buy" rating in a report on Thursday, July 17th. Two equities research analysts have rated the stock with a Strong Buy rating, eight have issued a Buy rating and three have issued a Hold rating to the company's stock. According to MarketBeat, Bilibili has a consensus rating of "Moderate Buy" and a consensus target price of $26.95.

Get Our Latest Analysis on Bilibili

Bilibili Profile

(

Free Report)

Bilibili Inc provides online entertainment services for the young generations in the People's Republic of China. It offers a range of digital content, including professional user generated videos, mobile games, and value-added services, such as live broadcasting, occupationally generated videos, audio drama on Maoer, and comics on Bilibili Comic.

See Also

Want to see what other hedge funds are holding BILI? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Bilibili Inc. Sponsored ADR (NASDAQ:BILI - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bilibili, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bilibili wasn't on the list.

While Bilibili currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.