Venture Visionary Partners LLC lowered its stake in shares of Huntington Bancshares Incorporated (NASDAQ:HBAN - Free Report) by 48.6% during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 150,953 shares of the bank's stock after selling 143,011 shares during the quarter. Venture Visionary Partners LLC's holdings in Huntington Bancshares were worth $2,266,000 as of its most recent SEC filing.

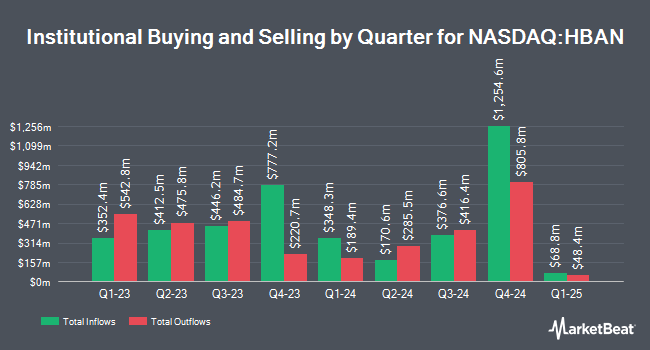

A number of other institutional investors also recently bought and sold shares of HBAN. BI Asset Management Fondsmaeglerselskab A S raised its holdings in shares of Huntington Bancshares by 59.1% in the fourth quarter. BI Asset Management Fondsmaeglerselskab A S now owns 142,288 shares of the bank's stock worth $2,315,000 after buying an additional 52,842 shares during the last quarter. Norinchukin Bank The increased its position in shares of Huntington Bancshares by 7.9% in the 4th quarter. Norinchukin Bank The now owns 63,613 shares of the bank's stock valued at $1,035,000 after acquiring an additional 4,683 shares during the period. MetLife Investment Management LLC raised its stake in Huntington Bancshares by 1.8% in the 4th quarter. MetLife Investment Management LLC now owns 384,366 shares of the bank's stock worth $6,254,000 after acquiring an additional 6,852 shares during the last quarter. Natixis acquired a new stake in Huntington Bancshares during the 4th quarter worth about $733,000. Finally, Transce3nd LLC purchased a new stake in Huntington Bancshares during the 4th quarter valued at about $48,000. 80.72% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Huntington Bancshares

In other Huntington Bancshares news, EVP Marcy C. Hingst sold 13,700 shares of the firm's stock in a transaction that occurred on Friday, June 13th. The stock was sold at an average price of $15.79, for a total value of $216,323.00. Following the sale, the executive vice president directly owned 337,879 shares of the company's stock, valued at approximately $5,335,109.41. This trade represents a 3.90% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Corporate insiders own 0.89% of the company's stock.

Analysts Set New Price Targets

Several research analysts have recently issued reports on the company. Raymond James Financial restated a "strong-buy" rating and issued a $21.00 price objective (up from $18.00) on shares of Huntington Bancshares in a research note on Tuesday, July 8th. Citigroup raised their price target on shares of Huntington Bancshares from $19.00 to $20.00 and gave the stock a "buy" rating in a research report on Wednesday, July 2nd. Jefferies Financial Group initiated coverage on shares of Huntington Bancshares in a report on Wednesday, May 21st. They issued a "buy" rating and a $20.00 price objective on the stock. TD Cowen initiated coverage on shares of Huntington Bancshares in a report on Thursday, May 15th. They set a "buy" rating and a $20.00 target price for the company. Finally, Wall Street Zen downgraded shares of Huntington Bancshares from a "hold" rating to a "sell" rating in a research report on Sunday, July 13th. Two investment analysts have rated the stock with a Strong Buy rating, fifteen have assigned a Buy rating, three have assigned a Hold rating and one has assigned a Sell rating to the company's stock. Based on data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $18.68.

Read Our Latest Research Report on Huntington Bancshares

Huntington Bancshares Stock Performance

HBAN stock traded up $0.70 during midday trading on Friday, hitting $17.36. 30,878,382 shares of the stock traded hands, compared to its average volume of 28,964,992. Huntington Bancshares Incorporated has a 1-year low of $11.91 and a 1-year high of $18.44. The company has a debt-to-equity ratio of 0.92, a current ratio of 0.89 and a quick ratio of 0.89. The stock's fifty day simple moving average is $16.63 and its 200-day simple moving average is $15.68. The firm has a market cap of $25.32 billion, a P/E ratio of 12.86, a PEG ratio of 0.89 and a beta of 0.93.

Huntington Bancshares Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, October 1st. Investors of record on Wednesday, September 17th will be issued a $0.155 dividend. The ex-dividend date of this dividend is Wednesday, September 17th. This represents a $0.62 dividend on an annualized basis and a yield of 3.6%. Huntington Bancshares's dividend payout ratio is presently 45.93%.

Huntington Bancshares Profile

(

Free Report)

Huntington Bancshares Incorporated operates as the bank holding company for The Huntington National Bank that provides commercial, consumer, and mortgage banking services in the United States. The company offers financial products and services to consumer and business customers, including deposits, lending, payments, mortgage banking, dealer financing, investment management, trust, brokerage, insurance, and other financial products and services.

Featured Stories

Before you consider Huntington Bancshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Huntington Bancshares wasn't on the list.

While Huntington Bancshares currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.