Victory Capital Management Inc. reduced its position in shares of IDEX Corporation (NYSE:IEX - Free Report) by 32.9% during the 1st quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 39,378 shares of the industrial products company's stock after selling 19,341 shares during the quarter. Victory Capital Management Inc. owned 0.05% of IDEX worth $7,126,000 as of its most recent SEC filing.

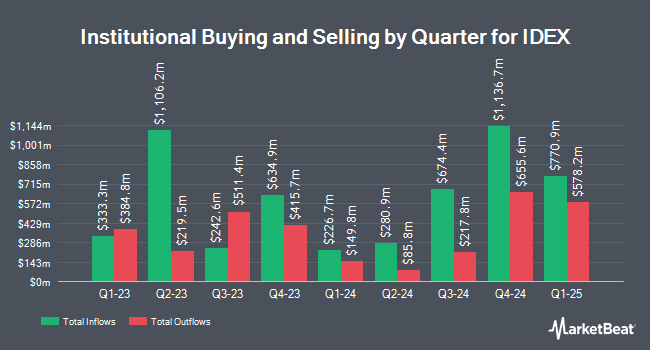

Several other hedge funds have also modified their holdings of the company. Wellington Management Group LLP boosted its stake in shares of IDEX by 49.1% during the 4th quarter. Wellington Management Group LLP now owns 4,219,596 shares of the industrial products company's stock worth $883,119,000 after acquiring an additional 1,388,667 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its stake in shares of IDEX by 8.2% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 3,666,777 shares of the industrial products company's stock worth $767,421,000 after acquiring an additional 277,964 shares in the last quarter. Impax Asset Management Group plc lifted its stake in IDEX by 11.5% in the 1st quarter. Impax Asset Management Group plc now owns 2,006,724 shares of the industrial products company's stock valued at $363,157,000 after buying an additional 207,172 shares in the last quarter. Geode Capital Management LLC raised its holdings in IDEX by 1.2% in the 4th quarter. Geode Capital Management LLC now owns 1,912,933 shares of the industrial products company's stock valued at $399,350,000 after acquiring an additional 21,758 shares during the last quarter. Finally, T. Rowe Price Investment Management Inc. raised its holdings in IDEX by 0.9% in the 4th quarter. T. Rowe Price Investment Management Inc. now owns 1,868,919 shares of the industrial products company's stock valued at $391,147,000 after acquiring an additional 17,087 shares during the last quarter. 97.96% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling

In other IDEX news, CFO Akhil Mahendra sold 250 shares of IDEX stock in a transaction on Thursday, June 5th. The shares were sold at an average price of $180.89, for a total value of $45,222.50. Following the transaction, the chief financial officer directly owned 5,035 shares in the company, valued at approximately $910,781.15. The trade was a 4.73% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Corporate insiders own 0.50% of the company's stock.

IDEX Stock Down 0.1%

NYSE:IEX traded down $0.14 during midday trading on Tuesday, hitting $184.30. 98,973 shares of the company were exchanged, compared to its average volume of 638,818. The company has a fifty day simple moving average of $180.64 and a 200 day simple moving average of $186.06. IDEX Corporation has a fifty-two week low of $153.36 and a fifty-two week high of $238.22. The company has a current ratio of 2.79, a quick ratio of 1.99 and a debt-to-equity ratio of 0.47. The company has a market capitalization of $13.92 billion, a PE ratio of 29.21, a price-to-earnings-growth ratio of 1.88 and a beta of 1.04.

IDEX (NYSE:IEX - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The industrial products company reported $1.75 EPS for the quarter, topping the consensus estimate of $1.64 by $0.11. IDEX had a net margin of 14.60% and a return on equity of 15.51%. The firm had revenue of $814.30 million for the quarter, compared to analyst estimates of $807.25 million. During the same period last year, the business earned $1.88 EPS. IDEX's revenue for the quarter was up 1.7% compared to the same quarter last year. As a group, equities analysts anticipate that IDEX Corporation will post 8.26 earnings per share for the current fiscal year.

IDEX Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, July 25th. Shareholders of record on Friday, July 11th were paid a $0.71 dividend. The ex-dividend date was Friday, July 11th. This represents a $2.84 dividend on an annualized basis and a yield of 1.54%. IDEX's dividend payout ratio is presently 45.01%.

Wall Street Analyst Weigh In

A number of brokerages have recently issued reports on IEX. Stifel Nicolaus raised their price target on shares of IDEX from $208.00 to $238.00 and gave the stock a "buy" rating in a report on Monday, July 21st. Royal Bank Of Canada raised their price target on shares of IDEX from $206.00 to $208.00 and gave the stock an "outperform" rating in a report on Friday, May 2nd. Mizuho set a $185.00 price target on shares of IDEX in a report on Friday, May 16th. Citigroup raised their price target on shares of IDEX from $208.00 to $216.00 and gave the stock a "buy" rating in a report on Monday, July 14th. Finally, Robert W. Baird set a $215.00 price target on shares of IDEX in a report on Friday, May 2nd. Two investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $218.13.

View Our Latest Research Report on IDEX

IDEX Profile

(

Free Report)

IDEX Corporation, together with its subsidiaries, provides applied solutions worldwide. The company operates through three segments: Fluid & Metering Technologies (FMT), Health & Science Technologies (HST), and Fire & Safety/Diversified Products (FSDP). The FMT segment designs, produces, and distributes positive displacement pumps, valves, small volume provers, flow meters, injectors, and other fluid-handling pump modules and systems, as well as flow monitoring and other services for the food, chemical, general industrial, water and wastewater, agricultural, and energy industries.

Further Reading

Before you consider IDEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEX wasn't on the list.

While IDEX currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report