Harvest Fund Management Co. Ltd raised its stake in shares of Vipshop Holdings Limited (NYSE:VIPS - Free Report) by 66.6% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The firm owned 216,491 shares of the technology company's stock after buying an additional 86,548 shares during the period. Harvest Fund Management Co. Ltd's holdings in Vipshop were worth $3,103,000 as of its most recent SEC filing.

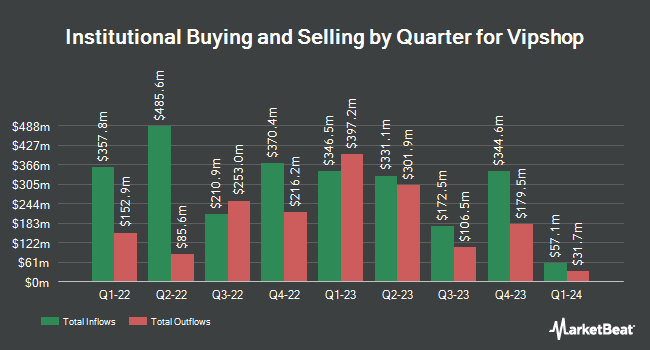

Other institutional investors also recently modified their holdings of the company. Wayfinding Financial LLC acquired a new stake in shares of Vipshop in the 1st quarter valued at $35,000. Sound Income Strategies LLC acquired a new stake in shares of Vipshop in the 1st quarter valued at $62,000. AM Investment Strategies LLC acquired a new stake in shares of Vipshop in the 1st quarter valued at $157,000. Jump Financial LLC acquired a new stake in shares of Vipshop in the 4th quarter valued at $161,000. Finally, Ballentine Partners LLC acquired a new stake in shares of Vipshop in the 1st quarter valued at $163,000. Institutional investors and hedge funds own 48.82% of the company's stock.

Vipshop Trading Down 2.6%

VIPS traded down $0.40 during trading on Wednesday, hitting $15.10. The stock had a trading volume of 935,470 shares, compared to its average volume of 2,486,227. The company has a 50 day simple moving average of $14.98 and a 200-day simple moving average of $14.77. Vipshop Holdings Limited has a 12 month low of $11.50 and a 12 month high of $17.94. The firm has a market cap of $7.74 billion, a PE ratio of 7.91, a P/E/G ratio of 1.73 and a beta of 0.58.

Analyst Upgrades and Downgrades

Several equities research analysts recently issued reports on VIPS shares. Wall Street Zen lowered shares of Vipshop from a "buy" rating to a "hold" rating in a research note on Thursday, May 29th. Bank of America dropped their target price on shares of Vipshop from $17.80 to $17.30 and set a "buy" rating on the stock in a report on Friday, July 18th. Barclays dropped their target price on shares of Vipshop from $20.00 to $19.00 and set an "overweight" rating on the stock in a report on Thursday, May 22nd. JPMorgan Chase & Co. dropped their target price on shares of Vipshop from $20.00 to $18.00 and set an "overweight" rating on the stock in a report on Monday, June 30th. Finally, Citigroup downgraded shares of Vipshop from a "buy" rating to a "neutral" rating and set a $18.00 target price on the stock. in a report on Tuesday, April 1st. Six analysts have rated the stock with a hold rating and three have issued a buy rating to the company. According to MarketBeat.com, the company has an average rating of "Hold" and a consensus price target of $15.83.

Get Our Latest Stock Report on Vipshop

About Vipshop

(

Free Report)

Vipshop Holdings Limited operates online platforms in the People's Republic of China. It operates in Vip.com, Shan Shan Outlets, and Others segments. The company offers womenswear, menswear, sportswear and sporting goods, shoes and bags, accessories, baby and children products, skincare and cosmetics, home goods and other lifestyle products, and supermarket products.

Featured Articles

Before you consider Vipshop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vipshop wasn't on the list.

While Vipshop currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.