Voya Investment Management LLC lifted its position in Cohu, Inc. (NASDAQ:COHU - Free Report) by 40.5% during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 321,232 shares of the semiconductor company's stock after purchasing an additional 92,600 shares during the quarter. Voya Investment Management LLC owned about 0.69% of Cohu worth $4,725,000 at the end of the most recent quarter.

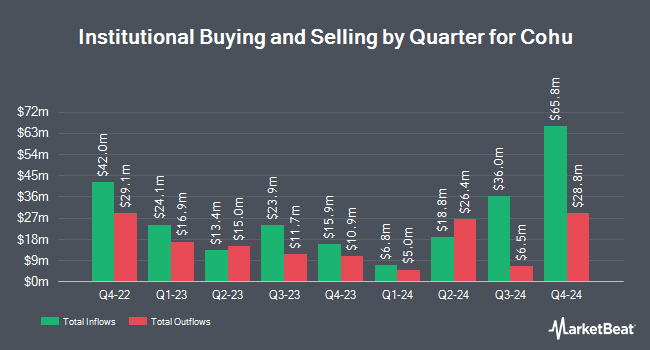

Other hedge funds also recently bought and sold shares of the company. Janney Montgomery Scott LLC grew its stake in shares of Cohu by 6.0% during the first quarter. Janney Montgomery Scott LLC now owns 25,642 shares of the semiconductor company's stock valued at $377,000 after buying an additional 1,454 shares during the last quarter. GAMMA Investing LLC increased its holdings in shares of Cohu by 172.2% in the 1st quarter. GAMMA Investing LLC now owns 2,659 shares of the semiconductor company's stock worth $39,000 after purchasing an additional 1,682 shares in the last quarter. Bank of America Corp DE grew its stake in shares of Cohu by 89.0% during the 4th quarter. Bank of America Corp DE now owns 110,722 shares of the semiconductor company's stock valued at $2,956,000 after purchasing an additional 52,141 shares during the period. Deutsche Bank AG increased its stake in shares of Cohu by 70.8% in the 4th quarter. Deutsche Bank AG now owns 69,558 shares of the semiconductor company's stock worth $1,857,000 after purchasing an additional 28,832 shares in the last quarter. Finally, Two Sigma Investments LP lifted its holdings in Cohu by 218.5% during the fourth quarter. Two Sigma Investments LP now owns 54,538 shares of the semiconductor company's stock valued at $1,456,000 after purchasing an additional 37,414 shares in the last quarter. Institutional investors own 94.67% of the company's stock.

Cohu Price Performance

NASDAQ:COHU traded up $0.63 on Monday, reaching $23.15. 282,145 shares of the company's stock traded hands, compared to its average volume of 412,040. The stock has a 50-day simple moving average of $20.09 and a 200-day simple moving average of $18.14. The firm has a market cap of $1.08 billion, a PE ratio of -12.38 and a beta of 1.34. Cohu, Inc. has a 12 month low of $12.57 and a 12 month high of $29.42. The company has a quick ratio of 3.51, a current ratio of 4.88 and a debt-to-equity ratio of 0.01.

Cohu (NASDAQ:COHU - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The semiconductor company reported $0.02 earnings per share for the quarter, topping the consensus estimate of ($0.02) by $0.04. Cohu had a negative return on equity of 3.74% and a negative net margin of 22.11%.The business had revenue of $107.68 million during the quarter, compared to the consensus estimate of $106.00 million. During the same period in the prior year, the company posted ($0.01) EPS. The firm's revenue for the quarter was up 2.9% compared to the same quarter last year. Cohu has set its Q3 2025 guidance at EPS. Equities research analysts forecast that Cohu, Inc. will post -0.36 earnings per share for the current year.

About Cohu

(

Free Report)

Cohu, Inc, through its subsidiaries, provides semiconductor test equipment and services in China, the United States, Taiwan, Malaysia, the Philippines, and internationally. The company supplies semiconductor test and inspection handlers, micro-electromechanical system (MEMS) test modules, test contactors, thermal sub-systems, and semiconductor automated test equipment for semiconductor manufacturers and test subcontractors.

See Also

Before you consider Cohu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cohu wasn't on the list.

While Cohu currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.