Wellington Management Group LLP acquired a new stake in Himax Technologies, Inc. (NASDAQ:HIMX - Free Report) during the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 456,825 shares of the semiconductor company's stock, valued at approximately $3,358,000. Wellington Management Group LLP owned 0.26% of Himax Technologies as of its most recent filing with the Securities and Exchange Commission (SEC).

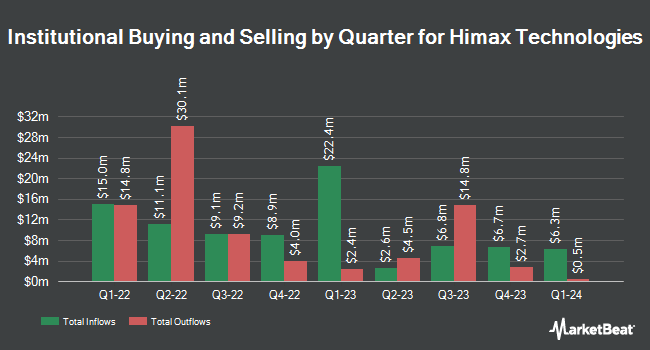

Other hedge funds have also made changes to their positions in the company. Point72 Asset Management L.P. grew its holdings in shares of Himax Technologies by 346.1% during the fourth quarter. Point72 Asset Management L.P. now owns 3,874,811 shares of the semiconductor company's stock worth $31,153,000 after buying an additional 3,006,311 shares during the last quarter. Point72 Hong Kong Ltd acquired a new stake in Himax Technologies during the 4th quarter worth approximately $18,431,000. Allianz Asset Management GmbH purchased a new position in shares of Himax Technologies in the 1st quarter valued at approximately $8,586,000. Soviero Asset Management LP acquired a new position in shares of Himax Technologies in the fourth quarter valued at approximately $4,020,000. Finally, Headwater Capital Co Ltd acquired a new position in shares of Himax Technologies in the first quarter valued at approximately $3,675,000. Institutional investors and hedge funds own 69.81% of the company's stock.

Himax Technologies Price Performance

Shares of HIMX stock traded up $0.11 during midday trading on Thursday, reaching $8.32. 536,429 shares of the company traded hands, compared to its average volume of 1,392,832. The firm's 50 day simple moving average is $8.63 and its two-hundred day simple moving average is $8.38. The firm has a market cap of $1.46 billion, a PE ratio of 19.81 and a beta of 2.30. The company has a debt-to-equity ratio of 0.03, a current ratio of 1.54 and a quick ratio of 1.37. Himax Technologies, Inc. has a 1-year low of $5.12 and a 1-year high of $13.91.

Himax Technologies (NASDAQ:HIMX - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The semiconductor company reported $0.10 earnings per share for the quarter, meeting the consensus estimate of $0.10. The firm had revenue of $214.80 million during the quarter, compared to the consensus estimate of $212.00 million. Himax Technologies had a return on equity of 8.34% and a net margin of 8.34%.Himax Technologies's quarterly revenue was down 10.4% on a year-over-year basis. During the same period last year, the business posted $0.17 EPS. Himax Technologies has set its Q3 2025 guidance at -0.040--0.020 EPS.

Analysts Set New Price Targets

Separately, Morgan Stanley started coverage on shares of Himax Technologies in a research report on Friday, May 9th. They issued an "overweight" rating and a $8.80 price objective on the stock. Two investment analysts have rated the stock with a Buy rating, According to data from MarketBeat, Himax Technologies presently has a consensus rating of "Buy" and an average price target of $11.90.

View Our Latest Research Report on HIMX

Himax Technologies Profile

(

Free Report)

Himax Technologies, Inc, a fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States. The company operates in two segments, Driver IC and Non-Driver Products. It offers display driver integrated circuits (ICs) and timing controllers that are used in televisions, PC monitors, laptops, mobile phones, tablets, automotive, ePaper devices, industrial displays, and other products.

Further Reading

Before you consider Himax Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Himax Technologies wasn't on the list.

While Himax Technologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.