Wellington Management Group LLP lessened its holdings in Dell Technologies Inc. (NYSE:DELL - Free Report) by 17.5% during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 61,360 shares of the technology company's stock after selling 13,027 shares during the quarter. Wellington Management Group LLP's holdings in Dell Technologies were worth $5,593,000 as of its most recent filing with the Securities & Exchange Commission.

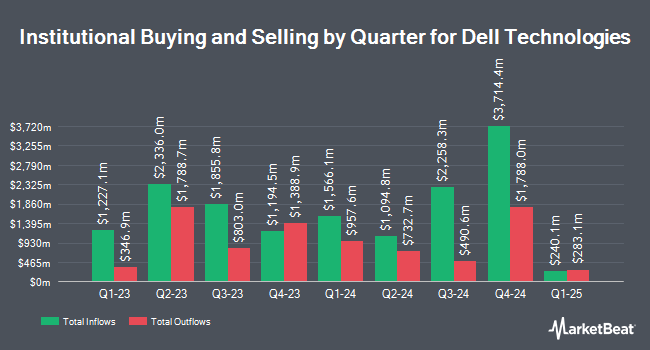

Several other hedge funds also recently bought and sold shares of DELL. Michael & Susan Dell Foundation bought a new position in Dell Technologies in the 4th quarter valued at $265,052,000. Janus Henderson Group PLC grew its position in shares of Dell Technologies by 160.5% during the 4th quarter. Janus Henderson Group PLC now owns 3,027,066 shares of the technology company's stock worth $348,814,000 after buying an additional 1,865,013 shares in the last quarter. Boston Partners increased its stake in shares of Dell Technologies by 34.4% during the first quarter. Boston Partners now owns 5,132,877 shares of the technology company's stock valued at $466,418,000 after buying an additional 1,312,600 shares during the period. Vanguard Group Inc. increased its stake in shares of Dell Technologies by 4.1% during the first quarter. Vanguard Group Inc. now owns 29,106,218 shares of the technology company's stock valued at $2,653,032,000 after buying an additional 1,145,658 shares during the period. Finally, Deutsche Bank AG increased its stake in shares of Dell Technologies by 38.1% during the first quarter. Deutsche Bank AG now owns 4,141,618 shares of the technology company's stock valued at $377,508,000 after buying an additional 1,142,012 shares during the period. Institutional investors own 76.37% of the company's stock.

Dell Technologies Price Performance

NYSE DELL traded down $11.85 during trading on Friday, hitting $122.20. The company's stock had a trading volume of 24,308,936 shares, compared to its average volume of 5,777,714. The company has a market cap of $82.96 billion, a PE ratio of 17.97, a P/E/G ratio of 0.85 and a beta of 1.01. The business's 50 day simple moving average is $129.15 and its 200-day simple moving average is $110.43. Dell Technologies Inc. has a fifty-two week low of $66.25 and a fifty-two week high of $147.66.

Dell Technologies (NYSE:DELL - Get Free Report) last issued its quarterly earnings results on Thursday, August 28th. The technology company reported $2.32 earnings per share for the quarter, topping the consensus estimate of $2.29 by $0.03. The business had revenue of $29.78 billion during the quarter, compared to the consensus estimate of $29.14 billion. Dell Technologies had a negative return on equity of 236.21% and a net margin of 4.73%.The company's quarterly revenue was up 19.0% on a year-over-year basis. During the same quarter last year, the company earned $1.89 earnings per share. Dell Technologies has set its Q3 2026 guidance at 2.450-2.450 EPS. FY 2026 guidance at 9.550-9.550 EPS. Analysts expect that Dell Technologies Inc. will post 6.93 EPS for the current fiscal year.

Dell Technologies Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Friday, August 1st. Shareholders of record on Tuesday, July 22nd were issued a $0.525 dividend. This represents a $2.10 annualized dividend and a yield of 1.7%. The ex-dividend date of this dividend was Tuesday, July 22nd. Dell Technologies's dividend payout ratio (DPR) is currently 30.88%.

Insiders Place Their Bets

In other Dell Technologies news, Director V (Gp) L.L.C. Slta sold 6,086 shares of the firm's stock in a transaction dated Thursday, July 17th. The stock was sold at an average price of $123.50, for a total value of $751,621.00. Following the completion of the sale, the director owned 986,261 shares of the company's stock, valued at approximately $121,803,233.50. This trade represents a 0.61% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CEO Michael S. Dell sold 10,000,000 shares of Dell Technologies stock in a transaction dated Thursday, June 26th. The stock was sold at an average price of $122.27, for a total value of $1,222,700,000.00. Following the sale, the chief executive officer directly owned 25,912,241 shares of the company's stock, valued at $3,168,289,707.07. This trade represents a 27.85% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 12,989,063 shares of company stock valued at $1,583,673,412. 42.00% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities analysts have recently commented on DELL shares. Susquehanna restated a "neutral" rating and set a $125.00 price target on shares of Dell Technologies in a research note on Wednesday, August 13th. UBS Group raised their price target on Dell Technologies from $145.00 to $155.00 and gave the company a "buy" rating in a research note on Friday. Wall Street Zen lowered Dell Technologies from a "buy" rating to a "hold" rating in a research note on Monday, July 14th. Bank of America raised their price target on Dell Technologies from $165.00 to $167.00 and gave the company a "buy" rating in a research note on Friday. Finally, JPMorgan Chase & Co. raised their price target on Dell Technologies from $125.00 to $145.00 and gave the company an "overweight" rating in a research note on Thursday, July 17th. Fourteen research analysts have rated the stock with a Buy rating and six have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $146.31.

View Our Latest Stock Report on Dell Technologies

Dell Technologies Profile

(

Free Report)

Dell Technologies Inc designs, develops, manufactures, markets, sells, and supports various comprehensive and integrated solutions, products, and services in the Americas, Europe, the Middle East, Asia, and internationally. The company operates through two segments, Infrastructure Solutions Group (ISG) and Client Solutions Group (CSG).

Read More

Before you consider Dell Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dell Technologies wasn't on the list.

While Dell Technologies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report