XTX Topco Ltd acquired a new stake in shares of Buckle, Inc. (The) (NYSE:BKE - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 18,684 shares of the company's stock, valued at approximately $716,000.

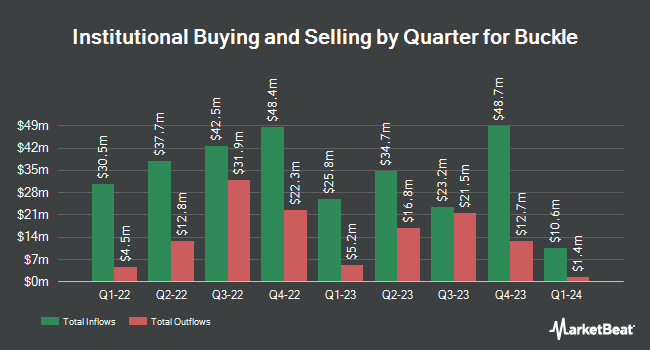

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Caption Management LLC acquired a new position in Buckle during the fourth quarter valued at approximately $36,000. Bellwether Advisors LLC acquired a new stake in shares of Buckle in the fourth quarter worth $43,000. State of Wyoming acquired a new stake in shares of Buckle in the fourth quarter worth $111,000. Viking Fund Management LLC acquired a new stake in shares of Buckle in the first quarter worth $115,000. Finally, Novem Group acquired a new stake in shares of Buckle in the fourth quarter worth $227,000. Institutional investors own 53.93% of the company's stock.

Wall Street Analyst Weigh In

BKE has been the topic of several research analyst reports. UBS Group restated a "neutral" rating on shares of Buckle in a research note on Wednesday, May 14th. Wall Street Zen raised Buckle from a "hold" rating to a "buy" rating in a research report on Friday, May 23rd.

Get Our Latest Research Report on Buckle

Insider Transactions at Buckle

In related news, CEO Dennis H. Nelson sold 20,453 shares of Buckle stock in a transaction dated Wednesday, June 11th. The stock was sold at an average price of $43.52, for a total value of $890,114.56. Following the completion of the sale, the chief executive officer directly owned 1,655,204 shares in the company, valued at $72,034,478.08. This trade represents a 1.22% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director James E. Shada sold 10,000 shares of the business's stock in a transaction dated Tuesday, July 22nd. The stock was sold at an average price of $49.84, for a total value of $498,400.00. Following the transaction, the director owned 85,352 shares of the company's stock, valued at $4,253,943.68. The trade was a 10.49% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 105,046 shares of company stock valued at $4,377,425. Corporate insiders own 39.00% of the company's stock.

Buckle Trading Down 0.3%

BKE stock traded down $0.17 during midday trading on Friday, hitting $52.53. The stock had a trading volume of 97,989 shares, compared to its average volume of 530,039. The firm has a market capitalization of $2.69 billion, a price-to-earnings ratio of 13.50 and a beta of 1.05. Buckle, Inc. has a 52 week low of $33.12 and a 52 week high of $54.25. The stock has a 50-day simple moving average of $46.64 and a 200 day simple moving average of $42.03.

Buckle (NYSE:BKE - Get Free Report) last issued its quarterly earnings data on Friday, May 23rd. The company reported $0.70 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.65 by $0.05. The company had revenue of $272.12 million during the quarter, compared to analysts' expectations of $264.28 million. Buckle had a return on equity of 43.13% and a net margin of 15.95%. The business's revenue was up 3.7% on a year-over-year basis. During the same period last year, the business earned $0.70 earnings per share.

Buckle Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 29th. Investors of record on Tuesday, July 15th were given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a yield of 2.7%. The ex-dividend date was Tuesday, July 15th. Buckle's dividend payout ratio (DPR) is presently 35.99%.

About Buckle

(

Free Report)

The Buckle, Inc operates as a retailer of casual apparel, footwear, and accessories for young men and women in the United States. It markets a selection of brand name casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories, and footwear, as well as private label merchandise primarily comprising BKE, Buckle Black, Salvage, Red by BKE, Daytrip, Gimmicks, Gilded Intent, FITZ + EDDI, Willow & Root, Outpost Makers, Departwest, Sterling & Stitch, Reclaim, BKE Vintage, Nova Industries, J.B.

Featured Articles

Before you consider Buckle, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Buckle wasn't on the list.

While Buckle currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.