Zions Bancorporation National Association UT acquired a new position in PPL Corporation (NYSE:PPL - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The firm acquired 136,651 shares of the utilities provider's stock, valued at approximately $4,934,000.

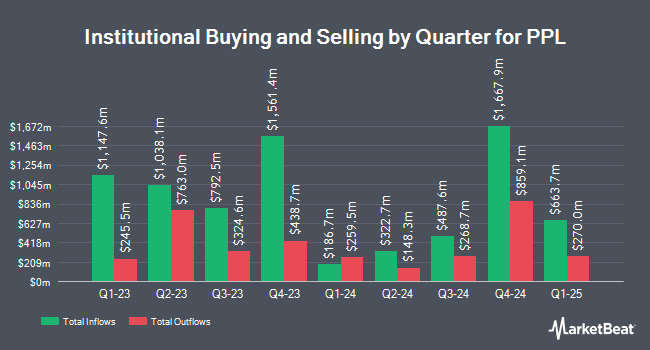

Other institutional investors and hedge funds have also bought and sold shares of the company. Bank of America Corp DE raised its position in shares of PPL by 12.1% in the 4th quarter. Bank of America Corp DE now owns 12,672,428 shares of the utilities provider's stock worth $411,347,000 after acquiring an additional 1,371,000 shares in the last quarter. Northern Trust Corp increased its holdings in shares of PPL by 5.8% in the 4th quarter. Northern Trust Corp now owns 8,570,225 shares of the utilities provider's stock worth $278,190,000 after purchasing an additional 468,789 shares in the last quarter. Federated Hermes Inc. increased its holdings in shares of PPL by 1.4% in the 1st quarter. Federated Hermes Inc. now owns 7,998,199 shares of the utilities provider's stock worth $288,815,000 after purchasing an additional 109,160 shares in the last quarter. Cohen & Steers Inc. boosted its stake in shares of PPL by 2.8% in the 4th quarter. Cohen & Steers Inc. now owns 6,987,399 shares of the utilities provider's stock worth $226,811,000 after buying an additional 188,500 shares during the last quarter. Finally, Bank of New York Mellon Corp boosted its stake in shares of PPL by 0.6% in the 1st quarter. Bank of New York Mellon Corp now owns 5,121,253 shares of the utilities provider's stock worth $184,928,000 after buying an additional 31,110 shares during the last quarter. Hedge funds and other institutional investors own 76.99% of the company's stock.

PPL Stock Performance

Shares of PPL traded down $0.06 during mid-day trading on Monday, hitting $36.29. 29,778,890 shares of the company's stock were exchanged, compared to its average volume of 7,143,206. The firm has a market capitalization of $26.84 billion, a P/E ratio of 27.09, a P/E/G ratio of 2.61 and a beta of 0.64. PPL Corporation has a fifty-two week low of $30.44 and a fifty-two week high of $36.99. The business's 50 day moving average is $34.73 and its two-hundred day moving average is $34.75. The company has a current ratio of 0.59, a quick ratio of 0.49 and a debt-to-equity ratio of 1.07.

PPL (NYSE:PPL - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The utilities provider reported $0.32 earnings per share for the quarter, missing analysts' consensus estimates of $0.37 by ($0.05). The business had revenue of $2.03 billion for the quarter, compared to analysts' expectations of $1.99 billion. PPL had a return on equity of 8.81% and a net margin of 11.22%. The company's revenue for the quarter was up 7.7% on a year-over-year basis. During the same period last year, the business earned $0.38 earnings per share. On average, equities analysts expect that PPL Corporation will post 1.83 earnings per share for the current year.

PPL Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Tuesday, July 1st. Stockholders of record on Tuesday, June 10th were given a $0.2725 dividend. The ex-dividend date of this dividend was Tuesday, June 10th. This represents a $1.09 annualized dividend and a dividend yield of 3.0%. PPL's payout ratio is presently 81.34%.

Insider Buying and Selling at PPL

In other news, COO David J. Bonenberger sold 2,165 shares of the business's stock in a transaction dated Tuesday, July 29th. The shares were sold at an average price of $35.86, for a total value of $77,636.90. Following the completion of the sale, the chief operating officer owned 45,560 shares of the company's stock, valued at approximately $1,633,781.60. The trade was a 4.54% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Insiders own 0.22% of the company's stock.

Analyst Ratings Changes

Several equities analysts recently weighed in on PPL shares. Wall Street Zen upgraded PPL from a "sell" rating to a "hold" rating in a research report on Friday, May 9th. Morgan Stanley reduced their target price on PPL from $38.00 to $37.00 and set an "overweight" rating on the stock in a report on Wednesday, June 18th. Guggenheim boosted their price objective on PPL from $38.00 to $40.00 and gave the stock a "buy" rating in a research note on Thursday, May 1st. Finally, Barclays upgraded PPL from a "hold" rating to a "strong-buy" rating in a report on Monday, July 7th. Two analysts have rated the stock with a hold rating, seven have issued a buy rating and two have given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Buy" and a consensus target price of $36.70.

View Our Latest Stock Analysis on PPL

PPL Company Profile

(

Free Report)

PPL Corporation, an energy company, focuses on providing electricity and natural gas to approximately 3.6 million customers in the United States. It operates through three segments: Kentucky Regulated, Pennsylvania Regulated, and Rhode Island Regulated. The company delivers electricity to customers in Pennsylvania, Kentucky, Virginia, and Rhode Island; delivers natural gas to customers in Kentucky and Rhode Island; and generates electricity from power plants in Kentucky.

Read More

Before you consider PPL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PPL wasn't on the list.

While PPL currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.