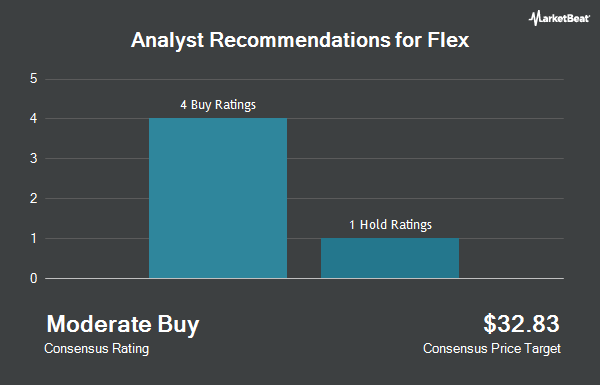

Flex Ltd. (NASDAQ:FLEX - Get Free Report) has been assigned a consensus recommendation of "Buy" from the seven brokerages that are currently covering the company, MarketBeat reports. Seven equities research analysts have rated the stock with a buy recommendation. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $53.71.

A number of equities analysts recently weighed in on FLEX shares. Barclays lifted their price objective on shares of Flex from $50.00 to $60.00 and gave the company an "overweight" rating in a research report on Friday. The Goldman Sachs Group reaffirmed a "buy" rating on shares of Flex in a research report on Friday, July 11th. JPMorgan Chase & Co. increased their price target on Flex from $44.00 to $60.00 and gave the company an "overweight" rating in a report on Thursday, July 17th. KeyCorp raised their target price on Flex from $50.00 to $60.00 and gave the company an "overweight" rating in a research note on Wednesday, July 2nd. Finally, Wall Street Zen raised shares of Flex from a "buy" rating to a "strong-buy" rating in a report on Saturday.

Read Our Latest Research Report on Flex

Flex Price Performance

Shares of Flex stock traded up $0.32 on Friday, hitting $49.99. 3,961,468 shares of the company were exchanged, compared to its average volume of 5,286,389. Flex has a 1-year low of $25.11 and a 1-year high of $53.97. The stock has a market capitalization of $18.68 billion, a price-to-earnings ratio of 21.93, a price-to-earnings-growth ratio of 1.83 and a beta of 1.07. The company has a 50-day moving average price of $47.06 and a 200 day moving average price of $40.64. The company has a quick ratio of 0.79, a current ratio of 1.36 and a debt-to-equity ratio of 0.59.

Flex (NASDAQ:FLEX - Get Free Report) last issued its quarterly earnings results on Thursday, July 24th. The technology company reported $0.72 EPS for the quarter, beating the consensus estimate of $0.63 by $0.09. Flex had a net margin of 3.42% and a return on equity of 20.25%. The company had revenue of $6.58 billion during the quarter, compared to analysts' expectations of $6.27 billion. During the same quarter last year, the company posted $0.51 EPS. The firm's revenue was up 4.1% compared to the same quarter last year. As a group, sell-side analysts predict that Flex will post 2.33 earnings per share for the current fiscal year.

Insider Transactions at Flex

In related news, CAO Daniel Wendler sold 1,245 shares of the company's stock in a transaction dated Tuesday, June 17th. The stock was sold at an average price of $45.01, for a total transaction of $56,037.45. Following the sale, the chief accounting officer owned 47,619 shares in the company, valued at approximately $2,143,331.19. This represents a 2.55% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. Also, COO Kwang Hooi Tan sold 8,509 shares of Flex stock in a transaction that occurred on Tuesday, June 17th. The stock was sold at an average price of $45.01, for a total value of $382,990.09. Following the transaction, the chief operating officer owned 276,136 shares of the company's stock, valued at $12,428,881.36. This represents a 2.99% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders have sold 1,135,941 shares of company stock worth $47,582,965. Corporate insiders own 0.57% of the company's stock.

Institutional Trading of Flex

A number of institutional investors have recently bought and sold shares of the business. Rise Advisors LLC bought a new position in Flex during the 1st quarter worth approximately $25,000. Olde Wealth Management LLC purchased a new stake in shares of Flex during the 1st quarter worth approximately $26,000. Cullen Frost Bankers Inc. purchased a new stake in Flex in the 1st quarter worth about $26,000. Concord Wealth Partners purchased a new position in Flex in the 2nd quarter valued at approximately $28,000. Finally, CX Institutional purchased a new stake in shares of Flex in the first quarter worth about $29,000. Institutional investors own 94.30% of the company's stock.

Flex Company Profile

(

Get Free ReportFlex Ltd. provides technology, supply chain, and manufacturing solutions in Asia, the Americas, and Europe. It operates through three segments: Flex Agility Solutions (FAS), Flex Reliability Solutions (FRS), and Nextracker. The FAS segment offers flexible supply and manufacturing system comprising communications, enterprise and cloud solution, which includes data, edge, and communications infrastructure; lifestyle solution including appliances, consumer packaging, floorcare, micro mobility, and audio; and consumer devices, such as mobile and high velocity consumer devices.

Read More

Before you consider Flex, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flex wasn't on the list.

While Flex currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.