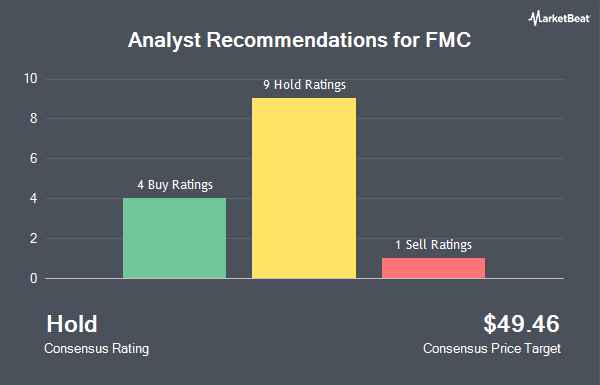

Shares of FMC Corporation (NYSE:FMC - Get Free Report) have earned an average rating of "Hold" from the fourteen research firms that are currently covering the firm, MarketBeat reports. One research analyst has rated the stock with a sell rating, eight have assigned a hold rating and five have assigned a buy rating to the company. The average 12 month target price among brokers that have issued ratings on the stock in the last year is $50.38.

A number of equities analysts have weighed in on FMC shares. KeyCorp lifted their price objective on FMC from $53.00 to $61.00 and gave the company an "overweight" rating in a research note on Monday, July 14th. Barclays boosted their price objective on FMC from $48.00 to $49.00 and gave the company an "overweight" rating in a report on Monday, July 7th. UBS Group decreased their price objective on FMC from $45.00 to $44.00 and set a "neutral" rating for the company in a report on Thursday. Wells Fargo & Company raised FMC from an "equal weight" rating to an "overweight" rating and boosted their price objective for the company from $41.00 to $50.00 in a report on Monday, June 23rd. Finally, Wall Street Zen raised FMC from a "sell" rating to a "hold" rating in a report on Saturday, June 14th.

Get Our Latest Report on FMC

FMC Stock Performance

Shares of NYSE:FMC traded down $1.01 on Friday, hitting $38.03. 2,269,338 shares of the company were exchanged, compared to its average volume of 1,621,922. FMC has a 1-year low of $32.83 and a 1-year high of $67.75. The stock's 50 day moving average price is $42.09 and its 200 day moving average price is $41.55. The company has a current ratio of 1.53, a quick ratio of 1.12 and a debt-to-equity ratio of 0.74. The firm has a market capitalization of $4.75 billion, a P/E ratio of 47.54, a price-to-earnings-growth ratio of 1.24 and a beta of 0.75.

FMC (NYSE:FMC - Get Free Report) last posted its quarterly earnings data on Wednesday, July 30th. The basic materials company reported $0.69 EPS for the quarter, topping the consensus estimate of $0.59 by $0.10. The business had revenue of $1.05 billion during the quarter, compared to the consensus estimate of $995.15 million. FMC had a net margin of 2.42% and a return on equity of 9.36%. The business's revenue for the quarter was up 1.2% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.63 earnings per share. Sell-side analysts predict that FMC will post 3.48 EPS for the current year.

FMC Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, October 16th. Shareholders of record on Tuesday, September 30th will be issued a $0.58 dividend. The ex-dividend date of this dividend is Tuesday, September 30th. This represents a $2.32 dividend on an annualized basis and a yield of 6.1%. FMC's payout ratio is presently 290.00%.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. Janus Henderson Group PLC increased its stake in shares of FMC by 0.5% during the fourth quarter. Janus Henderson Group PLC now owns 59,771 shares of the basic materials company's stock worth $2,905,000 after purchasing an additional 286 shares in the last quarter. Algert Global LLC increased its stake in shares of FMC by 0.5% during the fourth quarter. Algert Global LLC now owns 59,052 shares of the basic materials company's stock worth $2,871,000 after purchasing an additional 300 shares in the last quarter. Treasurer of the State of North Carolina increased its stake in shares of FMC by 0.6% during the fourth quarter. Treasurer of the State of North Carolina now owns 54,754 shares of the basic materials company's stock worth $2,662,000 after purchasing an additional 350 shares in the last quarter. Oak Thistle LLC increased its stake in shares of FMC by 5.5% during the first quarter. Oak Thistle LLC now owns 7,653 shares of the basic materials company's stock worth $323,000 after purchasing an additional 398 shares in the last quarter. Finally, Golden State Wealth Management LLC increased its stake in shares of FMC by 66.6% during the first quarter. Golden State Wealth Management LLC now owns 1,006 shares of the basic materials company's stock worth $42,000 after purchasing an additional 402 shares in the last quarter. Hedge funds and other institutional investors own 91.86% of the company's stock.

FMC Company Profile

(

Get Free ReportFMC Corporation, an agricultural sciences company, provides crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products, which are used in agriculture to enhance crop yield and quality by controlling a range of insects, weeds, and diseases, as well as in non-agricultural markets for pest control.

See Also

Before you consider FMC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and FMC wasn't on the list.

While FMC currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.