First Quantum Minerals Ltd. (OTCMKTS:FQVLF - Free Report) - Stock analysts at National Bank Financial reduced their FY2027 earnings per share (EPS) estimates for First Quantum Minerals in a report issued on Thursday, July 24th. National Bank Financial analyst S. Nagle now anticipates that the basic materials company will post earnings of $1.47 per share for the year, down from their prior forecast of $1.65. The consensus estimate for First Quantum Minerals' current full-year earnings is $0.03 per share.

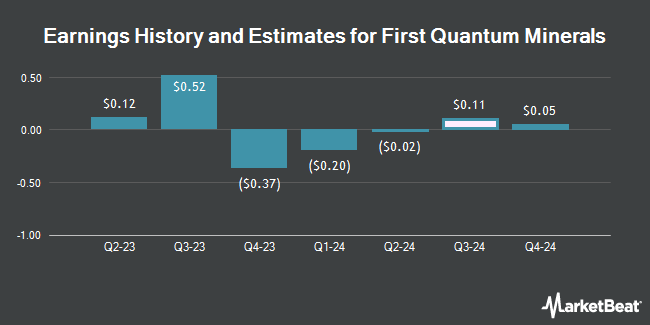

First Quantum Minerals (OTCMKTS:FQVLF - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The basic materials company reported $0.02 EPS for the quarter, topping the consensus estimate of ($0.03) by $0.05. First Quantum Minerals had a return on equity of 1.44% and a net margin of 4.08%. The business had revenue of $1.23 billion for the quarter, compared to the consensus estimate of $1.06 billion.

Several other analysts have also weighed in on FQVLF. Royal Bank Of Canada reaffirmed an "outperform" rating on shares of First Quantum Minerals in a research note on Friday, July 25th. Canaccord Genuity Group upgraded First Quantum Minerals from a "hold" rating to a "strong-buy" rating in a report on Wednesday, April 16th. Scotiabank reiterated a "sector perform" rating on shares of First Quantum Minerals in a research note on Tuesday, July 8th. BMO Capital Markets upgraded First Quantum Minerals to a "strong-buy" rating in a report on Tuesday, April 15th. Finally, Barclays reissued an "overweight" rating on shares of First Quantum Minerals in a report on Monday. Five research analysts have rated the stock with a hold rating, three have given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, First Quantum Minerals presently has a consensus rating of "Moderate Buy".

Read Our Latest Research Report on First Quantum Minerals

First Quantum Minerals Stock Up 1.6%

Shares of First Quantum Minerals stock traded up $0.27 on Monday, reaching $16.88. 9,872 shares of the company were exchanged, compared to its average volume of 198,199. First Quantum Minerals has a one year low of $10.18 and a one year high of $19.00. The company has a market capitalization of $14.08 billion, a price-to-earnings ratio of 70.34 and a beta of 1.38. The company has a 50-day moving average of $16.45 and a 200 day moving average of $14.33. The company has a current ratio of 1.87, a quick ratio of 0.94 and a debt-to-equity ratio of 0.50.

First Quantum Minerals Company Profile

(

Get Free Report)

First Quantum Minerals Ltd., together with its subsidiaries, engages in the exploration, development, and production of mineral properties. It primarily explores for copper, nickel, pyrite, silver, gold, and zinc ores, as well as produces acid. The company has operating mines located in Zambia, Panama, Finland, Turkey, Spain, Australia, and Mauritania, as well as a development project in Zambia.

Recommended Stories

Before you consider First Quantum Minerals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and First Quantum Minerals wasn't on the list.

While First Quantum Minerals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.