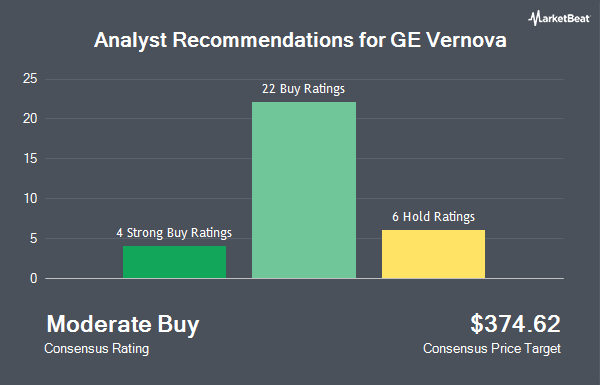

Shares of GE Vernova Inc. (NYSE:GEV - Get Free Report) have been assigned a consensus rating of "Moderate Buy" from the thirty-three ratings firms that are currently covering the stock, MarketBeat Ratings reports. Two investment analysts have rated the stock with a sell rating, eight have assigned a hold rating, nineteen have given a buy rating and four have issued a strong buy rating on the company. The average 12-month price target among analysts that have issued ratings on the stock in the last year is $592.6071.

A number of equities research analysts have issued reports on GEV shares. Melius Research set a $740.00 price target on GE Vernova and gave the stock a "buy" rating in a research note on Monday, September 15th. Weiss Ratings reiterated a "hold (c)" rating on shares of GE Vernova in a research note on Wednesday, October 8th. Seaport Res Ptn upgraded GE Vernova to a "strong-buy" rating in a research note on Thursday, July 10th. Bank of America increased their price target on GE Vernova from $550.00 to $620.00 and gave the stock a "buy" rating in a research note on Thursday, July 17th. Finally, Guggenheim lowered GE Vernova from a "buy" rating to a "neutral" rating in a research report on Monday, July 28th.

Get Our Latest Stock Report on GEV

Insider Buying and Selling at GE Vernova

In other news, CFO Kenneth Scott Parks sold 3,300 shares of the firm's stock in a transaction dated Tuesday, August 26th. The stock was sold at an average price of $620.00, for a total transaction of $2,046,000.00. Following the completion of the transaction, the chief financial officer owned 7,590 shares in the company, valued at $4,705,800. This trade represents a 30.30% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at the SEC website. 0.15% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the company. Farmers & Merchants Investments Inc. grew its position in shares of GE Vernova by 2.6% during the third quarter. Farmers & Merchants Investments Inc. now owns 1,967 shares of the company's stock valued at $1,210,000 after purchasing an additional 50 shares in the last quarter. Fort Washington Investment Advisors Inc. OH grew its position in shares of GE Vernova by 56.2% during the third quarter. Fort Washington Investment Advisors Inc. OH now owns 24,475 shares of the company's stock valued at $15,050,000 after purchasing an additional 8,809 shares in the last quarter. Old North State Wealth Management LLC grew its position in shares of GE Vernova by 1.8% during the third quarter. Old North State Wealth Management LLC now owns 1,442 shares of the company's stock valued at $887,000 after purchasing an additional 26 shares in the last quarter. SS&H Financial Advisors Inc. purchased a new position in shares of GE Vernova during the third quarter valued at about $307,000. Finally, Ullmann Wealth Partners Group LLC bought a new position in shares of GE Vernova in the 3rd quarter valued at about $201,000.

GE Vernova Stock Performance

Shares of GEV stock opened at $599.62 on Friday. GE Vernova has a 52-week low of $252.25 and a 52-week high of $677.29. The firm has a market capitalization of $163.23 billion, a PE ratio of 144.49, a PEG ratio of 4.35 and a beta of 1.72. The stock has a fifty day simple moving average of $616.42 and a two-hundred day simple moving average of $520.58.

GE Vernova (NYSE:GEV - Get Free Report) last issued its quarterly earnings results on Wednesday, July 23rd. The company reported $1.86 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.63 by $0.23. GE Vernova had a return on equity of 13.23% and a net margin of 3.16%.The business had revenue of $9.11 billion during the quarter, compared to analyst estimates of $8.78 billion. During the same quarter in the prior year, the business posted $4.65 EPS. GE Vernova's revenue for the quarter was up 11.1% compared to the same quarter last year. GE Vernova has set its FY 2025 guidance at EPS. On average, sell-side analysts forecast that GE Vernova will post 6.59 EPS for the current fiscal year.

GE Vernova Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Monday, November 17th. Stockholders of record on Monday, October 20th will be given a dividend of $0.25 per share. The ex-dividend date is Monday, October 20th. This represents a $1.00 dividend on an annualized basis and a dividend yield of 0.2%. GE Vernova's dividend payout ratio (DPR) is presently 24.10%.

About GE Vernova

(

Get Free Report)

GE Vernova LLC, an energy business company, generates electricity. It operates under three segments: Power, Wind, and Electrification. The Power segments generates and sells electricity through hydro, gas, nuclear, and steam power. Wind segment engages in the manufacturing and sale of wind turbine blades; and Electrification segment provides grid solutions, power conversion, solar, and storage solutions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GE Vernova, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Vernova wasn't on the list.

While GE Vernova currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.