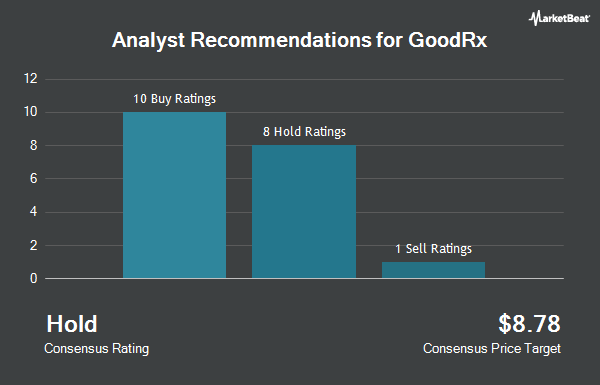

GoodRx Holdings, Inc. (NASDAQ:GDRX - Get Free Report) has been given a consensus recommendation of "Moderate Buy" by the eleven ratings firms that are presently covering the company, MarketBeat.com reports. Five research analysts have rated the stock with a hold recommendation, five have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12-month target price among brokers that have issued a report on the stock in the last year is $6.55.

A number of research analysts recently issued reports on the stock. Truist Financial dropped their target price on shares of GoodRx from $6.50 to $5.50 and set a "hold" rating on the stock in a research report on Thursday, April 10th. UBS Group reduced their target price on shares of GoodRx from $6.00 to $5.25 and set a "neutral" rating for the company in a research note on Tuesday, May 13th. Wells Fargo & Company reduced their price target on shares of GoodRx from $8.00 to $7.00 and set an "overweight" rating for the company in a research report on Tuesday, April 29th. Finally, The Goldman Sachs Group reduced their price target on shares of GoodRx from $6.00 to $5.00 and set a "neutral" rating for the company in a research report on Friday, May 9th.

View Our Latest Report on GDRX

Insider Activity

In other news, major shareholder Equity Vii L.P. Spectrum sold 10,677 shares of the stock in a transaction dated Thursday, July 3rd. The shares were sold at an average price of $4.80, for a total value of $51,249.60. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Insiders own 4.53% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the stock. National Bank of Canada FI increased its position in shares of GoodRx by 34.9% in the fourth quarter. National Bank of Canada FI now owns 8,308 shares of the company's stock worth $39,000 after purchasing an additional 2,151 shares during the last quarter. Hohimer Wealth Management LLC grew its position in GoodRx by 8.2% during the first quarter. Hohimer Wealth Management LLC now owns 35,218 shares of the company's stock valued at $155,000 after acquiring an additional 2,658 shares during the last quarter. SBI Securities Co. Ltd. grew its position in GoodRx by 13.8% during the first quarter. SBI Securities Co. Ltd. now owns 22,624 shares of the company's stock valued at $100,000 after acquiring an additional 2,748 shares during the last quarter. Gotham Asset Management LLC grew its position in GoodRx by 31.0% during the fourth quarter. Gotham Asset Management LLC now owns 17,677 shares of the company's stock valued at $82,000 after acquiring an additional 4,182 shares during the last quarter. Finally, Swiss National Bank grew its position in GoodRx by 4.1% during the fourth quarter. Swiss National Bank now owns 161,400 shares of the company's stock valued at $751,000 after acquiring an additional 6,400 shares during the last quarter. 63.77% of the stock is currently owned by institutional investors.

GoodRx Trading Down 3.3%

GDRX traded down $0.16 during trading on Thursday, reaching $4.74. 1,394,343 shares of the company's stock were exchanged, compared to its average volume of 1,432,500. GoodRx has a one year low of $3.68 and a one year high of $9.26. The company has a current ratio of 5.23, a quick ratio of 5.23 and a debt-to-equity ratio of 0.74. The stock has a market capitalization of $1.69 billion, a PE ratio of 59.26, a price-to-earnings-growth ratio of 2.11 and a beta of 1.24. The firm has a fifty day moving average price of $4.36 and a two-hundred day moving average price of $4.53.

GoodRx (NASDAQ:GDRX - Get Free Report) last posted its earnings results on Wednesday, May 7th. The company reported $0.09 earnings per share for the quarter, topping analysts' consensus estimates of $0.04 by $0.05. The firm had revenue of $202.97 million for the quarter, compared to analyst estimates of $202.25 million. GoodRx had a net margin of 3.57% and a return on equity of 7.85%. The company's revenue for the quarter was up 2.6% compared to the same quarter last year. During the same period in the previous year, the firm posted $0.08 EPS. As a group, equities research analysts forecast that GoodRx will post 0.13 earnings per share for the current fiscal year.

GoodRx Company Profile

(

Get Free ReportGoodRx Holdings, Inc, together with its subsidiaries, offers information and tools that enable consumers to compare prices and save on their prescription drug purchases in the United States. The company operates a price comparison platform that provides consumers with curated, geographically relevant prescription pricing, and access to negotiated prices.

Featured Stories

Before you consider GoodRx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GoodRx wasn't on the list.

While GoodRx currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.