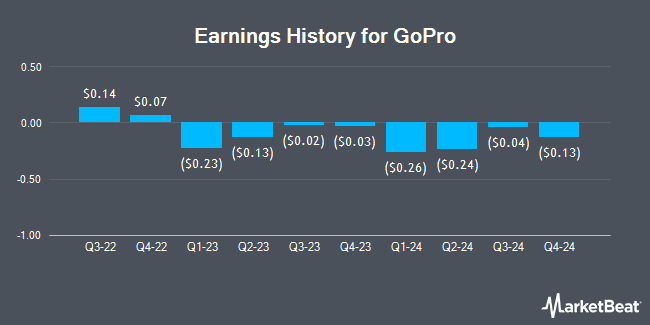

GoPro (NASDAQ:GPRO - Get Free Report) is expected to issue its Q2 2025 quarterly earnings data after the market closes on Monday, August 11th. Analysts expect the company to announce earnings of ($0.07) per share for the quarter. GoPro has set its Q2 2025 guidance at -0.110--0.030 EPS.

GoPro (NASDAQ:GPRO - Get Free Report) last announced its earnings results on Monday, May 12th. The company reported ($0.12) EPS for the quarter, beating analysts' consensus estimates of ($0.13) by $0.01. GoPro had a negative net margin of 17.93% and a negative return on equity of 60.09%. The firm had revenue of $134,308 billion for the quarter, compared to analysts' expectations of $124.65 million. On average, analysts expect GoPro to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

GoPro Stock Up 0.4%

Shares of GPRO stock traded up $0.01 during mid-day trading on Thursday, reaching $1.32. 1,323,372 shares of the company's stock traded hands, compared to its average volume of 6,199,189. The company's 50-day moving average price is $0.93 and its 200-day moving average price is $0.79. GoPro has a 12 month low of $0.40 and a 12 month high of $2.37. The company has a market cap of $207.18 million, a P/E ratio of -1.45 and a beta of 1.40.

Institutional Trading of GoPro

An institutional investor recently raised its position in GoPro stock. AQR Capital Management LLC increased its position in GoPro, Inc. (NASDAQ:GPRO - Free Report) by 957.3% in the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 3,687,711 shares of the company's stock after acquiring an additional 3,338,941 shares during the quarter. AQR Capital Management LLC owned about 2.34% of GoPro worth $2,445,000 at the end of the most recent quarter. 70.09% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research firms have commented on GPRO. Wedbush reissued a "neutral" rating and issued a $0.75 target price (down from $1.00) on shares of GoPro in a report on Tuesday, May 13th. Wall Street Zen raised GoPro from a "sell" rating to a "hold" rating in a research report on Thursday, May 22nd.

Read Our Latest Stock Analysis on GoPro

GoPro Company Profile

(

Get Free Report)

GoPro, Inc develops and sells cameras, mountable and wearable accessories, and subscription services and software in the Americas, Europe, the Middle East, Africa, the Asia and Pacific region, and internationally. The company provides cloud connected HERO12 Black, HERO11 Black, HERO11 Black Mini, HERO10 Black, HERO10 Black Bones, and HERO9 Black waterproof cameras; MAX, a 360-degree waterproof camera; Premium and Premium+ subscription services, which include full access to the Quik app, cloud storage supporting source video and photo quality, camera replacement, and damage protection; Quik subscription that offers access to editing tools, which allows users to edit photos, videos, and create cinematic stories; and Quik desktop and mobile apps that enable users to get their favorite photos and videos with footage from any phone or camera.

Further Reading

Before you consider GoPro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GoPro wasn't on the list.

While GoPro currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.