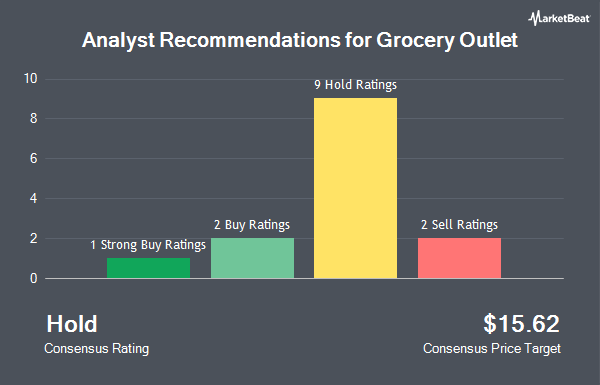

Shares of Grocery Outlet Holding Corp. (NASDAQ:GO - Get Free Report) have earned a consensus rating of "Hold" from the fourteen brokerages that are presently covering the company, MarketBeat Ratings reports. Two equities research analysts have rated the stock with a sell recommendation, nine have issued a hold recommendation, two have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1 year target price among analysts that have issued a report on the stock in the last year is $15.62.

A number of research analysts recently issued reports on the stock. Jefferies Financial Group upgraded shares of Grocery Outlet from a "hold" rating to a "buy" rating and boosted their target price for the company from $13.00 to $18.00 in a research report on Wednesday, April 16th. UBS Group lifted their target price on Grocery Outlet from $14.50 to $17.00 and gave the company a "neutral" rating in a research report on Wednesday, May 7th. Wells Fargo & Company increased their price target on Grocery Outlet from $18.00 to $19.00 and gave the company an "overweight" rating in a research report on Wednesday, May 7th. Finally, Telsey Advisory Group restated a "market perform" rating and set a $16.00 price target on shares of Grocery Outlet in a research report on Wednesday, April 30th.

View Our Latest Analysis on Grocery Outlet

Insider Buying and Selling at Grocery Outlet

In related news, Director Erik D. Ragatz bought 19,000 shares of the business's stock in a transaction that occurred on Friday, May 9th. The stock was bought at an average cost of $14.46 per share, for a total transaction of $274,740.00. Following the completion of the transaction, the director owned 19,000 shares of the company's stock, valued at approximately $274,740. The trade was a ∞ increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 4.50% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Grocery Outlet

A number of large investors have recently modified their holdings of GO. Raymond James Financial Inc. bought a new position in Grocery Outlet during the 4th quarter valued at approximately $1,079,000. Natixis Advisors LLC purchased a new position in shares of Grocery Outlet during the fourth quarter valued at approximately $240,000. KLP Kapitalforvaltning AS purchased a new position in shares of Grocery Outlet during the fourth quarter valued at approximately $326,000. EntryPoint Capital LLC bought a new stake in shares of Grocery Outlet in the 4th quarter worth approximately $242,000. Finally, New Age Alpha Advisors LLC purchased a new stake in shares of Grocery Outlet in the 4th quarter worth approximately $257,000. 99.87% of the stock is owned by hedge funds and other institutional investors.

Grocery Outlet Trading Down 1.8%

NASDAQ GO traded down $0.25 during trading hours on Friday, reaching $13.63. The company's stock had a trading volume of 2,218,518 shares, compared to its average volume of 3,109,406. Grocery Outlet has a 52 week low of $10.26 and a 52 week high of $21.67. The company has a debt-to-equity ratio of 0.39, a current ratio of 1.25 and a quick ratio of 0.25. The stock has a market cap of $1.34 billion, a P/E ratio of 85.19, a P/E/G ratio of 4.46 and a beta of 0.29. The firm has a fifty day simple moving average of $13.42 and a 200-day simple moving average of $14.29.

Grocery Outlet (NASDAQ:GO - Get Free Report) last issued its quarterly earnings results on Tuesday, May 6th. The company reported $0.13 EPS for the quarter, topping analysts' consensus estimates of $0.07 by $0.06. The company had revenue of $1.13 billion for the quarter, compared to analyst estimates of $1.12 billion. Grocery Outlet had a net margin of 0.39% and a return on equity of 6.21%. Grocery Outlet's revenue was up 8.6% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.09 earnings per share. Equities analysts forecast that Grocery Outlet will post 0.63 earnings per share for the current fiscal year.

About Grocery Outlet

(

Get Free ReportGrocery Outlet Holding Corp. operates as a retailer of consumables and fresh products sold through independently operated stores in the United States. Its stores offer products in various categories, such as dairy and deli, produce, floral, fresh meat, seafood products, grocery, general merchandise, health and beauty care, frozen food, beer and wine, and ethnic products.

Featured Articles

Before you consider Grocery Outlet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grocery Outlet wasn't on the list.

While Grocery Outlet currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.