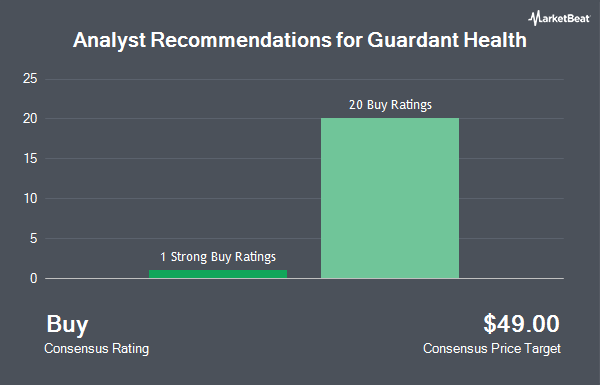

Guardant Health, Inc. (NASDAQ:GH - Get Free Report) has been given an average recommendation of "Buy" by the twenty-one ratings firms that are presently covering the stock, MarketBeat Ratings reports. Twenty equities research analysts have rated the stock with a buy rating and one has assigned a strong buy rating to the company. The average 12 month target price among brokers that have updated their coverage on the stock in the last year is $54.45.

Several equities analysts have recently weighed in on the company. Canaccord Genuity Group raised their target price on Guardant Health from $60.00 to $65.00 and gave the company a "buy" rating in a research report on Thursday, May 1st. UBS Group increased their price target on Guardant Health from $65.00 to $70.00 and gave the company a "buy" rating in a report on Thursday, May 1st. Mizuho lifted their price objective on Guardant Health from $60.00 to $65.00 and gave the stock an "outperform" rating in a research report on Friday, June 13th. Piper Sandler reiterated an "overweight" rating and set a $60.00 price objective (up previously from $50.00) on shares of Guardant Health in a research report on Tuesday, May 6th. Finally, Evercore ISI upgraded Guardant Health to a "strong-buy" rating in a research report on Monday, July 14th.

View Our Latest Stock Report on GH

Guardant Health Price Performance

NASDAQ GH traded down $0.95 during trading hours on Tuesday, reaching $43.32. The company's stock had a trading volume of 1,748,233 shares, compared to its average volume of 1,717,476. The firm has a market capitalization of $5.37 billion, a price-to-earnings ratio of -12.78 and a beta of 1.44. Guardant Health has a 1-year low of $20.14 and a 1-year high of $53.42. The company's 50-day moving average is $46.83 and its two-hundred day moving average is $44.86.

Guardant Health (NASDAQ:GH - Get Free Report) last released its earnings results on Wednesday, April 30th. The company reported ($0.49) earnings per share for the quarter, beating the consensus estimate of ($0.57) by $0.08. The firm had revenue of $203.47 million during the quarter, compared to analysts' expectations of $189.91 million. The business's revenue was up 20.8% compared to the same quarter last year. During the same quarter last year, the business earned ($0.46) EPS. Equities analysts forecast that Guardant Health will post -2.9 EPS for the current fiscal year.

Insiders Place Their Bets

In other news, CEO Amirali Talasaz sold 100,000 shares of Guardant Health stock in a transaction on Tuesday, July 1st. The stock was sold at an average price of $50.88, for a total value of $5,088,000.00. Following the completion of the sale, the chief executive officer directly owned 1,971,830 shares of the company's stock, valued at approximately $100,326,710.40. The trade was a 4.83% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, Director Musa Tariq sold 3,213 shares of Guardant Health stock in a transaction on Wednesday, June 18th. The shares were sold at an average price of $49.47, for a total value of $158,947.11. Following the completion of the sale, the director directly owned 7,190 shares of the company's stock, valued at $355,689.30. The trade was a 30.89% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders sold 342,300 shares of company stock valued at $17,082,238. Insiders own 6.10% of the company's stock.

Institutional Investors Weigh In On Guardant Health

Institutional investors have recently modified their holdings of the company. Signaturefd LLC boosted its holdings in Guardant Health by 50.5% in the second quarter. Signaturefd LLC now owns 635 shares of the company's stock valued at $33,000 after purchasing an additional 213 shares during the period. NewEdge Advisors LLC boosted its holdings in Guardant Health by 13.5% in the fourth quarter. NewEdge Advisors LLC now owns 1,929 shares of the company's stock valued at $59,000 after purchasing an additional 230 shares during the period. American Century Companies Inc. boosted its holdings in Guardant Health by 0.3% in the first quarter. American Century Companies Inc. now owns 104,206 shares of the company's stock valued at $4,439,000 after purchasing an additional 282 shares during the period. IFP Advisors Inc boosted its holdings in Guardant Health by 120.1% in the second quarter. IFP Advisors Inc now owns 612 shares of the company's stock valued at $33,000 after purchasing an additional 334 shares during the period. Finally, Summit Investment Advisors Inc. boosted its holdings in Guardant Health by 3.3% in the fourth quarter. Summit Investment Advisors Inc. now owns 12,346 shares of the company's stock valued at $377,000 after purchasing an additional 391 shares during the period. 92.60% of the stock is owned by institutional investors and hedge funds.

About Guardant Health

(

Get Free ReportGuardant Health, Inc, a precision oncology company, provides blood and tissue tests, data sets, and analytics in the United States and internationally. The company provides Guardant360; Guardant360 LDT; Guardant360 CDx Test; Guardant360 Response Test; Guardant360 TissueNext Test; GuardantINFINITY Test; GuardantConnect, an integrated software-based solution designed for clinical and biopharmaceutical customers to connect patients tested with assays with actionable alterations with potentially relevant clinical studies; GuardantOMNI Test for advanced stage cancer; and GuardantINFORM, an in-silico research platform for tumor evolution and treatment resistance across various biomarker-driven cancers.

See Also

Before you consider Guardant Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Guardant Health wasn't on the list.

While Guardant Health currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.