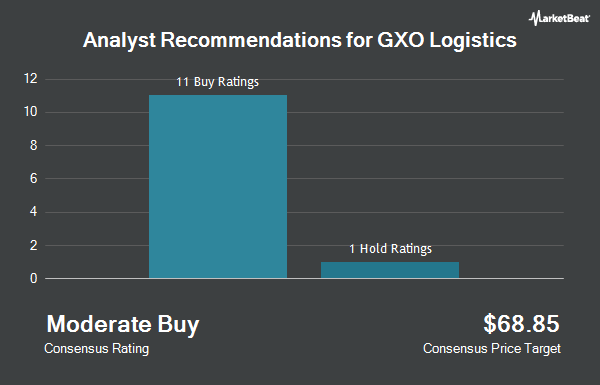

Shares of GXO Logistics, Inc. (NYSE:GXO - Get Free Report) have been given an average recommendation of "Moderate Buy" by the fourteen research firms that are currently covering the firm, MarketBeat.com reports. Four analysts have rated the stock with a hold recommendation and ten have given a buy recommendation to the company. The average 12 month price target among analysts that have covered the stock in the last year is $57.4286.

GXO has been the subject of a number of recent analyst reports. Barclays increased their price objective on GXO Logistics from $45.00 to $52.00 and gave the stock an "equal weight" rating in a report on Thursday, July 10th. Truist Financial upgraded GXO Logistics from a "hold" rating to a "buy" rating and upped their target price for the stock from $48.00 to $62.00 in a research report on Friday, July 11th. Wells Fargo & Company upped their target price on GXO Logistics from $48.00 to $57.00 and gave the stock an "overweight" rating in a research report on Monday, July 7th. Citigroup upped their target price on GXO Logistics from $56.00 to $59.00 and gave the stock a "buy" rating in a research report on Wednesday, July 9th. Finally, JPMorgan Chase & Co. upped their target price on GXO Logistics from $52.00 to $56.00 and gave the stock an "overweight" rating in a research report on Tuesday, July 8th.

View Our Latest Report on GXO

GXO Logistics Stock Performance

GXO stock traded up $0.15 on Friday, reaching $48.22. The company's stock had a trading volume of 154,089 shares, compared to its average volume of 1,443,369. GXO Logistics has a 52 week low of $30.46 and a 52 week high of $63.33. The company has a market capitalization of $5.52 billion, a P/E ratio of 77.69, a price-to-earnings-growth ratio of 1.75 and a beta of 1.64. The firm has a fifty day moving average of $47.25 and a two-hundred day moving average of $42.13. The company has a debt-to-equity ratio of 0.88, a current ratio of 0.78 and a quick ratio of 0.78.

GXO Logistics (NYSE:GXO - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The company reported $0.29 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.26 by $0.03. GXO Logistics had a return on equity of 10.49% and a net margin of 0.61%. The business had revenue of $2.98 billion during the quarter, compared to analyst estimates of $2.94 billion. During the same period in the prior year, the company posted $0.45 EPS. The business's revenue for the quarter was up 21.2% compared to the same quarter last year. As a group, analysts predict that GXO Logistics will post 2.49 EPS for the current fiscal year.

Institutional Trading of GXO Logistics

A number of hedge funds have recently modified their holdings of the business. Hantz Financial Services Inc. lifted its holdings in shares of GXO Logistics by 1,964.4% in the second quarter. Hantz Financial Services Inc. now owns 929 shares of the company's stock valued at $45,000 after purchasing an additional 884 shares in the last quarter. Arkadios Wealth Advisors raised its holdings in shares of GXO Logistics by 15.6% during the second quarter. Arkadios Wealth Advisors now owns 14,631 shares of the company's stock worth $713,000 after acquiring an additional 1,973 shares in the last quarter. Whalen Wealth Management Inc. acquired a new position in GXO Logistics during the second quarter worth $304,000. Teacher Retirement System of Texas increased its position in GXO Logistics by 3.9% during the second quarter. Teacher Retirement System of Texas now owns 18,151 shares of the company's stock worth $884,000 after buying an additional 684 shares during the last quarter. Finally, Y Intercept Hong Kong Ltd acquired a new position in GXO Logistics during the second quarter worth $6,996,000. Hedge funds and other institutional investors own 90.67% of the company's stock.

About GXO Logistics

(

Get Free Report)

GXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Featured Articles

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.