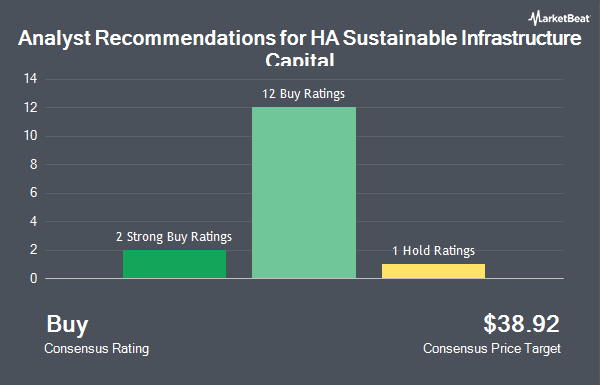

Shares of HA Sustainable Infrastructure Capital, Inc. (NYSE:HASI - Get Free Report) have earned a consensus rating of "Buy" from the eleven analysts that are currently covering the company, MarketBeat Ratings reports. One research analyst has rated the stock with a hold recommendation, nine have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average twelve-month price objective among analysts that have issued a report on the stock in the last year is $38.40.

HASI has been the subject of a number of recent analyst reports. Robert W. Baird lowered their target price on shares of HA Sustainable Infrastructure Capital from $47.00 to $41.00 and set an "outperform" rating for the company in a research note on Tuesday, April 15th. Wall Street Zen downgraded shares of HA Sustainable Infrastructure Capital from a "hold" rating to a "sell" rating in a report on Thursday, May 22nd.

Check Out Our Latest Stock Analysis on HASI

Hedge Funds Weigh In On HA Sustainable Infrastructure Capital

Several hedge funds have recently modified their holdings of HASI. FMR LLC increased its holdings in shares of HA Sustainable Infrastructure Capital by 393.3% during the fourth quarter. FMR LLC now owns 5,688,560 shares of the real estate investment trust's stock valued at $152,624,000 after acquiring an additional 4,535,345 shares in the last quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its holdings in shares of HA Sustainable Infrastructure Capital by 441.0% during the first quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 1,997,416 shares of the real estate investment trust's stock valued at $58,404,000 after acquiring an additional 1,628,182 shares in the last quarter. Norges Bank acquired a new position in shares of HA Sustainable Infrastructure Capital during the fourth quarter valued at about $30,557,000. Wellington Management Group LLP increased its holdings in shares of HA Sustainable Infrastructure Capital by 7.2% during the fourth quarter. Wellington Management Group LLP now owns 14,155,411 shares of the real estate investment trust's stock valued at $379,790,000 after acquiring an additional 949,253 shares in the last quarter. Finally, Tidal Investments LLC increased its holdings in shares of HA Sustainable Infrastructure Capital by 2,466.7% during the fourth quarter. Tidal Investments LLC now owns 699,275 shares of the real estate investment trust's stock valued at $18,762,000 after acquiring an additional 672,031 shares in the last quarter. Institutional investors and hedge funds own 96.14% of the company's stock.

HA Sustainable Infrastructure Capital Trading Down 0.3%

NYSE HASI traded down $0.09 on Friday, hitting $27.60. 671,097 shares of the stock were exchanged, compared to its average volume of 1,098,927. The company has a debt-to-equity ratio of 1.91, a quick ratio of 11.04 and a current ratio of 11.04. The stock has a fifty day moving average price of $26.54 and a two-hundred day moving average price of $27.04. The firm has a market capitalization of $3.35 billion, a P/E ratio of 26.54, a P/E/G ratio of 1.03 and a beta of 1.68. HA Sustainable Infrastructure Capital has a 52-week low of $21.98 and a 52-week high of $36.56.

HA Sustainable Infrastructure Capital Announces Dividend

The business also recently disclosed a quarterly dividend, which was paid on Friday, July 11th. Stockholders of record on Wednesday, July 2nd were issued a dividend of $0.42 per share. The ex-dividend date of this dividend was Wednesday, July 2nd. This represents a $1.68 annualized dividend and a dividend yield of 6.09%. HA Sustainable Infrastructure Capital's dividend payout ratio (DPR) is currently 161.54%.

HA Sustainable Infrastructure Capital Company Profile

(

Get Free ReportHA Sustainable Infrastructure Capital, Inc, through its subsidiaries, engages in the investment of energy efficiency, renewable energy, and sustainable infrastructure markets in the United States. The company's portfolio includes equity investments, commercial and government receivables, real estate, and debt securities.

See Also

Before you consider HA Sustainable Infrastructure Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HA Sustainable Infrastructure Capital wasn't on the list.

While HA Sustainable Infrastructure Capital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.