Stock analysts at BMO Capital Markets began coverage on shares of Horace Mann Educators (NYSE:HMN - Get Free Report) in a research note issued to investors on Monday, MarketBeat.com reports. The firm set an "outperform" rating and a $48.00 price target on the insurance provider's stock. BMO Capital Markets' target price would suggest a potential upside of 16.46% from the company's current price.

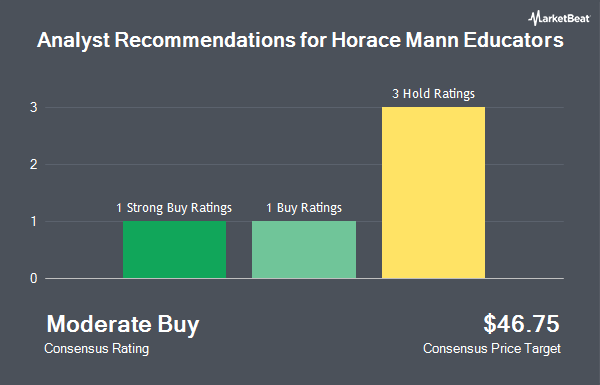

HMN has been the subject of several other research reports. Raymond James Financial reaffirmed a "strong-buy" rating on shares of Horace Mann Educators in a research note on Thursday, May 15th. Wall Street Zen upgraded Horace Mann Educators from a "buy" rating to a "strong-buy" rating in a report on Friday, July 18th. Finally, Piper Sandler lifted their price objective on Horace Mann Educators from $44.00 to $45.00 and gave the stock a "neutral" rating in a report on Thursday, July 3rd. Three research analysts have rated the stock with a hold rating, one has given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, Horace Mann Educators presently has an average rating of "Moderate Buy" and a consensus target price of $46.75.

Read Our Latest Research Report on HMN

Horace Mann Educators Stock Performance

Shares of HMN traded down $1.31 on Monday, reaching $41.22. 325,213 shares of the company's stock traded hands, compared to its average volume of 252,800. The company has a current ratio of 0.09, a quick ratio of 0.09 and a debt-to-equity ratio of 0.41. The stock has a market cap of $1.68 billion, a PE ratio of 14.93 and a beta of 0.27. The stock's 50 day simple moving average is $42.24 and its two-hundred day simple moving average is $41.35. Horace Mann Educators has a 52-week low of $31.95 and a 52-week high of $44.44.

Horace Mann Educators (NYSE:HMN - Get Free Report) last announced its quarterly earnings results on Tuesday, May 6th. The insurance provider reported $1.07 earnings per share for the quarter, beating the consensus estimate of $0.88 by $0.19. The company had revenue of $416.40 million during the quarter, compared to analysts' expectations of $421.40 million. Horace Mann Educators had a return on equity of 11.86% and a net margin of 7.04%. The firm's quarterly revenue was up 7.9% compared to the same quarter last year. During the same period in the previous year, the business earned $0.62 earnings per share. On average, analysts forecast that Horace Mann Educators will post 3.87 earnings per share for the current fiscal year.

Horace Mann Educators declared that its board has initiated a share buyback program on Tuesday, May 13th that permits the company to repurchase $50.00 million in outstanding shares. This repurchase authorization permits the insurance provider to purchase up to 3% of its stock through open market purchases. Stock repurchase programs are often an indication that the company's board of directors believes its stock is undervalued.

Insider Transactions at Horace Mann Educators

In related news, EVP Bret A. Conklin sold 15,472 shares of the firm's stock in a transaction on Wednesday, May 28th. The stock was sold at an average price of $43.52, for a total value of $673,341.44. Following the transaction, the executive vice president directly owned 55,792 shares of the company's stock, valued at approximately $2,428,067.84. This trade represents a 21.71% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Marita Zuraitis sold 5,000 shares of the firm's stock in a transaction dated Monday, June 2nd. The shares were sold at an average price of $43.24, for a total value of $216,200.00. Following the sale, the chief executive officer directly owned 310,451 shares in the company, valued at approximately $13,423,901.24. This represents a 1.59% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 46,198 shares of company stock worth $1,999,575 in the last ninety days. Insiders own 4.00% of the company's stock.

Institutional Investors Weigh In On Horace Mann Educators

Several large investors have recently made changes to their positions in the company. Teacher Retirement System of Texas increased its holdings in shares of Horace Mann Educators by 10.8% in the second quarter. Teacher Retirement System of Texas now owns 25,043 shares of the insurance provider's stock worth $1,076,000 after purchasing an additional 2,450 shares during the last quarter. First Citizens Bank & Trust Co. purchased a new position in Horace Mann Educators in the second quarter worth about $514,000. DekaBank Deutsche Girozentrale purchased a new position in Horace Mann Educators in the second quarter worth about $613,000. New York State Teachers Retirement System grew its position in Horace Mann Educators by 0.7% in the second quarter. New York State Teachers Retirement System now owns 69,533 shares of the insurance provider's stock worth $2,988,000 after acquiring an additional 467 shares in the last quarter. Finally, Cornerstone Wealth Group LLC grew its position in Horace Mann Educators by 48.6% in the second quarter. Cornerstone Wealth Group LLC now owns 10,700 shares of the insurance provider's stock worth $460,000 after acquiring an additional 3,500 shares in the last quarter. 99.28% of the stock is owned by institutional investors.

About Horace Mann Educators

(

Get Free Report)

Horace Mann Educators Corporation, together with its subsidiaries, operates as an insurance holding company in the United States. The company operates through Property & Casualty, Life & Retirement, and Supplemental & Group Benefits segments. Its Property & Casualty segment offers insurance products, including private passenger auto insurance, residential home insurance, and personal umbrella insurance; and provides auto coverages including liability and collision, and property coverage for homeowners and renters.

See Also

Before you consider Horace Mann Educators, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Horace Mann Educators wasn't on the list.

While Horace Mann Educators currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.