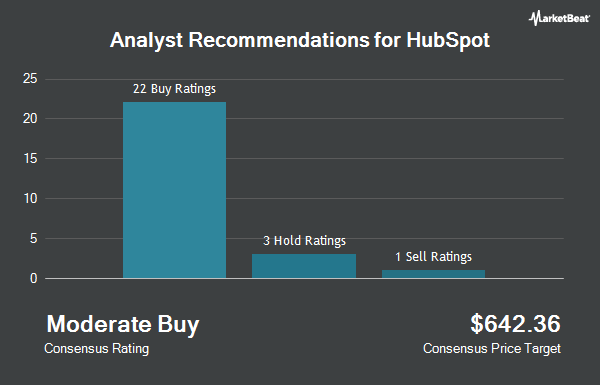

HubSpot, Inc. (NYSE:HUBS - Get Free Report) has received an average rating of "Moderate Buy" from the thirty brokerages that are covering the stock, MarketBeat reports. Four analysts have rated the stock with a hold recommendation, twenty-five have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 12 month price objective among brokerages that have issued ratings on the stock in the last year is $766.71.

A number of analysts have recently weighed in on HUBS shares. Mizuho cut their price objective on shares of HubSpot from $900.00 to $700.00 and set an "outperform" rating on the stock in a research note on Tuesday, April 15th. KeyCorp raised shares of HubSpot from a "sector weight" rating to an "overweight" rating and set a $920.00 price target on the stock in a report on Thursday, February 13th. Barclays reduced their price objective on HubSpot from $815.00 to $745.00 and set an "overweight" rating for the company in a research note on Friday, May 9th. Piper Sandler upped their target price on HubSpot from $535.00 to $645.00 and gave the stock a "neutral" rating in a research note on Friday, May 9th. Finally, Oppenheimer lifted their price target on HubSpot from $700.00 to $750.00 and gave the company an "outperform" rating in a research report on Friday, May 9th.

Check Out Our Latest Stock Analysis on HUBS

Insider Buying and Selling at HubSpot

In related news, insider Brian Halligan sold 8,500 shares of the business's stock in a transaction dated Tuesday, April 15th. The shares were sold at an average price of $538.60, for a total transaction of $4,578,100.00. Following the transaction, the insider now directly owns 525,687 shares in the company, valued at approximately $283,135,018.20. The trade was a 1.59% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, CEO Yamini Rangan sold 680 shares of the stock in a transaction dated Thursday, April 24th. The shares were sold at an average price of $600.00, for a total transaction of $408,000.00. Following the completion of the sale, the chief executive officer now owns 71,693 shares of the company's stock, valued at approximately $43,015,800. The trade was a 0.94% decrease in their position. The disclosure for this sale can be found here. Insiders sold 20,062 shares of company stock valued at $11,516,757 over the last quarter. 4.50% of the stock is currently owned by insiders.

Institutional Investors Weigh In On HubSpot

Several hedge funds and other institutional investors have recently made changes to their positions in the stock. Vanguard Group Inc. grew its holdings in HubSpot by 4.0% in the 1st quarter. Vanguard Group Inc. now owns 5,246,734 shares of the software maker's stock valued at $2,997,407,000 after buying an additional 201,994 shares in the last quarter. Price T Rowe Associates Inc. MD boosted its position in shares of HubSpot by 17.0% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 4,910,062 shares of the software maker's stock valued at $2,805,070,000 after acquiring an additional 714,980 shares during the last quarter. Wellington Management Group LLP boosted its position in shares of HubSpot by 5.3% during the 4th quarter. Wellington Management Group LLP now owns 1,477,190 shares of the software maker's stock valued at $1,029,262,000 after acquiring an additional 74,990 shares during the last quarter. Massachusetts Financial Services Co. MA grew its holdings in shares of HubSpot by 37.3% in the first quarter. Massachusetts Financial Services Co. MA now owns 927,927 shares of the software maker's stock valued at $530,115,000 after purchasing an additional 251,853 shares during the period. Finally, Geode Capital Management LLC increased its position in HubSpot by 1.2% during the fourth quarter. Geode Capital Management LLC now owns 830,405 shares of the software maker's stock worth $577,572,000 after purchasing an additional 9,922 shares during the last quarter. Institutional investors and hedge funds own 90.39% of the company's stock.

HubSpot Price Performance

HubSpot stock traded down $25.24 during trading hours on Friday, hitting $580.83. 1,206,050 shares of the stock traded hands, compared to its average volume of 616,848. The firm's 50 day moving average price is $591.29 and its 200-day moving average price is $666.37. The stock has a market capitalization of $30.63 billion, a price-to-earnings ratio of 6,454.33, a P/E/G ratio of 41.44 and a beta of 1.70. HubSpot has a 1 year low of $434.84 and a 1 year high of $881.13.

HubSpot Company Profile

(

Get Free ReportHubSpot, Inc, together with its subsidiaries, provides a cloud-based customer relationship management (CRM) platform for businesses in the Americas, Europe, and the Asia Pacific. The company's CRM platform includes Marketing Hub, a toolset for marketing automation and email, social media, SEO, and reporting and analytics; Sales Hub offers email templates and tracking, conversations and live chat, meeting and call scheduling, lead and website visit alerts, lead scoring, sales automation, pipeline management, quoting, forecasting, and reporting; Service Hub, a service software designed to help businesses manage, respond, and connect with customers; and Content Management Systems Hub enables businesses to create new and edit existing web content.

Recommended Stories

Before you consider HubSpot, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HubSpot wasn't on the list.

While HubSpot currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.