IBEX (NASDAQ:IBEX - Get Free Report) is anticipated to post its Q3 2025 quarterly earnings results after the market closes on Thursday, May 8th. Analysts expect IBEX to post earnings of $0.73 per share and revenue of $131.23 million for the quarter. IBEX has set its FY 2025 guidance at EPS.

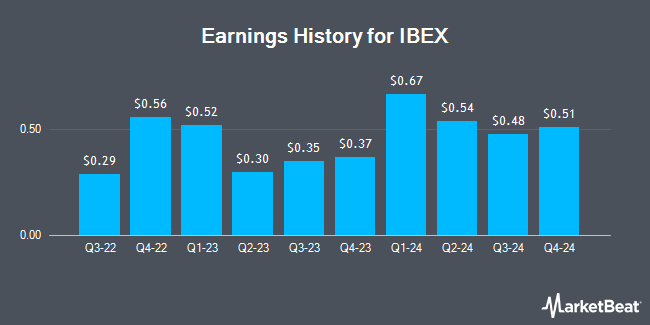

IBEX (NASDAQ:IBEX - Get Free Report) last released its quarterly earnings data on Thursday, February 6th. The company reported $0.51 EPS for the quarter, beating the consensus estimate of $0.49 by $0.02. IBEX had a net margin of 7.08% and a return on equity of 25.29%.

IBEX Stock Performance

Shares of NASDAQ IBEX traded up $0.07 during mid-day trading on Tuesday, reaching $25.85. 205,925 shares of the company were exchanged, compared to its average volume of 122,022. The stock has a market capitalization of $341.01 million, a P/E ratio of 12.14 and a beta of 0.74. The company has a quick ratio of 1.44, a current ratio of 1.44 and a debt-to-equity ratio of 0.01. The company's 50-day simple moving average is $24.39 and its 200-day simple moving average is $22.44. IBEX has a twelve month low of $13.61 and a twelve month high of $27.83.

Wall Street Analysts Forecast Growth

Separately, Royal Bank of Canada increased their target price on IBEX from $21.00 to $24.00 and gave the stock a "sector perform" rating in a research note on Friday, February 7th.

Read Our Latest Stock Report on IBEX

Insider Buying and Selling at IBEX

In related news, Director Mohammedulla Khaishgi sold 12,600 shares of the business's stock in a transaction dated Thursday, February 20th. The stock was sold at an average price of $26.50, for a total value of $333,900.00. Following the completion of the transaction, the director now owns 89,912 shares of the company's stock, valued at $2,382,668. The trade was a 12.29 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CEO Robert Thomas Dechant sold 49,931 shares of the stock in a transaction dated Wednesday, February 26th. The stock was sold at an average price of $26.24, for a total transaction of $1,310,189.44. Following the sale, the chief executive officer now owns 213,633 shares in the company, valued at $5,605,729.92. The trade was a 18.94 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 160,567 shares of company stock valued at $4,152,086 in the last quarter. Company insiders own 6.72% of the company's stock.

IBEX Company Profile

(

Get Free Report)

IBEX Limited provides end-to-end technology-enabled customer lifecycle experience solutions in the United States and internationally. The company products and services portfolio includes ibex Connect, that offers customer service, technical support, revenue generation, and other revenue generation outsourced back-office services through the CX model, which integrates voice, email, chat, SMS, social media, and other communication applications; ibex Digital, a customer acquisition solution that comprises digital marketing, e-commerce technology, and platform solutions; and ibex CX, a customer experience solution, which provides a suite of proprietary software tools to measure, monitor, and manage its clients' customer experience.

Featured Articles

Before you consider IBEX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IBEX wasn't on the list.

While IBEX currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.