International Consolidated Airlines Group (LON:IAG - Free Report) had its price objective increased by Royal Bank Of Canada from GBX 440 ($5.92) to GBX 500 ($6.72) in a research report sent to investors on Thursday, MarketBeat.com reports. Royal Bank Of Canada currently has an outperform rating on the stock.

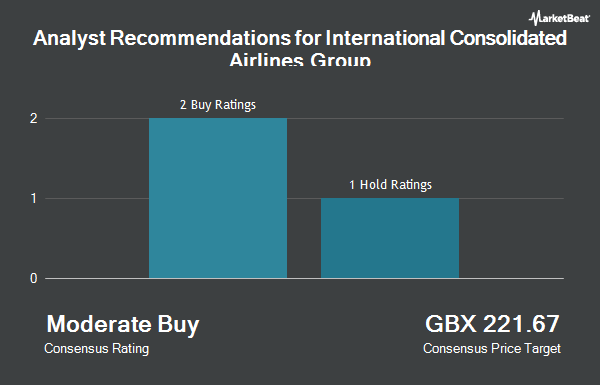

A number of other brokerages have also recently commented on IAG. Deutsche Bank Aktiengesellschaft restated a "buy" rating and set a GBX 460 ($6.18) price target on shares of International Consolidated Airlines Group in a research note on Monday, August 4th. Peel Hunt reaffirmed a "buy" rating and set a GBX 420 ($5.65) target price on shares of International Consolidated Airlines Group in a report on Friday, August 1st. One analyst has rated the stock with a sell rating and six have given a buy rating to the company. Based on data from MarketBeat, the stock has an average rating of "Moderate Buy" and a consensus price target of GBX 403.33 ($5.42).

Read Our Latest Analysis on International Consolidated Airlines Group

International Consolidated Airlines Group Trading Up 0.1%

Shares of International Consolidated Airlines Group stock traded up GBX 0.20 ($0.00) during trading on Thursday, hitting GBX 373.90 ($5.03). The company's stock had a trading volume of 10,696,299 shares, compared to its average volume of 23,432,467. The company has a debt-to-equity ratio of 338.12, a current ratio of 0.70 and a quick ratio of 0.63. The stock has a 50-day moving average price of GBX 351.26 and a two-hundred day moving average price of GBX 318.03. The stock has a market cap of £22.09 billion, a price-to-earnings ratio of 7.90, a price-to-earnings-growth ratio of 0.21 and a beta of 2.31. International Consolidated Airlines Group has a 52 week low of GBX 163.65 ($2.20) and a 52 week high of GBX 393.20 ($5.29).

About International Consolidated Airlines Group

(

Get Free Report)

International Consolidated Airlines Group SA, together with its subsidiaries, engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, the United States, and rest of the world. It also provides aircraft leasing, aircraft maintenance, tour operation, air freight operations, call centre, ground handling, trustee, retail, IT, finance, procurement, storage and custody, aircraft technical assistance, human resources support, and airport infrastructure development services; and manages airline loyalty programmes.

Read More

Before you consider International Consolidated Airlines Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and International Consolidated Airlines Group wasn't on the list.

While International Consolidated Airlines Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.