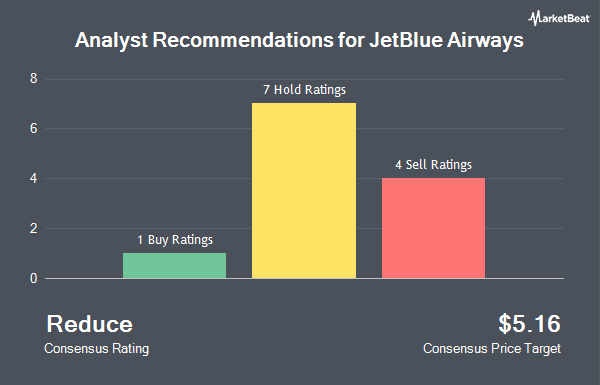

JetBlue Airways Co. (NASDAQ:JBLU - Get Free Report) has received an average rating of "Reduce" from the twelve brokerages that are presently covering the stock, Marketbeat.com reports. Four research analysts have rated the stock with a sell recommendation, seven have issued a hold recommendation and one has assigned a buy recommendation to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is $5.16.

A number of equities analysts recently commented on the stock. Seaport Res Ptn lowered shares of JetBlue Airways from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, January 28th. UBS Group lowered their price target on shares of JetBlue Airways from $5.00 to $3.00 and set a "sell" rating on the stock in a research report on Monday, April 7th. Susquehanna lowered their price target on shares of JetBlue Airways from $6.00 to $4.00 and set a "neutral" rating on the stock in a research report on Monday, April 7th. Citigroup raised their price target on shares of JetBlue Airways from $4.25 to $5.00 and gave the stock a "neutral" rating in a research report on Monday, May 5th. Finally, Bank of America lowered their price target on shares of JetBlue Airways from $5.25 to $4.25 and set an "underperform" rating on the stock in a research report on Thursday, April 3rd.

Check Out Our Latest Stock Analysis on JetBlue Airways

JetBlue Airways Stock Performance

Shares of NASDAQ JBLU traded up $0.09 during mid-day trading on Tuesday, reaching $4.88. 16,640,832 shares of the company were exchanged, compared to its average volume of 19,538,380. The company's 50-day simple moving average is $4.67 and its 200-day simple moving average is $6.10. The company has a quick ratio of 1.18, a current ratio of 1.10 and a debt-to-equity ratio of 3.08. The stock has a market capitalization of $1.73 billion, a P/E ratio of -2.09 and a beta of 1.79. JetBlue Airways has a twelve month low of $3.34 and a twelve month high of $8.31.

JetBlue Airways (NASDAQ:JBLU - Get Free Report) last released its quarterly earnings results on Tuesday, April 29th. The transportation company reported ($0.59) EPS for the quarter, topping analysts' consensus estimates of ($0.61) by $0.02. JetBlue Airways had a negative net margin of 8.57% and a negative return on equity of 9.31%. The business had revenue of $2.14 billion for the quarter, compared to analyst estimates of $2.17 billion. During the same period last year, the firm earned ($0.43) earnings per share. JetBlue Airways's revenue for the quarter was down 3.1% compared to the same quarter last year. As a group, research analysts predict that JetBlue Airways will post -0.69 earnings per share for the current year.

Insider Activity at JetBlue Airways

In related news, CFO Ursula L. Hurley sold 15,000 shares of JetBlue Airways stock in a transaction that occurred on Tuesday, February 18th. The shares were sold at an average price of $7.50, for a total transaction of $112,500.00. Following the sale, the chief financial officer now directly owns 41,833 shares of the company's stock, valued at approximately $313,747.50. The trade was a 26.39% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 1.18% of the stock is currently owned by insiders.

Institutional Investors Weigh In On JetBlue Airways

Several hedge funds and other institutional investors have recently made changes to their positions in the stock. CIBC Asset Management Inc grew its holdings in shares of JetBlue Airways by 6.4% during the 4th quarter. CIBC Asset Management Inc now owns 30,416 shares of the transportation company's stock valued at $239,000 after purchasing an additional 1,823 shares during the last quarter. Xponance Inc. grew its holdings in shares of JetBlue Airways by 10.2% during the 4th quarter. Xponance Inc. now owns 22,613 shares of the transportation company's stock valued at $178,000 after purchasing an additional 2,095 shares during the last quarter. Vident Advisory LLC grew its holdings in shares of JetBlue Airways by 10.9% during the 4th quarter. Vident Advisory LLC now owns 23,181 shares of the transportation company's stock valued at $182,000 after purchasing an additional 2,284 shares during the last quarter. Blue Trust Inc. grew its holdings in shares of JetBlue Airways by 130.8% during the 4th quarter. Blue Trust Inc. now owns 4,478 shares of the transportation company's stock valued at $35,000 after purchasing an additional 2,538 shares during the last quarter. Finally, Summit Investment Advisors Inc. grew its holdings in shares of JetBlue Airways by 8.9% during the 4th quarter. Summit Investment Advisors Inc. now owns 32,679 shares of the transportation company's stock valued at $257,000 after purchasing an additional 2,666 shares during the last quarter. 83.71% of the stock is owned by institutional investors.

About JetBlue Airways

(

Get Free ReportJetBlue Airways Corporation provides air transportation services. The company operates a fleet of Airbus A321, Airbus A220, Airbus A321neo, Airbus A320 Restyled, Airbus A320, Airbus A321 with Mint, Airbus A321neo with Mint, Airbus A321neoLR with Mint, and Embraer E190 aircraft. It also serves 100 destinations across the United States, the Caribbean and Latin America, Canada, and Europe.

See Also

Before you consider JetBlue Airways, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and JetBlue Airways wasn't on the list.

While JetBlue Airways currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.