JPMorgan Chase & Co. restated their overweight rating on shares of Goodyear Tire & Rubber (NASDAQ:GT - Free Report) in a report released on Thursday, MarketBeat Ratings reports. The brokerage currently has a $17.00 price target on the stock, down from their prior price target of $18.00.

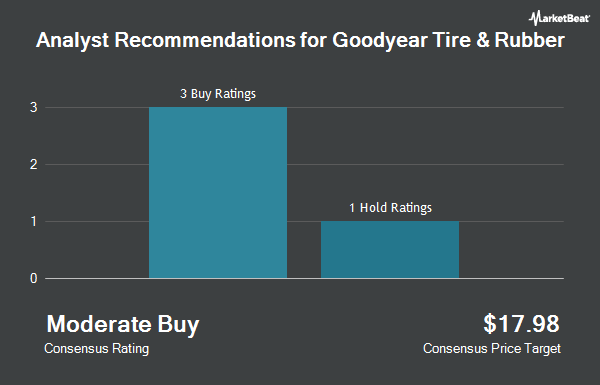

Several other research firms also recently issued reports on GT. Deutsche Bank Aktiengesellschaft upgraded shares of Goodyear Tire & Rubber from a "hold" rating to a "buy" rating and set a $13.00 price objective on the stock in a report on Monday, March 31st. Wall Street Zen lowered Goodyear Tire & Rubber from a "buy" rating to a "hold" rating in a research report on Saturday, May 10th. Argus upgraded Goodyear Tire & Rubber from a "hold" rating to a "buy" rating and set a $12.00 price objective on the stock in a research report on Tuesday, February 18th. Finally, TD Cowen assumed coverage on Goodyear Tire & Rubber in a research report on Friday, March 7th. They issued a "buy" rating and a $14.00 price objective on the stock. Three research analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat, Goodyear Tire & Rubber presently has a consensus rating of "Moderate Buy" and an average target price of $14.00.

Get Our Latest Research Report on GT

Goodyear Tire & Rubber Stock Up 1.6%

Shares of GT stock traded up $0.18 during mid-day trading on Thursday, hitting $11.13. 2,727,082 shares of the stock traded hands, compared to its average volume of 5,307,388. The stock has a market cap of $3.18 billion, a P/E ratio of 46.27 and a beta of 1.42. The stock's fifty day moving average is $10.14 and its two-hundred day moving average is $9.61. Goodyear Tire & Rubber has a 52-week low of $7.27 and a 52-week high of $12.58. The company has a debt-to-equity ratio of 1.30, a current ratio of 1.04 and a quick ratio of 0.55.

Goodyear Tire & Rubber (NASDAQ:GT - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The company reported ($0.04) EPS for the quarter, beating the consensus estimate of ($0.06) by $0.02. The business had revenue of $4.25 billion during the quarter, compared to analyst estimates of $4.41 billion. Goodyear Tire & Rubber had a net margin of 0.37% and a return on equity of 6.21%. The company's quarterly revenue was down 6.3% on a year-over-year basis. During the same period in the prior year, the firm posted $0.10 earnings per share. Equities analysts predict that Goodyear Tire & Rubber will post 1.5 EPS for the current year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in GT. Norges Bank purchased a new position in shares of Goodyear Tire & Rubber during the 4th quarter valued at approximately $39,626,000. Nuveen LLC purchased a new position in shares of Goodyear Tire & Rubber during the 1st quarter valued at approximately $20,422,000. Maple Rock Capital Partners Inc. purchased a new position in Goodyear Tire & Rubber in the 4th quarter valued at $16,875,000. CenterBook Partners LP acquired a new stake in Goodyear Tire & Rubber during the 1st quarter worth $13,413,000. Finally, Atlantic Investment Management Inc. purchased a new stake in shares of Goodyear Tire & Rubber during the fourth quarter worth $11,803,000. Hedge funds and other institutional investors own 84.19% of the company's stock.

Goodyear Tire & Rubber Company Profile

(

Get Free Report)

Goodyear Tire & Rubber Co engages in the development, manufacture, distribution, and sale of tires. It operates through the following geographical segments: Americas, Europe, Middle East, and Africa, and Asia Pacific. The Americas segment is involved in the development, manufacture, distribution, and sale of tires and related products and services in North, Central, and South America.

Featured Articles

Before you consider Goodyear Tire & Rubber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goodyear Tire & Rubber wasn't on the list.

While Goodyear Tire & Rubber currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.