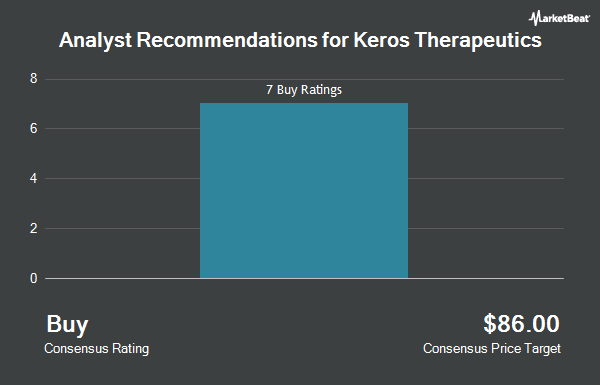

Shares of Keros Therapeutics, Inc. (NASDAQ:KROS - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the fourteen brokerages that are presently covering the company, Marketbeat.com reports. Seven analysts have rated the stock with a hold rating and seven have issued a buy rating on the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $30.00.

KROS has been the subject of several recent analyst reports. Wedbush restated a "neutral" rating and issued a $15.00 price target on shares of Keros Therapeutics in a research note on Friday, May 30th. Bank of America downgraded Keros Therapeutics from a "buy" rating to a "neutral" rating and lowered their price objective for the company from $32.00 to $18.00 in a research report on Tuesday, June 10th. Finally, HC Wainwright lowered their price target on Keros Therapeutics from $25.00 to $20.00 and set a "buy" rating on the stock in a report on Friday, August 8th.

Read Our Latest Stock Report on Keros Therapeutics

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. GAMMA Investing LLC lifted its stake in shares of Keros Therapeutics by 7,690.3% in the 1st quarter. GAMMA Investing LLC now owns 2,415 shares of the company's stock valued at $237,000 after acquiring an additional 2,384 shares during the last quarter. FNY Investment Advisers LLC purchased a new position in shares of Keros Therapeutics during the 1st quarter worth approximately $25,000. CWM LLC boosted its holdings in shares of Keros Therapeutics by 10,157.7% in the first quarter. CWM LLC now owns 2,667 shares of the company's stock valued at $27,000 after acquiring an additional 2,641 shares in the last quarter. Tower Research Capital LLC TRC grew its holdings in Keros Therapeutics by 149.2% in the second quarter. Tower Research Capital LLC TRC now owns 3,153 shares of the company's stock valued at $42,000 after purchasing an additional 1,888 shares during the period. Finally, Police & Firemen s Retirement System of New Jersey raised its holdings in shares of Keros Therapeutics by 29.7% during the second quarter. Police & Firemen s Retirement System of New Jersey now owns 8,257 shares of the company's stock worth $110,000 after purchasing an additional 1,892 shares during the period. Institutional investors own 71.56% of the company's stock.

Keros Therapeutics Stock Performance

Shares of KROS traded down $0.48 during mid-day trading on Friday, reaching $15.56. 562,755 shares of the company's stock traded hands, compared to its average volume of 349,748. The business's 50-day moving average price is $14.78 and its 200-day moving average price is $13.65. The stock has a market capitalization of $632.05 million, a P/E ratio of 50.20, a price-to-earnings-growth ratio of 2.01 and a beta of 1.06. Keros Therapeutics has a 12 month low of $9.12 and a 12 month high of $72.37.

Keros Therapeutics (NASDAQ:KROS - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The company reported ($0.76) earnings per share for the quarter, beating the consensus estimate of ($1.14) by $0.38. The business had revenue of $0.02 million for the quarter, compared to analyst estimates of $3.83 million. Keros Therapeutics had a net margin of 8.06% and a return on equity of 2.96%. Keros Therapeutics's revenue was up 49002.7% compared to the same quarter last year. During the same period in the prior year, the business posted ($1.25) earnings per share. Equities research analysts anticipate that Keros Therapeutics will post -4.74 EPS for the current year.

About Keros Therapeutics

(

Get Free Report)

Keros Therapeutics, Inc, a clinical-stage biopharmaceutical company, develops and commercializes novel therapeutics for patients with disorders that are linked to dysfunctional signaling of the transforming growth factor-beta family of proteins in the United States. The company's lead product candidate is KER-050, which is being developed for the treatment of low blood cell counts, or cytopenias, including anemia and thrombocytopenia in patients with myelodysplastic syndromes, as well as in patients with myelofibrosis.

Featured Stories

Before you consider Keros Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Keros Therapeutics wasn't on the list.

While Keros Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.