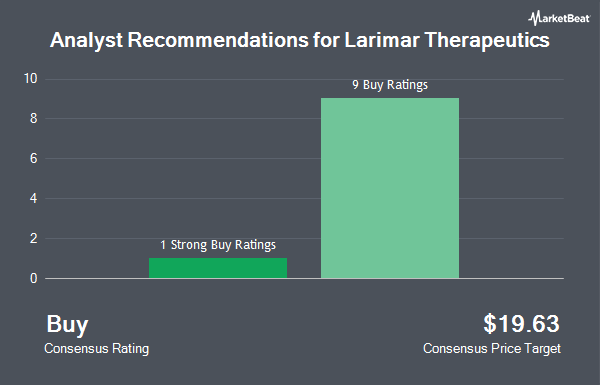

Larimar Therapeutics, Inc. (NASDAQ:LRMR - Get Free Report) has earned a consensus rating of "Buy" from the nine analysts that are covering the stock, MarketBeat reports. Eight equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating on the company. The average 12-month price objective among brokerages that have covered the stock in the last year is $18.50.

Several analysts have issued reports on the stock. Wedbush decreased their price target on shares of Larimar Therapeutics from $17.00 to $15.00 and set an "outperform" rating on the stock in a research report on Tuesday, June 24th. Guggenheim reaffirmed a "buy" rating and set a $26.00 price objective on shares of Larimar Therapeutics in a report on Tuesday, June 24th. Finally, Citigroup reaffirmed a "buy" rating on shares of Larimar Therapeutics in a report on Tuesday, June 24th.

Check Out Our Latest Stock Report on Larimar Therapeutics

Larimar Therapeutics Price Performance

NASDAQ:LRMR traded down $0.11 during midday trading on Friday, reaching $3.53. The stock had a trading volume of 1,402,500 shares, compared to its average volume of 787,655. Larimar Therapeutics has a 1-year low of $1.61 and a 1-year high of $9.50. The firm's fifty day simple moving average is $2.89 and its 200-day simple moving average is $2.76. The stock has a market capitalization of $226.03 million, a P/E ratio of -2.37 and a beta of 0.86.

Larimar Therapeutics (NASDAQ:LRMR - Get Free Report) last posted its earnings results on Wednesday, April 30th. The company reported ($0.46) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.42) by ($0.04). On average, equities research analysts anticipate that Larimar Therapeutics will post -1.15 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Larimar Therapeutics

Several institutional investors have recently added to or reduced their stakes in the company. Envestnet Asset Management Inc. lifted its holdings in Larimar Therapeutics by 12.3% during the 4th quarter. Envestnet Asset Management Inc. now owns 35,525 shares of the company's stock valued at $137,000 after purchasing an additional 3,877 shares during the last quarter. Bank of America Corp DE lifted its holdings in Larimar Therapeutics by 8.1% during the 4th quarter. Bank of America Corp DE now owns 53,190 shares of the company's stock valued at $206,000 after purchasing an additional 3,980 shares during the last quarter. BNP Paribas Financial Markets bought a new position in Larimar Therapeutics during the 4th quarter valued at about $25,000. Wells Fargo & Company MN lifted its holdings in Larimar Therapeutics by 51.7% during the 4th quarter. Wells Fargo & Company MN now owns 19,657 shares of the company's stock valued at $76,000 after purchasing an additional 6,701 shares during the last quarter. Finally, American Century Companies Inc. increased its position in Larimar Therapeutics by 14.2% in the 1st quarter. American Century Companies Inc. now owns 64,284 shares of the company's stock valued at $138,000 after acquiring an additional 7,990 shares in the last quarter. 91.92% of the stock is owned by institutional investors.

Larimar Therapeutics Company Profile

(

Get Free ReportLarimar Therapeutics, Inc, a clinical-stage biotechnology company, focuses on developing treatments for rare diseases using its novel cell penetrating peptide technology platform. Its lead product candidate is CTI-1601, which is in Phase 2 OLE clinical trial for the treatment of Friedreich's ataxia, a rare, progressive and fatal genetic disease.

See Also

Before you consider Larimar Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Larimar Therapeutics wasn't on the list.

While Larimar Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.