Oppenheimer initiated coverage on shares of Lexeo Therapeutics (NASDAQ:LXEO - Free Report) in a report issued on Thursday morning, MarketBeat.com reports. The brokerage issued an outperform rating and a $20.00 target price on the stock.

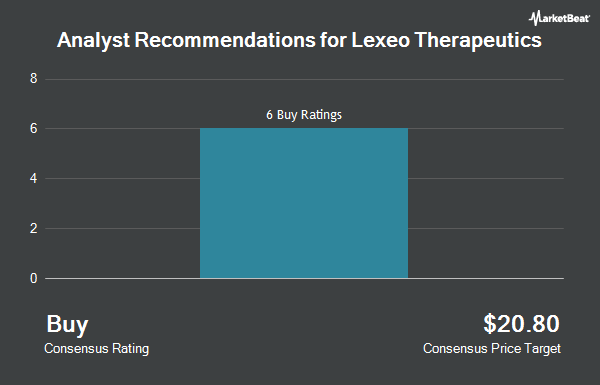

LXEO has been the subject of several other research reports. HC Wainwright dropped their price objective on shares of Lexeo Therapeutics from $23.00 to $15.00 and set a "buy" rating for the company in a research report on Friday, May 16th. JPMorgan Chase & Co. dropped their price objective on Lexeo Therapeutics from $16.00 to $10.00 and set an "overweight" rating for the company in a report on Friday, May 30th. Finally, Chardan Capital lowered their price target on Lexeo Therapeutics from $22.00 to $20.00 and set a "buy" rating for the company in a research note on Tuesday, May 13th. Six analysts have rated the stock with a buy rating, According to MarketBeat, the company currently has a consensus rating of "Buy" and a consensus target price of $17.17.

Read Our Latest Stock Report on Lexeo Therapeutics

Lexeo Therapeutics Price Performance

LXEO stock traded up $0.25 during trading on Thursday, hitting $4.86. 150,819 shares of the stock traded hands, compared to its average volume of 674,981. Lexeo Therapeutics has a one year low of $1.45 and a one year high of $12.95. The company has a 50 day simple moving average of $3.99 and a 200 day simple moving average of $3.72. The company has a current ratio of 3.42, a quick ratio of 3.42 and a debt-to-equity ratio of 0.01. The stock has a market cap of $161.17 million, a price-to-earnings ratio of -1.48 and a beta of 1.35.

Lexeo Therapeutics (NASDAQ:LXEO - Get Free Report) last released its quarterly earnings results on Monday, May 12th. The company reported ($0.99) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.80) by ($0.19). Equities analysts expect that Lexeo Therapeutics will post -3.14 EPS for the current fiscal year.

Institutional Trading of Lexeo Therapeutics

A number of institutional investors have recently bought and sold shares of LXEO. JPMorgan Chase & Co. lifted its holdings in shares of Lexeo Therapeutics by 30.1% in the fourth quarter. JPMorgan Chase & Co. now owns 13,371 shares of the company's stock worth $88,000 after acquiring an additional 3,093 shares during the last quarter. Wells Fargo & Company MN raised its position in shares of Lexeo Therapeutics by 49.9% during the fourth quarter. Wells Fargo & Company MN now owns 11,156 shares of the company's stock worth $73,000 after acquiring an additional 3,714 shares during the last quarter. Barclays PLC raised its position in shares of Lexeo Therapeutics by 9.9% during the fourth quarter. Barclays PLC now owns 55,161 shares of the company's stock worth $363,000 after acquiring an additional 4,951 shares during the last quarter. Rhumbline Advisers raised its holdings in Lexeo Therapeutics by 19.8% during the 1st quarter. Rhumbline Advisers now owns 30,192 shares of the company's stock worth $105,000 after purchasing an additional 4,995 shares during the last quarter. Finally, Allostery Investments LP bought a new stake in Lexeo Therapeutics in the 4th quarter valued at about $33,000. Institutional investors own 60.67% of the company's stock.

About Lexeo Therapeutics

(

Get Free Report)

Lexeo Therapeutics, Inc operates as a clinical stage genetic medicine company that focuses on hereditary and acquired diseases. The company develops LX2006, which is an AAVrh10-based gene therapy candidate for the treatment of Friedreich's ataxia (FA) cardiomyopathy; LX2020, an AAVrh10-based gene therapy candidate for the treatment of plakophilin-2 arrhythmogenic cardiomyopathy; LX2021, a gene therapy candidate for the treatment of DSP cardiomyopathy associated with it; and LX2022, a gene therapy candidate for the treatment of hypertrophic cardiomyopathy, or HCM caused by TNNI3 gene.

See Also

Before you consider Lexeo Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lexeo Therapeutics wasn't on the list.

While Lexeo Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.