Lloyds Banking Group (LON:LLOY - Get Free Report) was upgraded by equities researchers at JPMorgan Chase & Co. to a "neutral" rating in a research report issued to clients and investors on Monday, Marketbeat reports. The brokerage presently has a GBX 85 ($1.13) price objective on the financial services provider's stock, up from their prior price objective of GBX 79 ($1.05). JPMorgan Chase & Co.'s target price indicates a potential upside of 4.35% from the company's previous close.

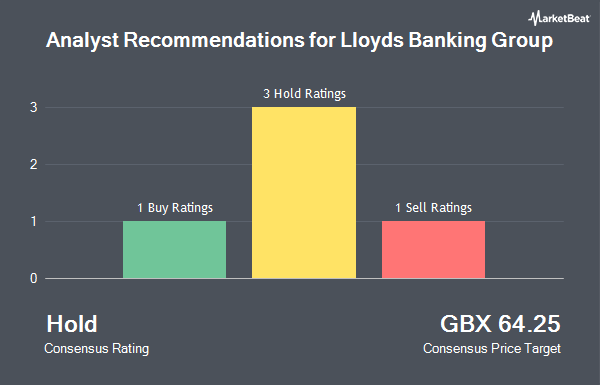

Several other brokerages also recently weighed in on LLOY. Royal Bank Of Canada raised Lloyds Banking Group to an "outperform" rating and set a GBX 95 ($1.26) target price for the company in a research report on Monday. Shore Capital reiterated a "hold" rating and issued a GBX 74 ($0.98) price target on shares of Lloyds Banking Group in a research note on Thursday, July 24th. Finally, Citigroup boosted their price target on Lloyds Banking Group from GBX 75 ($1.00) to GBX 77 ($1.02) and gave the stock a "neutral" rating in a research note on Friday. Four equities research analysts have rated the stock with a hold rating and one has given a buy rating to the stock. According to MarketBeat, Lloyds Banking Group has a consensus rating of "Hold" and an average target price of GBX 77.20 ($1.03).

Read Our Latest Stock Analysis on LLOY

Lloyds Banking Group Price Performance

Shares of LON LLOY opened at GBX 81.46 ($1.08) on Monday. Lloyds Banking Group has a 1-year low of GBX 52.44 ($0.70) and a 1-year high of GBX 82 ($1.09). The business has a 50-day moving average of GBX 76.75 and a 200-day moving average of GBX 71.60. The company has a market capitalization of £49.39 billion, a price-to-earnings ratio of 10.30, a PEG ratio of 1.84 and a beta of 1.23.

Lloyds Banking Group (LON:LLOY - Get Free Report) last issued its earnings results on Thursday, July 24th. The financial services provider reported GBX 3.80 ($0.05) earnings per share for the quarter. Lloyds Banking Group had a return on equity of 11.22% and a net margin of 16.66%. Research analysts expect that Lloyds Banking Group will post 7.3199528 EPS for the current fiscal year.

Insider Activity at Lloyds Banking Group

In related news, insider Charlie Nunn purchased 238,593 shares of the business's stock in a transaction that occurred on Friday, June 20th. The shares were acquired at an average price of GBX 76 ($1.01) per share, with a total value of £181,330.68 ($240,779.02). Also, insider William Chalmers bought 152,181 shares of the stock in a transaction that occurred on Friday, June 20th. The stock was acquired at an average price of GBX 76 ($1.01) per share, for a total transaction of £115,657.56 ($153,575.30). Company insiders own 0.17% of the company's stock.

About Lloyds Banking Group

(

Get Free Report)

We are the largest UK retail and commercial financial services provider with over 25 million customers and a presence in nearly every community.

The Group's main business activities are retail and commercial banking, general insurance and long-term savings, provided through the largest branch network and digital bank in the UK, with well recognised brands including Lloyds Bank, Halifax, Bank of Scotland and Scottish Widows.

Our shares are quoted on the London and New York stock exchanges and we are one of the largest companies in the FTSE 100 index.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Lloyds Banking Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lloyds Banking Group wasn't on the list.

While Lloyds Banking Group currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.