Lovesac (NASDAQ:LOVE - Get Free Report) issued an update on its third quarter 2026 earnings guidance on Thursday morning. The company provided EPS guidance of -0.830--0.51 for the period, compared to the consensus EPS estimate of -0.300. The company issued revenue guidance of $151.0 million-$161.0 million, compared to the consensus revenue estimate of $155.6 million. Lovesac also updated its FY 2026 guidance to 0.520-1.05 EPS.

Lovesac Stock Up 0.9%

LOVE stock traded up $0.16 during mid-day trading on Tuesday, hitting $17.88. 141,308 shares of the company were exchanged, compared to its average volume of 417,167. The firm has a market capitalization of $260.06 million, a P/E ratio of 28.37, a PEG ratio of 0.56 and a beta of 2.35. The business has a fifty day simple moving average of $18.77 and a 200-day simple moving average of $18.64. Lovesac has a 12-month low of $12.12 and a 12-month high of $39.49.

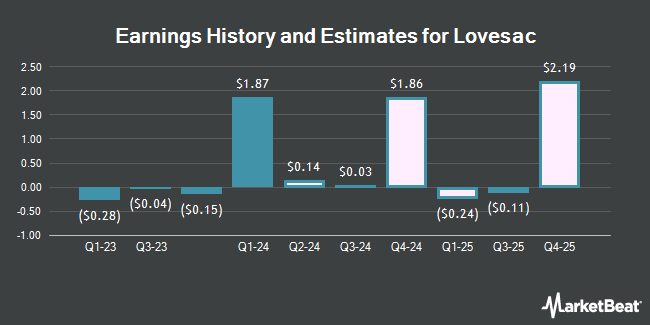

Lovesac (NASDAQ:LOVE - Get Free Report) last announced its earnings results on Thursday, September 11th. The company reported ($0.45) earnings per share for the quarter, topping the consensus estimate of ($0.72) by $0.27. The company had revenue of $160.53 million during the quarter, compared to analyst estimates of $160.42 million. Lovesac had a net margin of 1.87% and a return on equity of 6.35%. Lovesac's revenue was up 2.5% compared to the same quarter last year. During the same quarter last year, the firm posted ($0.38) earnings per share. Lovesac has set its Q3 2026 guidance at -0.830--0.51 EPS. FY 2026 guidance at 0.520-1.05 EPS. Research analysts predict that Lovesac will post 0.39 EPS for the current year.

Wall Street Analyst Weigh In

Several research analysts have weighed in on LOVE shares. Wall Street Zen raised shares of Lovesac from a "sell" rating to a "hold" rating in a research note on Saturday, July 12th. Maxim Group lowered their price objective on shares of Lovesac from $38.00 to $33.00 and set a "buy" rating for the company in a research note on Friday. Canaccord Genuity Group reissued a "buy" rating and issued a $30.00 price objective on shares of Lovesac in a research note on Friday. Finally, DA Davidson reissued a "buy" rating and issued a $24.00 price objective on shares of Lovesac in a research note on Tuesday, September 9th. Five investment analysts have rated the stock with a Buy rating, According to MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus target price of $30.00.

Check Out Our Latest Stock Report on LOVE

Insider Activity at Lovesac

In other Lovesac news, Director Walter Field Mclallen bought 1,950 shares of the business's stock in a transaction dated Friday, June 20th. The shares were acquired at an average cost of $18.08 per share, with a total value of $35,256.00. Following the acquisition, the director directly owned 40,000 shares of the company's stock, valued at $723,200. The trade was a 5.12% increase in their position. The purchase was disclosed in a legal filing with the SEC, which is accessible through this link. 12.46% of the stock is owned by insiders.

Hedge Funds Weigh In On Lovesac

A number of institutional investors have recently modified their holdings of the business. Nomura Holdings Inc. increased its holdings in shares of Lovesac by 222.9% in the 2nd quarter. Nomura Holdings Inc. now owns 145,721 shares of the company's stock valued at $2,652,000 after acquiring an additional 100,586 shares during the period. Corient Private Wealth LLC acquired a new position in Lovesac in the 2nd quarter valued at $2,024,000. MML Investors Services LLC increased its stake in Lovesac by 1.0% in the 2nd quarter. MML Investors Services LLC now owns 218,845 shares of the company's stock valued at $3,983,000 after buying an additional 2,203 shares during the period. BNP Paribas Financial Markets increased its stake in Lovesac by 130.4% in the 2nd quarter. BNP Paribas Financial Markets now owns 1,938 shares of the company's stock valued at $35,000 after buying an additional 1,097 shares during the period. Finally, Bridgeway Capital Management LLC increased its stake in Lovesac by 252.8% in the 2nd quarter. Bridgeway Capital Management LLC now owns 306,687 shares of the company's stock valued at $5,582,000 after buying an additional 219,762 shares during the period. 91.32% of the stock is owned by institutional investors and hedge funds.

Lovesac Company Profile

(

Get Free Report)

The Lovesac Company designs, manufactures, and sells furniture. It offers sactionals, such as seats and sides; sacs, including foam beanbag chairs; and other products comprising drink holders, footsac blankets, decorative pillows, fitted seat tables, and ottomans. The company markets its products primarily through www.lovesac.com website, as well as showrooms at top tier malls, lifestyle centers, mobile concierges, kiosks, and street locations in 41 states in the United States; and in store pop-up- shops and shop-in-shops, and barter inventory transactions.

See Also

Before you consider Lovesac, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lovesac wasn't on the list.

While Lovesac currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.