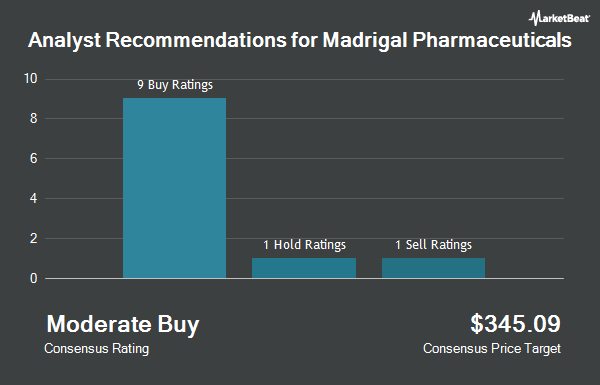

Shares of Madrigal Pharmaceuticals, Inc. (NASDAQ:MDGL - Get Free Report) have earned an average recommendation of "Moderate Buy" from the nine analysts that are currently covering the stock, Marketbeat Ratings reports. One analyst has rated the stock with a hold recommendation and eight have assigned a buy recommendation to the company. The average 1 year target price among brokerages that have updated their coverage on the stock in the last year is $420.63.

Several brokerages have issued reports on MDGL. B. Riley reissued a "buy" rating and issued a $460.00 price objective (up from $422.00) on shares of Madrigal Pharmaceuticals in a research note on Friday, May 2nd. Wall Street Zen upgraded shares of Madrigal Pharmaceuticals from a "sell" rating to a "hold" rating in a research note on Monday, May 5th. JMP Securities reissued a "market outperform" rating and set a $443.00 price target on shares of Madrigal Pharmaceuticals in a report on Thursday, April 24th. UBS Group lifted their price objective on Madrigal Pharmaceuticals from $441.00 to $458.00 and gave the company a "buy" rating in a report on Friday, May 2nd. Finally, Canaccord Genuity Group boosted their target price on Madrigal Pharmaceuticals from $394.00 to $420.00 and gave the stock a "buy" rating in a research report on Friday, May 2nd.

Get Our Latest Report on Madrigal Pharmaceuticals

Insider Transactions at Madrigal Pharmaceuticals

In related news, Director Rebecca Taub sold 26,444 shares of the firm's stock in a transaction that occurred on Wednesday, July 16th. The stock was sold at an average price of $353.47, for a total value of $9,347,160.68. Following the completion of the transaction, the director directly owned 461,044 shares of the company's stock, valued at $162,965,222.68. This trade represents a 5.42% decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Paul A. Friedman sold 26,176 shares of Madrigal Pharmaceuticals stock in a transaction on Wednesday, July 16th. The stock was sold at an average price of $353.47, for a total value of $9,252,430.72. Following the transaction, the director directly owned 187,164 shares of the company's stock, valued at approximately $66,156,859.08. This represents a 12.27% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last ninety days, insiders sold 60,377 shares of company stock valued at $21,316,969. 21.50% of the stock is currently owned by corporate insiders.

Institutional Investors Weigh In On Madrigal Pharmaceuticals

A number of large investors have recently added to or reduced their stakes in the business. Rhumbline Advisers raised its position in Madrigal Pharmaceuticals by 7.9% during the first quarter. Rhumbline Advisers now owns 26,364 shares of the biopharmaceutical company's stock worth $8,733,000 after acquiring an additional 1,924 shares during the last quarter. GAMMA Investing LLC increased its position in Madrigal Pharmaceuticals by 131.4% during the first quarter. GAMMA Investing LLC now owns 118 shares of the biopharmaceutical company's stock worth $39,000 after buying an additional 67 shares in the last quarter. Franklin Resources Inc. raised its position in shares of Madrigal Pharmaceuticals by 340.1% in the fourth quarter. Franklin Resources Inc. now owns 6,087 shares of the biopharmaceutical company's stock valued at $1,878,000 after buying an additional 4,704 shares during the last quarter. Raymond James Financial Inc. acquired a new position in Madrigal Pharmaceuticals in the 4th quarter valued at $16,615,000. Finally, Prudential Financial Inc. lifted its stake in shares of Madrigal Pharmaceuticals by 166.2% during the 4th quarter. Prudential Financial Inc. now owns 3,655 shares of the biopharmaceutical company's stock worth $1,128,000 after purchasing an additional 2,282 shares during the period. 98.50% of the stock is owned by institutional investors and hedge funds.

Madrigal Pharmaceuticals Price Performance

Shares of MDGL opened at $298.40 on Friday. The company has a debt-to-equity ratio of 0.17, a quick ratio of 5.58 and a current ratio of 5.91. Madrigal Pharmaceuticals has a fifty-two week low of $200.63 and a fifty-two week high of $377.46. The firm has a 50-day simple moving average of $293.62 and a 200-day simple moving average of $312.17. The company has a market capitalization of $6.62 billion, a price-to-earnings ratio of -16.53 and a beta of -1.05.

Madrigal Pharmaceuticals (NASDAQ:MDGL - Get Free Report) last released its earnings results on Thursday, May 1st. The biopharmaceutical company reported ($3.32) earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($3.62) by $0.30. Madrigal Pharmaceuticals had a negative return on equity of 50.54% and a negative net margin of 123.38%. The business had revenue of $137.25 million for the quarter, compared to analyst estimates of $112.79 million. During the same quarter in the previous year, the company posted ($7.38) earnings per share. On average, equities research analysts anticipate that Madrigal Pharmaceuticals will post -23.47 earnings per share for the current year.

Madrigal Pharmaceuticals Company Profile

(

Get Free ReportMadrigal Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, focuses on the development of therapeutics for the treatment of non-alcoholic steatohepatitis (NASH) in the United States. Its lead product candidate is resmetirom, a liver-directed thyroid hormone receptor beta agonist, which is in Phase 3 clinical trials for treating NASH.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Madrigal Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Madrigal Pharmaceuticals wasn't on the list.

While Madrigal Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.