Mayville Engineering (NYSE:MEC - Get Free Report) is expected to be releasing its Q2 2025 earnings data after the market closes on Tuesday, August 5th. Analysts expect Mayville Engineering to post earnings of $0.10 per share and revenue of $137.98 million for the quarter. Mayville Engineering has set its FY 2025 guidance at EPS.

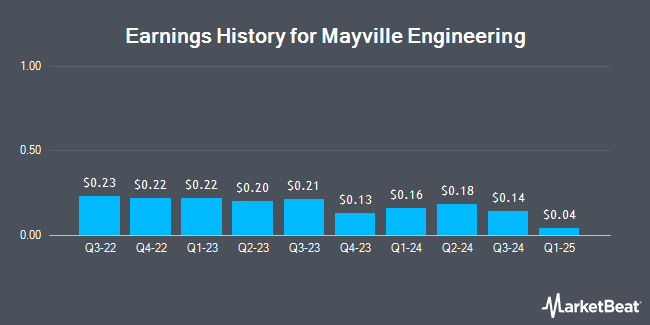

Mayville Engineering (NYSE:MEC - Get Free Report) last released its quarterly earnings results on Tuesday, May 6th. The company reported $0.04 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.01 by $0.03. The company had revenue of $135.58 million for the quarter, compared to the consensus estimate of $134.52 million. Mayville Engineering had a net margin of 4.09% and a return on equity of 9.30%. During the same quarter in the prior year, the firm earned $0.22 earnings per share. On average, analysts expect Mayville Engineering to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Mayville Engineering Trading Down 2.3%

Mayville Engineering stock traded down $0.38 during trading hours on Friday, hitting $16.39. The company had a trading volume of 110,629 shares, compared to its average volume of 106,275. The firm has a market cap of $335.36 million, a P/E ratio of 15.18 and a beta of 1.15. The company has a debt-to-equity ratio of 0.31, a quick ratio of 0.91 and a current ratio of 1.67. Mayville Engineering has a 1 year low of $11.72 and a 1 year high of $23.02. The company has a 50-day moving average price of $15.87 and a two-hundred day moving average price of $14.86.

Institutional Inflows and Outflows

An institutional investor recently raised its position in Mayville Engineering stock. Jane Street Group LLC boosted its stake in shares of Mayville Engineering Company, Inc. (NYSE:MEC - Free Report) by 158.6% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm owned 47,194 shares of the company's stock after acquiring an additional 28,946 shares during the quarter. Jane Street Group LLC owned about 0.23% of Mayville Engineering worth $634,000 as of its most recent filing with the Securities and Exchange Commission. Institutional investors and hedge funds own 45.44% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have weighed in on the stock. Citigroup reissued a "buy" rating and set a $21.00 target price (up previously from $17.00) on shares of Mayville Engineering in a research report on Monday, July 14th. DA Davidson initiated coverage on shares of Mayville Engineering in a report on Tuesday, June 17th. They set a "buy" rating and a $23.00 price objective on the stock.

Get Our Latest Report on Mayville Engineering

About Mayville Engineering

(

Get Free Report)

Mayville Engineering Company, Inc, together with its subsidiaries, engages in the production, design, prototyping and tooling, fabrication, aluminum extrusion, coating, and assembling of aftermarket components in the United States. It also supplies engineered components to original equipment manufacturers.

See Also

Before you consider Mayville Engineering, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mayville Engineering wasn't on the list.

While Mayville Engineering currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.