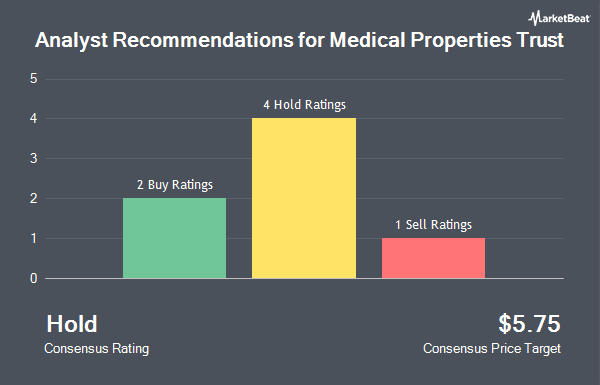

Medical Properties Trust, Inc. (NYSE:MPW - Get Free Report) has received an average recommendation of "Hold" from the seven analysts that are covering the company, Marketbeat.com reports. One analyst has rated the stock with a sell rating, four have given a hold rating and two have given a buy rating to the company. The average 12-month price target among brokerages that have issued ratings on the stock in the last year is $5.67.

A number of equities research analysts recently commented on MPW shares. Wall Street Zen downgraded Medical Properties Trust from a "hold" rating to a "sell" rating in a research report on Saturday, July 5th. Royal Bank Of Canada decreased their price objective on Medical Properties Trust from $5.00 to $4.50 and set a "sector perform" rating on the stock in a research report on Monday, June 30th.

View Our Latest Research Report on Medical Properties Trust

Medical Properties Trust Price Performance

Shares of NYSE MPW traded down $0.04 during mid-day trading on Friday, reaching $4.23. The company's stock had a trading volume of 3,153,027 shares, compared to its average volume of 10,661,921. The firm has a market capitalization of $2.54 billion, a PE ratio of -1.53 and a beta of 1.29. The company has a debt-to-equity ratio of 1.99, a current ratio of 3.23 and a quick ratio of 3.23. The stock has a fifty day moving average of $4.41 and a two-hundred day moving average of $4.93. Medical Properties Trust has a 52 week low of $3.51 and a 52 week high of $6.55.

Medical Properties Trust (NYSE:MPW - Get Free Report) last posted its earnings results on Thursday, May 1st. The real estate investment trust reported $0.14 EPS for the quarter, missing analysts' consensus estimates of $0.15 by ($0.01). The firm had revenue of $223.80 million during the quarter, compared to analysts' expectations of $233.80 million. Medical Properties Trust had a negative return on equity of 31.14% and a negative net margin of 174.35%. Medical Properties Trust's quarterly revenue was down 17.5% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.24 earnings per share. As a group, sell-side analysts anticipate that Medical Properties Trust will post 0.78 EPS for the current fiscal year.

Medical Properties Trust Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Thursday, July 17th. Stockholders of record on Wednesday, June 18th were paid a dividend of $0.08 per share. The ex-dividend date was Wednesday, June 18th. This represents a $0.32 dividend on an annualized basis and a dividend yield of 7.57%. Medical Properties Trust's dividend payout ratio is -11.55%.

Institutional Inflows and Outflows

Hedge funds have recently modified their holdings of the business. Raymond James Financial Inc. bought a new position in shares of Medical Properties Trust during the fourth quarter valued at approximately $2,114,000. Teacher Retirement System of Texas bought a new position in shares of Medical Properties Trust during the first quarter valued at approximately $478,000. Hudson Bay Capital Management LP bought a new position in shares of Medical Properties Trust during the fourth quarter valued at approximately $4,562,000. JPMorgan Chase & Co. grew its stake in shares of Medical Properties Trust by 4.6% during the fourth quarter. JPMorgan Chase & Co. now owns 1,782,664 shares of the real estate investment trust's stock valued at $7,042,000 after buying an additional 77,879 shares during the last quarter. Finally, Allianz Asset Management GmbH grew its stake in shares of Medical Properties Trust by 43.2% during the first quarter. Allianz Asset Management GmbH now owns 7,134,629 shares of the real estate investment trust's stock valued at $43,022,000 after buying an additional 2,152,861 shares during the last quarter. Institutional investors own 71.79% of the company's stock.

About Medical Properties Trust

(

Get Free ReportMedical Properties Trust, Inc is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world's largest owners of hospital real estate with 441 facilities and approximately 44,000 licensed beds as of September 30, 2023.

Featured Articles

Before you consider Medical Properties Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medical Properties Trust wasn't on the list.

While Medical Properties Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.