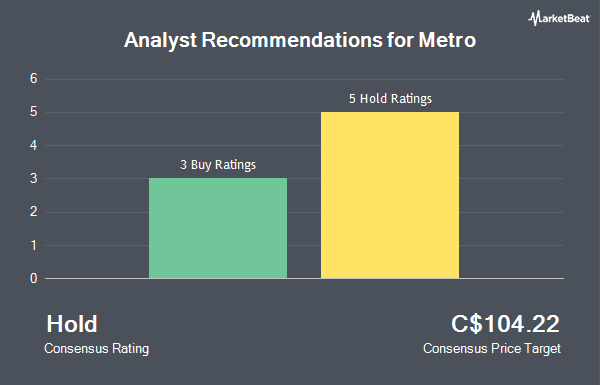

Metro Inc. (TSE:MRU - Get Free Report) has received an average rating of "Hold" from the seven analysts that are presently covering the company, Marketbeat reports. Four equities research analysts have rated the stock with a hold recommendation and three have given a buy recommendation to the company. The average 12-month target price among analysts that have covered the stock in the last year is C$109.75.

Several research firms recently issued reports on MRU. TD Securities lifted their price objective on Metro from C$112.00 to C$118.00 and gave the stock a "buy" rating in a report on Thursday, July 31st. National Bankshares dropped their price target on shares of Metro from C$110.00 to C$107.00 and set a "sector perform" rating for the company in a research note on Wednesday. Royal Bank Of Canada boosted their price objective on shares of Metro from C$98.00 to C$112.00 in a report on Monday, July 21st. Finally, BMO Capital Markets upped their price target on Metro from C$110.00 to C$115.00 and gave the stock an "outperform" rating in a research note on Tuesday, August 5th.

Read Our Latest Stock Analysis on MRU

Metro Stock Performance

TSE MRU opened at C$94.48 on Thursday. Metro has a twelve month low of C$81.01 and a twelve month high of C$109.20. The stock has a market capitalization of C$20.55 billion, a price-to-earnings ratio of 20.49, a PEG ratio of 4.06 and a beta of 0.22. The company has a current ratio of 1.35, a quick ratio of 0.41 and a debt-to-equity ratio of 62.29. The stock has a 50-day moving average of C$96.60 and a 200 day moving average of C$101.46.

Metro Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, November 12th. Investors of record on Wednesday, November 12th will be paid a dividend of $0.37 per share. This represents a $1.48 dividend on an annualized basis and a dividend yield of 1.6%. The ex-dividend date is Thursday, October 23rd. Metro's dividend payout ratio is presently 30.59%.

Metro Company Profile

(

Get Free Report)

Metro is one of the largest grocery retailers in Canada. With its 2018 acquisition of Jean Coutu, it also boasts a meaningful drugstore footprint. Noteworthy grocery banners include Metro, Metro Plus, Super C, and Food Basics, while its pharmacies primarily operate under the Jean Coutu and Brunet trademarks.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Metro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Metro wasn't on the list.

While Metro currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.