HCA Healthcare (NYSE:HCA - Get Free Report) had its price objective lowered by Morgan Stanley from $410.00 to $400.00 in a research note issued to investors on Monday,Benzinga reports. The brokerage currently has an "equal weight" rating on the stock. Morgan Stanley's price target points to a potential upside of 19.67% from the company's previous close.

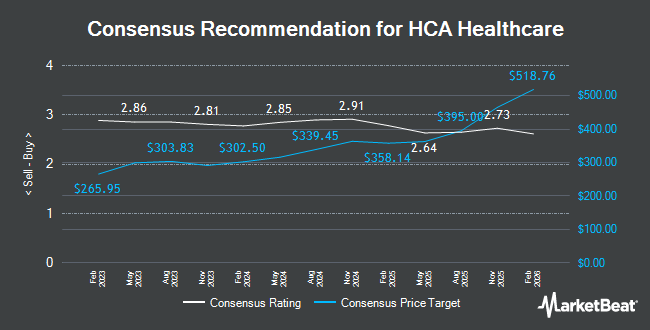

Several other brokerages have also recently issued reports on HCA. Bank of America cut HCA Healthcare from a "buy" rating to a "neutral" rating and set a $394.00 price objective for the company. in a report on Wednesday, July 16th. Royal Bank Of Canada reissued an "outperform" rating and issued a $404.00 target price (up previously from $376.00) on shares of HCA Healthcare in a report on Monday, June 23rd. Baird R W lowered shares of HCA Healthcare from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, April 15th. Wells Fargo & Company raised HCA Healthcare from an "underweight" rating to an "equal weight" rating and upped their target price for the company from $320.00 to $385.00 in a research note on Thursday, May 29th. Finally, Wolfe Research lowered HCA Healthcare from an "outperform" rating to a "peer perform" rating in a research note on Monday. Nine research analysts have rated the stock with a hold rating, nine have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $398.69.

Read Our Latest Research Report on HCA Healthcare

HCA Healthcare Price Performance

HCA Healthcare stock opened at $334.26 on Monday. HCA Healthcare has a 12 month low of $289.98 and a 12 month high of $417.14. The company has a debt-to-equity ratio of 69.07, a current ratio of 0.98 and a quick ratio of 0.86. The business has a 50 day simple moving average of $373.81 and a 200-day simple moving average of $346.16. The stock has a market capitalization of $80.41 billion, a PE ratio of 14.05, a price-to-earnings-growth ratio of 1.15 and a beta of 1.47.

HCA Healthcare (NYSE:HCA - Get Free Report) last posted its quarterly earnings results on Friday, July 25th. The company reported $6.84 earnings per share for the quarter, beating analysts' consensus estimates of $6.20 by $0.64. HCA Healthcare had a negative return on equity of 7,363.11% and a net margin of 8.21%. The firm had revenue of $18.61 billion for the quarter, compared to the consensus estimate of $18.49 billion. During the same period in the previous year, the business earned $5.50 earnings per share. The company's revenue for the quarter was up 6.4% compared to the same quarter last year. Equities analysts predict that HCA Healthcare will post 24.98 earnings per share for the current year.

Insiders Place Their Bets

In other HCA Healthcare news, COO Jon M. Foster sold 15,698 shares of the stock in a transaction that occurred on Tuesday, May 13th. The shares were sold at an average price of $369.32, for a total transaction of $5,797,585.36. Following the transaction, the chief operating officer owned 12,646 shares of the company's stock, valued at $4,670,420.72. This trade represents a 55.38% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. 1.30% of the stock is currently owned by corporate insiders.

Hedge Funds Weigh In On HCA Healthcare

A number of large investors have recently bought and sold shares of the stock. Sanders Capital LLC grew its stake in HCA Healthcare by 1.0% during the fourth quarter. Sanders Capital LLC now owns 11,655,563 shares of the company's stock worth $3,498,417,000 after buying an additional 116,826 shares during the period. Geode Capital Management LLC grew its stake in HCA Healthcare by 1.3% during the fourth quarter. Geode Capital Management LLC now owns 3,871,057 shares of the company's stock worth $1,159,882,000 after buying an additional 50,321 shares during the period. Capital World Investors grew its stake in HCA Healthcare by 0.7% during the fourth quarter. Capital World Investors now owns 2,928,452 shares of the company's stock worth $878,975,000 after buying an additional 19,121 shares during the period. Price T Rowe Associates Inc. MD grew its stake in HCA Healthcare by 83.4% during the first quarter. Price T Rowe Associates Inc. MD now owns 2,399,372 shares of the company's stock worth $829,104,000 after buying an additional 1,091,416 shares during the period. Finally, Northern Trust Corp raised its stake in shares of HCA Healthcare by 12.4% during the fourth quarter. Northern Trust Corp now owns 2,017,971 shares of the company's stock valued at $605,694,000 after purchasing an additional 223,248 shares during the period. Hedge funds and other institutional investors own 62.73% of the company's stock.

About HCA Healthcare

(

Get Free Report)

HCA Healthcare, Inc, through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States. It operates general and acute care hospitals that offers medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services; and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.