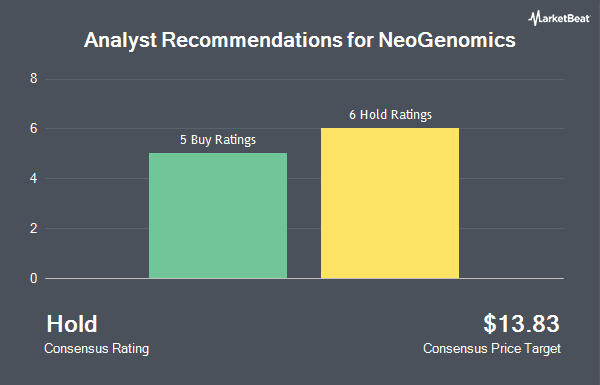

NeoGenomics, Inc. (NASDAQ:NEO - Get Free Report) has been given a consensus rating of "Hold" by the sixteen analysts that are currently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a sell recommendation, eight have given a hold recommendation and seven have assigned a buy recommendation to the company. The average 12-month price objective among brokers that have updated their coverage on the stock in the last year is $12.5556.

A number of research firms have commented on NEO. Morgan Stanley set a $8.00 price objective on shares of NeoGenomics and gave the stock an "equal weight" rating in a report on Wednesday, July 30th. Piper Sandler set a $11.00 price objective on shares of NeoGenomics and gave the stock an "overweight" rating in a report on Monday, August 4th. William Blair reaffirmed a "market perform" rating on shares of NeoGenomics in a report on Tuesday, July 29th. BTIG Research reaffirmed a "neutral" rating on shares of NeoGenomics in a report on Wednesday, July 30th. Finally, Weiss Ratings reaffirmed a "sell (d-)" rating on shares of NeoGenomics in a report on Wednesday, October 8th.

View Our Latest Stock Analysis on NeoGenomics

Institutional Investors Weigh In On NeoGenomics

Hedge funds have recently added to or reduced their stakes in the stock. Brooklyn Investment Group bought a new stake in shares of NeoGenomics during the first quarter valued at about $35,000. Headlands Technologies LLC bought a new stake in shares of NeoGenomics during the second quarter valued at about $32,000. CWM LLC raised its stake in shares of NeoGenomics by 42.6% during the first quarter. CWM LLC now owns 6,299 shares of the medical research company's stock valued at $60,000 after purchasing an additional 1,883 shares in the last quarter. AlphaQuest LLC bought a new stake in NeoGenomics in the first quarter worth about $60,000. Finally, Moors & Cabot Inc. bought a new stake in NeoGenomics in the first quarter worth about $95,000. 98.50% of the stock is currently owned by institutional investors.

NeoGenomics Stock Up 5.4%

NEO stock opened at $10.59 on Tuesday. NeoGenomics has a twelve month low of $4.72 and a twelve month high of $19.11. The company has a current ratio of 3.92, a quick ratio of 3.58 and a debt-to-equity ratio of 0.40. The company has a market capitalization of $1.37 billion, a P/E ratio of -13.07 and a beta of 1.61. The firm has a 50 day simple moving average of $8.05 and a 200-day simple moving average of $7.71.

NeoGenomics Company Profile

(

Get Free Report)

NeoGenomics, Inc operates a network of cancer-focused testing laboratories in the United States and the United Kingdom. It operates through Clinical Services and Advanced Diagnostics segments. The company offers testing services to hospitals, academic centers, pathologists, oncologists, clinicians, pharmaceutical companies, and clinical laboratories.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NeoGenomics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NeoGenomics wasn't on the list.

While NeoGenomics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.